Colorado is a uniformity state. FTA Uniformity specifies a Distributor’s Fuel Tax Report which serves as a summary of motor fuel receipts and disbursements and is used to calculate motor fuel tax that is due. This report must be substantiated with a series of Schedules of Receipts and Disbursements. The paper reports and schedules produced by Agvance will be for informational purposes only. Only the related EDI report will be filed with the state.

General information regarding Motor Fuel can be found here.

- Products will need to be set up as Motor Fuel Products before the Motor Fuel Tax screens described in this specification will be available.

- Reconciliation can only happen within the current fiscal year. Linking to a prior year to reconcile is not available.

Colorado Motor Fuel reporting is available at Accounting / Motor Fuel / Reports / Colorado.

Uniformity Distributor's Fuel Tax Report

The Distributor’s Fuel Tax Report varies by state. It is used to summarize Receipts and Disbursements and must be supported by various Schedules of Receipts and Disbursements. See below for filing requirements, rules, and options.

https://tax.colorado.gov/fuel-distributor-return-filing

PIDX Code System

FTA Motor Fuel Tax Section Uniformity Committee adopted the PIDX code system for the product codes used on the Uniform forms. Most states do not use all of these product types and in some cases they treat two different products as the same product (for example, reporting Alcohol, Ethanol, and Methanol all as code 241). Below is a list of FTA products and their product code. These Motor Fuel Types must be set up exactly for Uniformity Motor Fuel Reporting.

| Product | FTA (PIDX) Code | Colorado Code |

| Alcohol | 123 | 241 |

| Ethanol | 241 | 241 |

| Methanol | 243 | 241 |

| Aviation Gasoline | 125 | 125 |

| Blending Components | 122 | 65 if with gasoline |

| (Includes Transmix) | 122 | 160 if with diesel |

| Compressed Natural Gas | 224 | Reported on Form 86 |

| Diesel Fuel - Dye Added | 228 | 228 - Form 87 only |

| High Sulfur Diesel - Dye Added | 226 | 228 - Form 87 only |

| Low Sulfur Diesel - Dye Added | 227 | 228 - Form 87 only |

| No. 1 Diesel - Dye Added | 231 | 228 - Form 87 Only |

| Diesel Fuel - Undyed | 160 | 160 |

| Low Sulfur Diesel #1 - Undyed | 161 | 160 |

| Low Sulfur Diesel #2- Undyed | 167 | 160 |

| No. 1 Fuel Oil - Undyed | 150 | 160 |

| Gasohol | 124 | 124 |

| Gasoline | 65 | 65 |

| Gasoline MTBE | 71 | 65 |

| Jet Fuel | 130 | 130 |

| Kerosene - Undyed | 142 | 142 |

| Low Sulfur Kerosene - Undyed | 145 | 142 |

| High Sulfur Kerosene - Undyed | 147 | 142 |

| Kerosene - Dye Added | 72 | Do Not Report |

| Low Sulfur Kerosene - Dye Added | 73 | Do Not Report |

| High Sulfur Kerosene - Dye Added | 74 | Do Not Report |

| Liquid Natural Gas | 225 | Reported on Form 86 |

| Propane | 54 | Reported on Form 86 |

| Residual Fuel Oil | 175 | Do Not Report |

Uniformity Schedule Types/MOT

Schedules of Receipts

- Schedule Type CO1 Gallons received tax paid.

- Schedule Type CO2 Gallons received from licensed distributors, tax unpaid.

- Schedule Type CO3 Gallons imported from another state direct to a customer.

- Schedule Type CO4 Gallons imported from another state into tax free storage.

Schedules of Disbursements

- Schedule Type CO5 Gallons delivered tax collected.

- Schedule Type CO6 Gallons delivered from licensed distributors, tax not collected

- Schedule Type CO7 Gallons exported to other state

- Schedule Type CO8 Gallons delivered to US Government, tax-exempt

- Schedule Type CO9 Gallons delivered to State & Local government, tax-exempt

- Schedule Type CO10 Gallons delivered to other tax-exempt entities

Modes of Transportation

The following modes of transportation are used by Uniformity.

- J – Truck

- R – Rail

- B – Barge

- S – Ship

- GS – Gas Station

- PL – Pipeline

Business Functions

Uniformity State Defaults Setup

General Setup for Colorado is found at Motor Fuel / Setup / Setup Uniformity State Defaults. Colorado reports on Gross Gallons as the default.

- Gross Gallons and Net Gallons (if being imported/exported)

- Gross Gallons are required to be reported for all fuel except for LPG.

- LPG is reported on Net Gallons and taxed only upon disbursement for Motor Vehicle use.

Colorado Reports

The Colorado Reports screen at Motor Fuel / Reports / Colorado is used to create the reports needed to file to the State of Colorado. This screen also has one setup area specific to the State of Colorado.

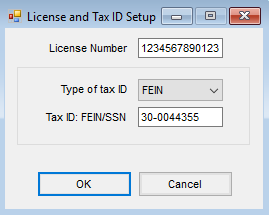

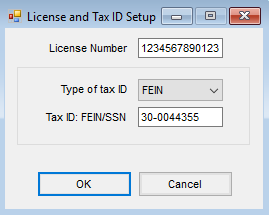

- Company Licenses – Select Company Licenses to enter the License Number, Type of tax ID, and Tax ID: FEIN/SSN.

