There are a few different scenarios of voiding/reversing Vendor disbursements.

- Scenario 1 – The Bill is correct and the disbursement exists in the current Agvance data.

- Scenario 2 – The Bill is correct and the disbursement does not exist in current Agvance data.

- Scenario 3 – The Bill needs to be changed, the User wants to change it only in the current year, and the disbursement exists in the current year.

- Scenario 4 – The Bill needs to be changed, the User wants to change it only in the current year, and the disbursement does not exist in the current year.

- Scenario 5 – The disbursement was posted to the next fiscal month.

The following are the steps to correct each instance:

Scenario 1

The Bill is correct and the disbursement is in the current Agvance data.

- On the Vendor's Activity tab, highlight the check to be reversed and select Void.

- When the Disbursement screen appears, select Void again.

- A window will display to reverse the Journal Entry created by the payment of the Bill. Select Reverse. This will debit the account credited in the original payment (probably checking) and credit A/P.

- The Bill may now be paid.

Scenario 2

The Bill is correct and the disbursement was entered in a prior year's Agvance dataset.

- Void the disbursement from the Vendor's Activity tab in the current year’s dataset.

- In the current year’s dataset, create a Vendor-type JE, debiting the account credited in the original payment (probably checking) and crediting the Accounts Payable GL account.

- The Bill may now be paid.

Scenario 3

The Bill needs to be changed, the User wants to change it only in the current year, and the disbursement exists in the current year.

- Void the disbursement from the Vendor's Activity tab.

- This will trigger a Vendor-type JE debiting the account credited in the original payment (probably checking) and crediting A/P.

- Void the A/P Bill.

- Re-enter the corrected A/P Bill.

- The differences in expense amounts from the corrected A/P Bill will be contained in the current year, not the prior year.

- The Bill may now be paid.

Scenario 4

The Bill needs to be changed, the User wants to change it only in the current year, and the disbursement was entered in a prior year's Agvance dataset.

- Void the disbursement from the Vendor's Activity tab in the current year’s dataset.

- In the current year’s dataset, create a Vendor-type JE, debiting the account credited in the original payment (probably checking) and crediting the Accounts Payable GL account.

- Void the A/P Bill.

- Re-enter the corrected A/P Bill.

- The differences in expense amounts from the corrected A/P Bill will be contained in the current year, not the prior year.

- The Bill may now be paid.

Scenario 5

The disbursement was posted to the next fiscal month.

