This method is divided into two procedures, and the approach used will depend on if the total value will ever be fully paid or if it is considered a down payment and will not be fully paid.

Procedure 1 (Partial Payment is Only Payment)

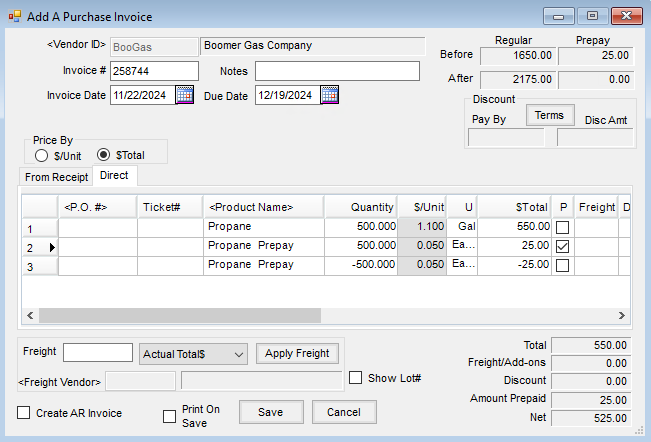

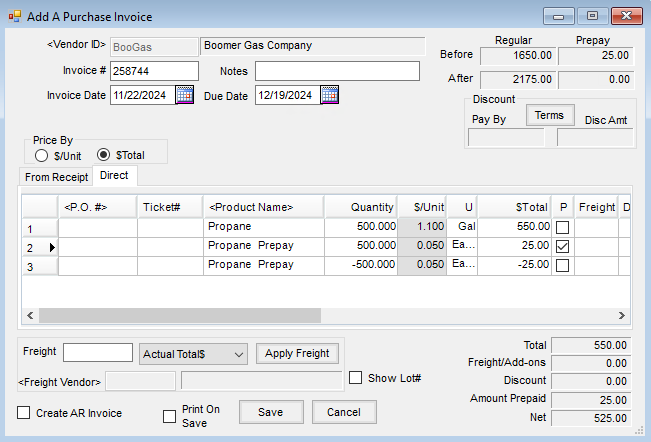

Example: Propane is sometimes prepaid $0.05/gal when ordering. The actual product cost is $1.10/gal.

- Enter a Quick Check for the amount of the prepay. Check the Prepay box to indicate the dollars are Vendor Prepay. The expense account will be Accounts Payable.

- When the Purchase Invoice arrives, select the propane Product for the entire quantity received using the gross price of $1.10/gal (including the prepay dollars).

- Add two miscellaneous line items (ex. Propane Prepay). One line will be positive for the prepaid quantity and dollars and marked as Paid. The other will be unpaid for a negative of the same quantity and dollars.

- Save the Purchase Invoice. The unpaid Bill created will be for the unpaid portion only.

Procedure 2 (prepay will eventually be fully paid)

Using the example from Method 1:

- Enter a prepaid Purchase Order for the entire amount of the contract. [# gallons at $1.10/gallon]

- Partially pay the resulting Bill at the agreed on deposit price. [# gallons at $0.05/gallon]

- Change the Due Date on the Bill to the next payment date.

Using this method, Agvance will display the correct overall balances through entries to the Prepay balance and offsetting entries to the Regular balance. When the Bill is fully paid, the Prepay balance will be correct and no offsetting entries will remain on the Regular balance.