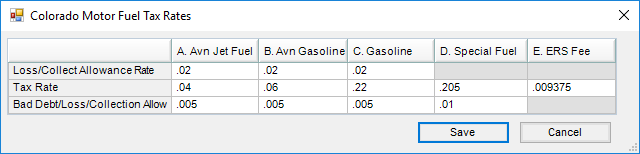

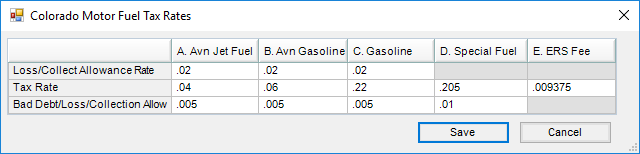

- Tax Rates Setup – Indicate the Loss/Collect Allowance Rate, Tax Rate, and Bad Deb/Loss/Collection Allow.

Schedule of Receipts and Disbursements

Uniformity Schedules of Receipts

There are four Schedules of Receipts. These Schedules are identical except for whether or not tax was paid on the receipt and whether or not the fuel was imported. Each Schedule is used to report a single type of fuel. If multiple types of fuel are received, multiple copies of the Schedule will be created. All of the states that have adopted Uniformity use these Schedules. In some cases, a state may not require a column of information. In these cases, the column is included on the Schedule but is not filled in. The Schedule Types are:

- CO1 – Gallons received, tax paid

- CO2 – Gallons received from licensed fuel distributor, tax unpaid

- CO3 – Gallons imported from another state direct to customer

- CO4 – Gallons imported from another state into tax free storage

These Schedules include the following information for each receipt:

- Carrier Name

- Carrier FEIN

- Mode of Transportation

- Point of Origin Terminal or City, State or Airport Code

- Point of Destination Terminal or City, State or Airport Code

- Who Acquired From

- Seller's FEIN

- Date Received

- Document Number

- Net Gallons

- Gross Gallons

- Billed Gallons

Logic for Schedules of Receipts

All of the Schedules of Receipts are produced at the same time. Purchase Invoices are the source of data for these schedules.

The Schedules of Receipts will have one detail line for each Sales Invoice line item that meets the following criteria:

- The Schedule on the line item (InvoiceLi.MFSched) is CO1, CO2, CO3, or CO4

- The Invoice Date is within the Date Range specified for the report

The Schedules of Receipts detail lines will be grouped based on the Schedule Type and Fuel Type Code with each Schedule Type and Fuel Type on a separate page. For example:

- All of the 065 Type Products with Schedule Type 2 will be reported on one (or more) pages.

- All of the 160 Type Products with Schedule Type 2 will be reported on one (or more) pages.

Each page includes a subtotal of that page. The detail lines on each page are sorted by Invoice Date/Bill of Lading number (Ticket number). The Total of all detail lines from all pages is printed at the bottom of the last page of each Schedule Type.

Uniformity Schedules of Disbursements

There are six Schedules of Disbursements. These schedules are identical except for whether or not tax was paid on the Disbursements and whether or not the fuel was exported. Each schedule is used to report a single type of fuel. If multiple types of fuel are delivered, multiple copies of the schedule will be created. All of the states that have adopted Uniformity use these schedules. In some cases, a state may not require a column of information. In these cases, the column is included on the schedule but is not filled in. The schedule types are:

- Schedule Type CO5 – Gallons delivered, tax collected

- Schedule Type CO6 – Gallons delivered from licensed distributors, tax not collected

- Schedule Type CO7 – Gallons exported to the state of __________

- Schedule Type CO8 – Gallons delivered to US Government, tax-exempt

- Schedule Type CO9 – Gallons delivered to state and local government, tax-exempt

- Schedule Type CO10 – Gallons delivered to other tax-exempt entities

These Schedules include the following information for each receipt:

- Carrier Name

- Carrier FEIN

- Mode of Transportation

- Point of Origin Terminal or City, State or Airport Code

- Point of Destination Terminal or City, State or Airport Code

- Customer Sold to (First Customer if split but it will never be a split)

- Purchaser's FEIN

- Invoice Date

- Document Number

- Net Gallons

- Gross Gallons

- Billed Gallons

Logic for Schedules of Disbursements

All of the Schedules of Disbursements are produced at the same time. Sales Invoices are the source of data for these schedules.

The Schedules of Disbursements will have one detail line for each Sales Invoice line item that meets the following criteria:

- The Schedule on the line item (InvoiceLi.MFSched) is CO5, CO6, CO7, CO8, CO9, or CO10.

- The Invoice Date is within the Date Range specified for the report.

The Schedules of Disbursements detail lines will be grouped based on the Schedule Type and Fuel Type Code with each Schedule Type and Fuel Type on a separate page. For example:

- All of the 065 Type Products with Schedule Type CO5 will be reported on one (or more) pages.

- All of the 160 Type Products with Schedule Type 2 will be reported on one (or more) pages.

Each page includes a subtotal of that page. The detail lines on each page are sorted by Invoice Date/Bill of Lading number. The Total of all detail lines from all pages is printed at the bottom of the last page of each Schedule Type.