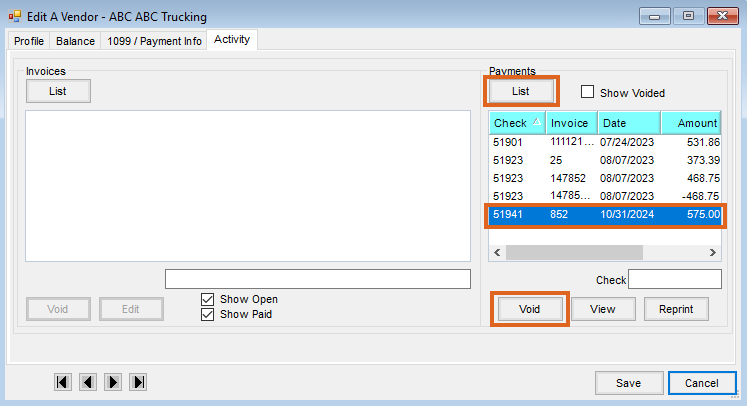

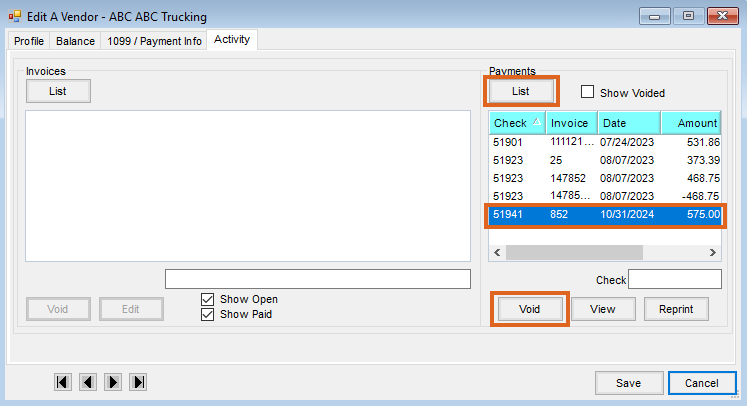

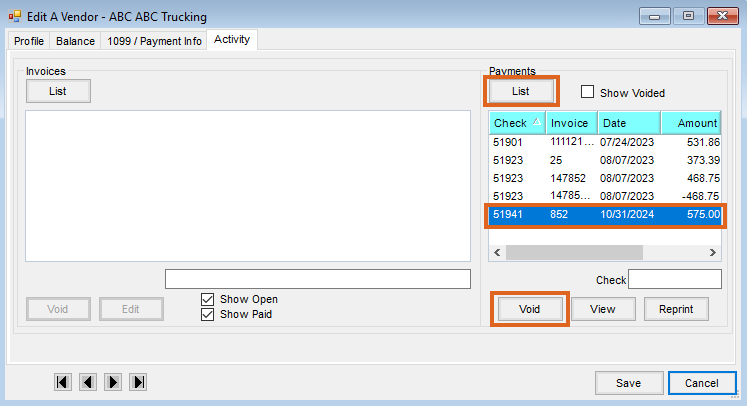

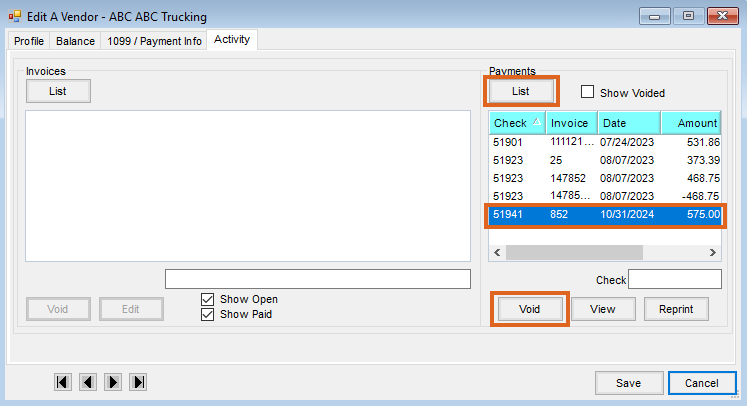

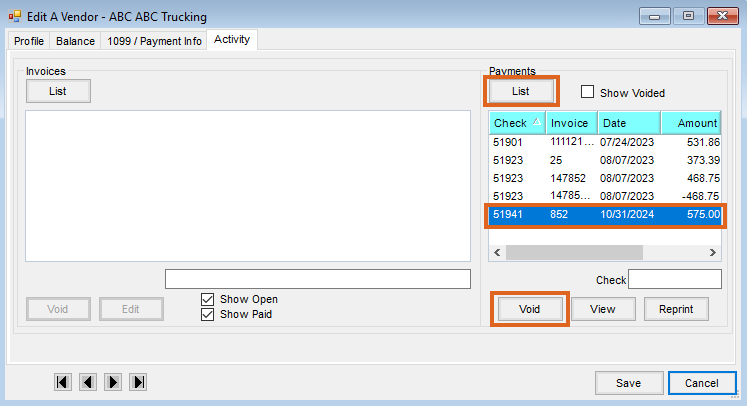

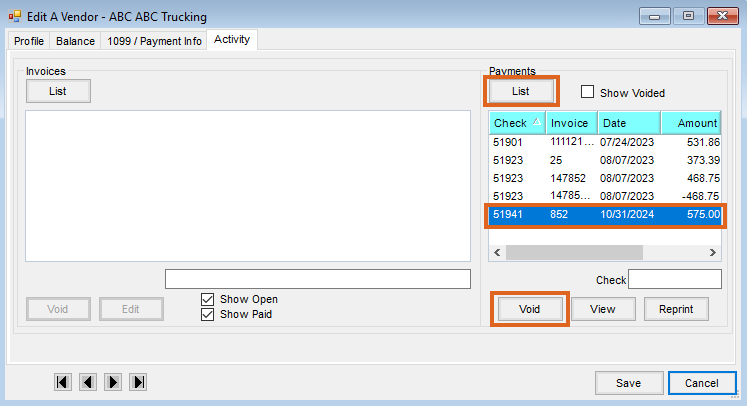

- At File / Open / Vendor, edit the Vendor and select the Activity tab.

- Choose List under Payments. This will list the payments for the Vendor.

- Highlight the check to be reversed and select Void.

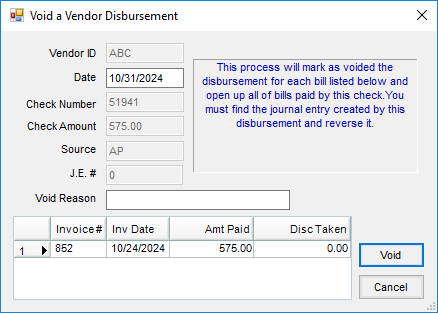

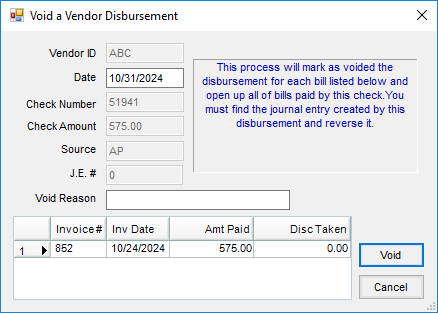

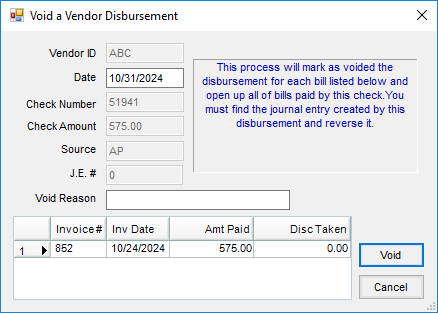

- When the Disbursement screen appears, select Void again.

