General information regarding Motor Fuel can be found here.

- Products will need to be set up as Motor Fuel Products before the Motor Fuel Tax screens described in this specification will be available.

- Reconciliation can only happen within the current fiscal year. Linking to a prior year to reconcile is not available.

Ohio Motor Fuel reporting is available at Accounting / Motor Fuel / Reports / Ohio.

State of Ohio Setup

At Motor Fuel / Reports / Ohio, there are specific setups unique to the State of Ohio. Company Licenses, Customer Licenses, Tax Rate Setup, and EDI Setup information are set up in this area.

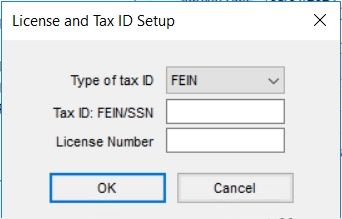

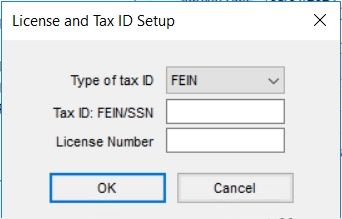

- Company Licenses – The License and Tax ID Setup window is where Company License Number Information is set up. Enter the License Number, select the Type of tax ID, and enter the Tax ID: FEIN/SSN. When finished, select OK to save.

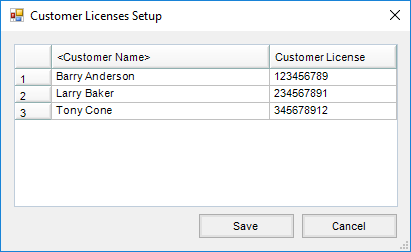

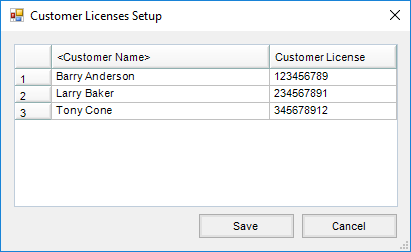

- Customer Licenses – The Customer Licenses Setup window is used to set up license numbers for Customers. Double-click <Customer Name> then choose the Customers from the Select Customers window. Select Done to add the Customers to the list. Enter the Customer License for each of the Customers and select Save when finished.

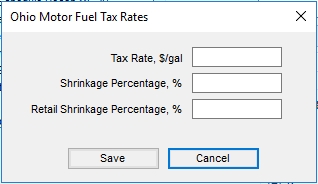

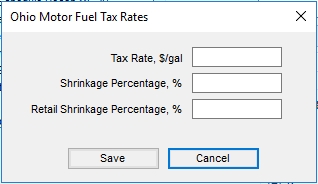

- Tax Rates Setup – The Ohio Tax Rates window is used to set up tax rates for use on Motor Fuel Tax reports. These fields can be edited since rates and percentages are subject to change.

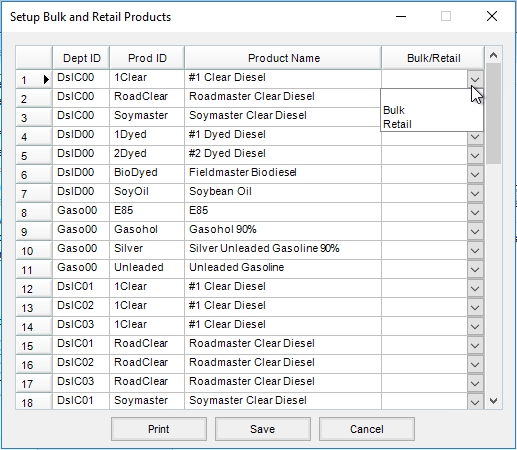

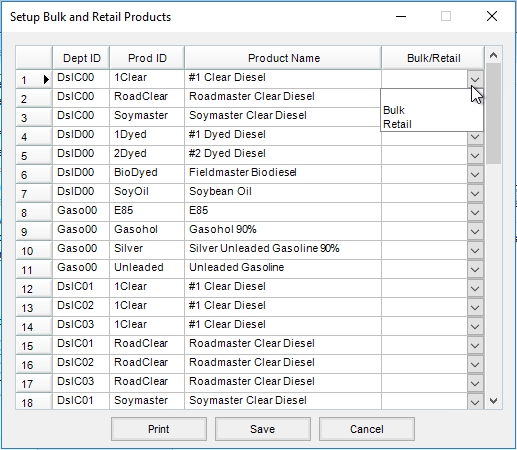

- Bulk/Retail Products– The Ohio Bulk/Retail Products window is used to choose either Bulk or Retail for specific products used on Motor Fuel Tax reports.

