Sometimes a partial payment is paid to a vendor to lock in a specific price for product that will be purchased at a later date. An example of this might be prepaying $0.05 per gallon for Propane to the vendor which locks in an actual product cost of $1.05 per gallon.

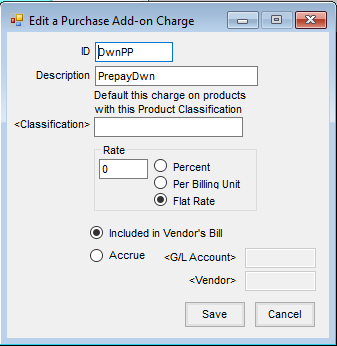

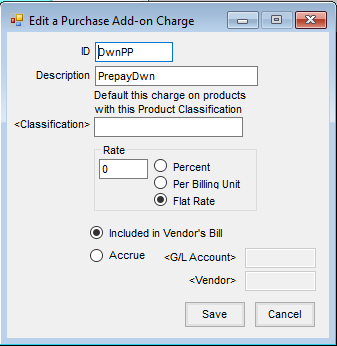

- If an add-on charge for partial vendor prepay doesn’t already exist, go to Setup / Inventory / Purchase Add-on Charges and select Add to create a new Purchase Add-on Charge. Enter an ID, Description, Rate Type, and Bill Type. The rate may be set as a Percent, Per Billing Unit, or a Flat Rate. This rate type is editable at the Purchase Order depending on the contract type being prepaid. The Classification is an optional setting. If used, this add-on Charge defaults onto any line item containing a product with a matching classification. This new add-on must be marked Included in Vendor’s Bill to influence the amount paid.

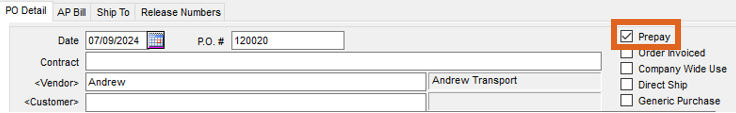

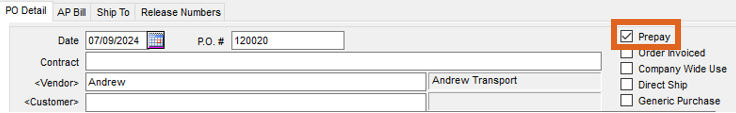

- Add a Purchase Order from Inventory / Purchase Orders.

- Mark the Prepay option on the Purchase Order.

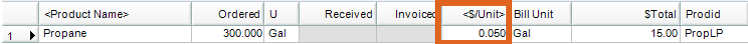

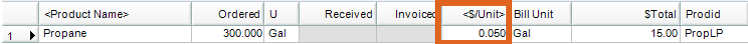

- Select the product being purchased and set the $/Unit as the amount being prepaid.

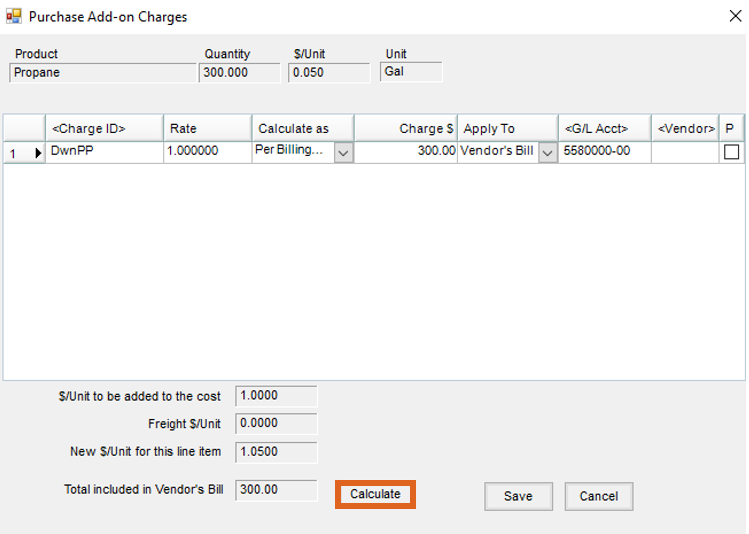

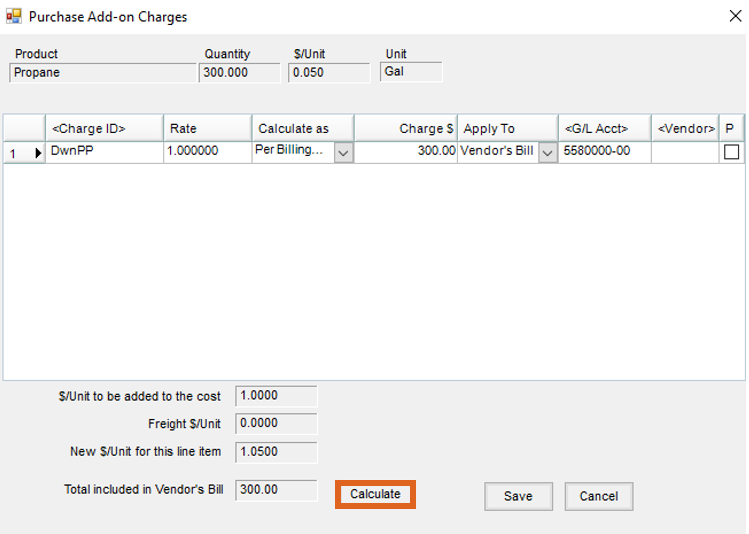

- Double-click in the Add-On field. If the add-on charge doesn’t automatically show in the grid, double-click on <Charge ID> and select the partial prepay add-on charge.

- Set the Rate as the unpaid amount and set Calculate as to Per Billing Unit.

- Choose Calculate. This displays the unpaid portion that will later be billed for this Purchase Order. Note that the New $/Unit for this line item displays the full amount of the unit price so the product’s cost will be correctly updated.

- Save the purchase add-on.

- The Purchase Order now displays the amount booked. Selecting Apply calculates the amount of Prepay.

- The PO can now be received against on a Purchase Receipt as normal. The add-on charge follows through based on the Purchase Order set up and quantity received.

- The Purchase Receipt can then be imported into a Purchase Invoice. The add-on charges setup on the Purchase Order follow through the Purchase Receipt into the Purchase Invoice.