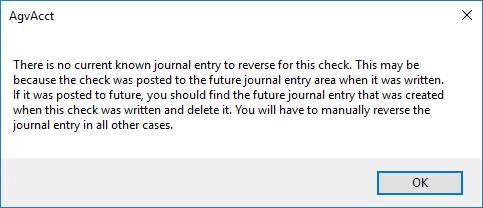

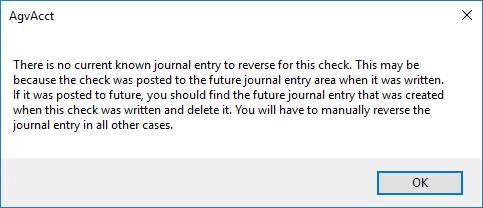

- A message will display stating the program cannot find the Journal Entry for that check. This is because the Journal Entry is a Future Journal Entry not yet posted to the General Ledger.

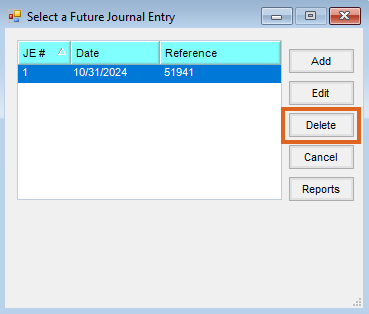

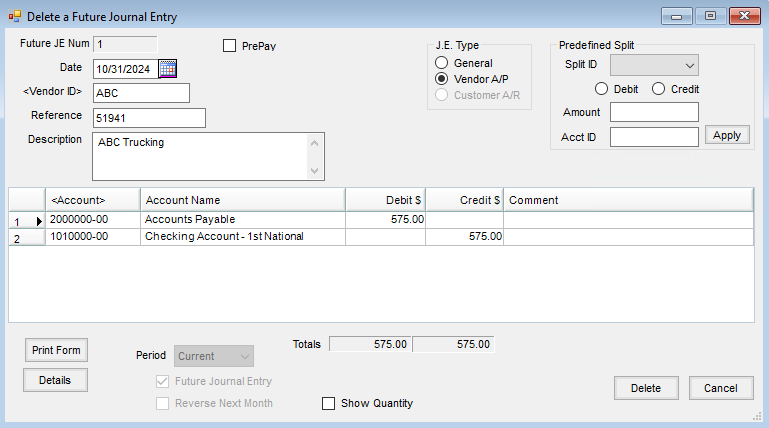

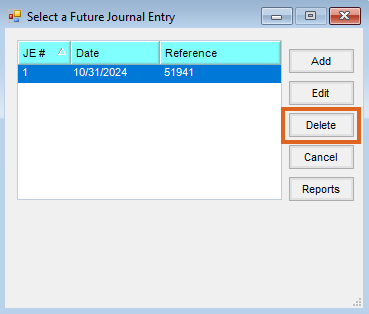

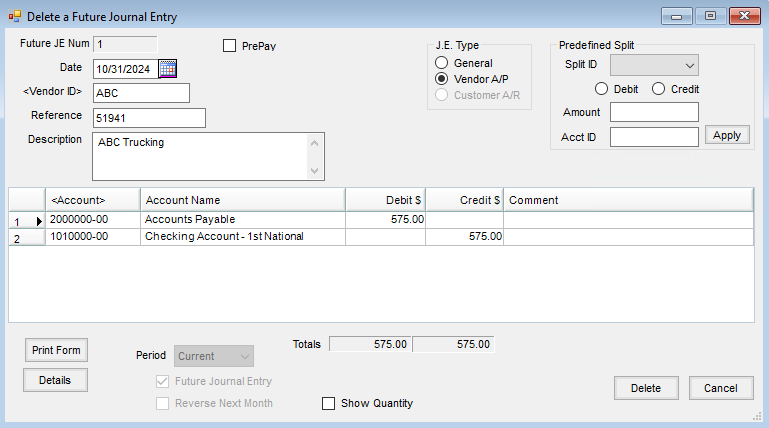

- Proceed to G/L / Future Journal Entries and delete the corresponding Future Journal Entry.

- Review and make sure the appropriate Future Journal Entry was selected then choose Delete.

If the fiscal month has been closed, the Future Journal Entry has been posted and no longer exists. In this case, a message will display indicating the Journal Entry cannot be found when trying to void the check. A manual Journal Entry for the void of the check will need to be added.

In the current year's dataset, create a Vendor-type JE debiting the account credited in the original payment (probably checking) and crediting the Accounts Payable GL account.