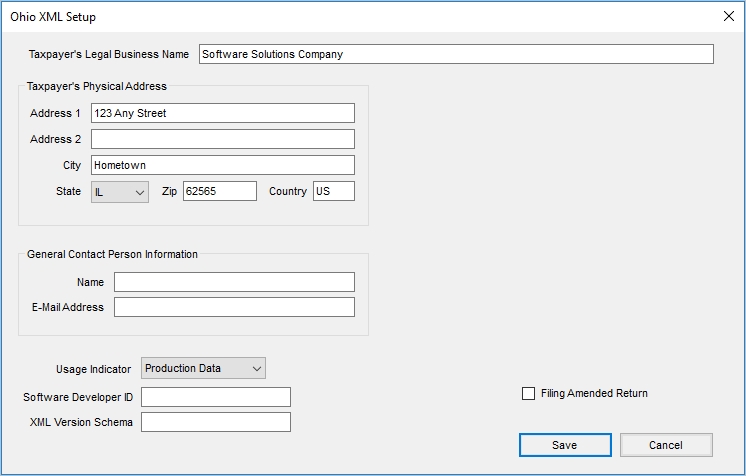

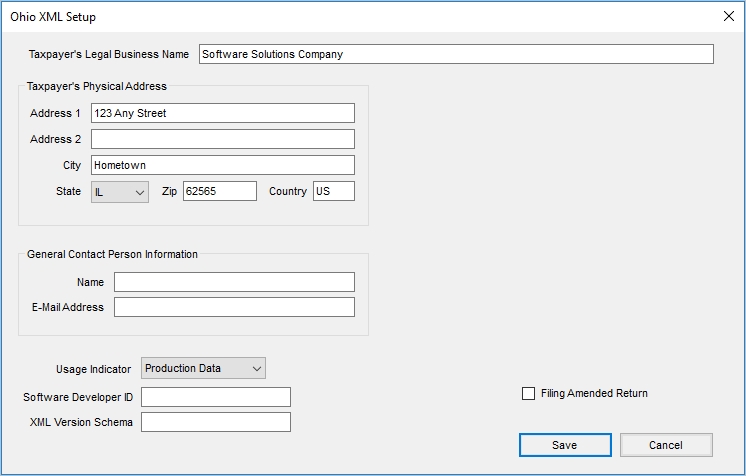

- XML Setup – The XML Setup window is used to input information for filing Motor Fuel Tax reports electronically. All Ohio Motor fuel tax taxpayers must file and pay electronically.

- Select the Filing Amended Return checkbox to file an amended return. Amended Returns must be filed in the same manner as the original return and if filed electronically should provide all schedule detail records.

- Select the Filing Amended Return checkbox to file an amended return. Amended Returns must be filed in the same manner as the original return and if filed electronically should provide all schedule detail records.

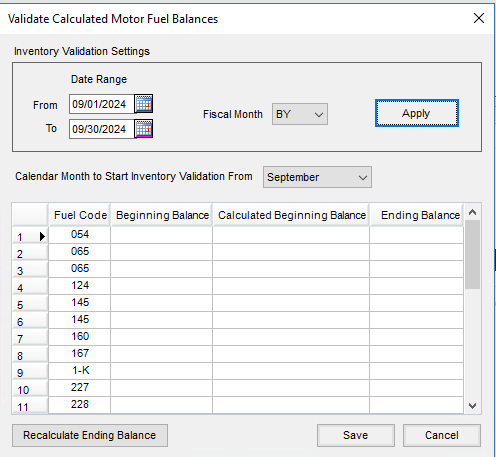

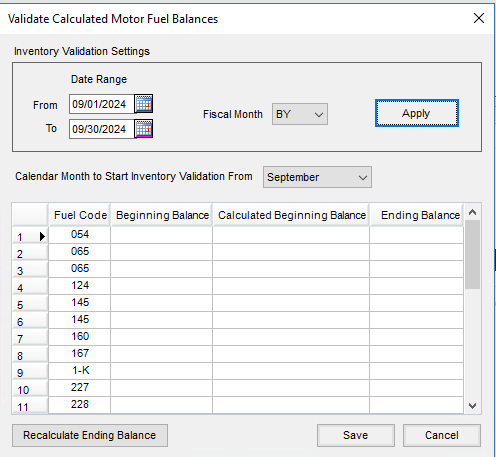

- Validate MF Balances – Ohio requires a Physical Beginning and Physical Ending Inventory. Select Validate MF Balances to open a window for validating the motor fuel balances per fuel code. Select Fiscal Month, From and To Date Range (Do NOT use Calendar icons). Click Apply to populate the grid below. Make sure the correct month is displayed in the Calendar Month to Start Inventory Validation from drop-down.

- Fuel Code – Populated with the Fuel Codes that are setup in the General Info area in the Motor Fuel module.

- Beginning Balance – Populated from the last validated Ending Balance.

- Enter correct Beginning Balance for each Fuel Code.

- If within current year, there should not be issues.

- If in Month 1 and Beginning Balances are correct, then use BY for Fiscal Month.

- Select Save.

- Calculated Beginning Balance – Beginning of Year balance +/- the transactions that have occurred throughout the year prior to the From Date (From Date minus 1). The transactions should include Purchase Invoices, Sales Invoices, and Inventory Adjustments. Look at the following dates to determine the transaction date: purinvdt.pidtmfbilloflad (Purchase Invoice), invoice.invdate (Sales Invoice), and invadj.date (Inventory Adjustment).

- Ending Balance – Beginning of Year balance +/- transactions that have occurred throughout the year up through the To Date. The transactions should include Purchase Invoices, Sales Invoices, and Inventory Adjustments. Look at the following dates to determine the transaction date: purinvdt.pidtmfbilloflad (Purchase Invoice), invoice.invdate (Sales Invoice), and invadj.date (Inventory Adjustment).

Setup Uniformity States Defaults

General Setup for Ohio is found at Motor Fuel / Setup / Setup Uniformity State Defaults.

Gasoline Schedule Recap (MF-2A)

Header Information

- Name

- FEIN – From License Setup

- Month/Year – From OH Reports window

Untaxed Receipts

- Line 1 – Total gallons from Schedule 2 for Product Code 065

- Line 2 – Total gallons from Schedule 3 for Product Code 065

- Line 3 – Line 1 plus Line 2

Credits

- Line 4 – Total gallons from Schedule 6 for Product Code 065

- Line 5 – Total gallons from Schedule 7 for Product Code 065

- Line 6 – Total gallons from Schedule 8 for Product Code 065

- Line 7 – Total gallons from Schedule 10B for Product Code 065

- Line 8 – Line 4 plus Line 5 plus Line 6 plus Line 7

Taxable Gallons

- Line 9 – Line 3 minus Line 8

Reconciliation Report

- Line 1 – Copy Line 9 from above

- Line 2 – From Motor Fuel EOM Table. Total for Product Code 065. See Physical Inventory Balances section in this document.

- Line 3 – Total gallons from Schedule 1 for Product Code 065

- Line 4 – Line 1 plus Line 2 plus Line 3

- Line 5 – From Calculated Ending Balance for Product Code 065. See Physical Inventory Balances section in this document.

- Line 6 – Total gallons from Schedule 5 for Product Code 065

- Line 7 – Line 5 plus Line 6

- Line 8 – Line 7 minus Line 4

Low Sulfur Dyed Diesel Fuel Schedule Recap (MF-2B)

Header Information

- Name

- FEIN – From License Setup

- Month/Year – From OH Reports window

Untaxed Receipts

- Line 1 - From Motor Fuel EOM Table. Total for Product Code 227. See Physical Inventory Balances section in this document.

- Line 2 – Total gallons from Schedule 2 for Product Code 227

- Line 3 – Total gallons from Schedule 3 for Product Code 227

- Line 4 – Line 1 plus Line 2 plus Line 3

Credits

- Line 5 – Total gallons from Schedule 6 for Product Code 227

- Line 6 – Total gallons from Schedule 7 for Product Code 227

- Line 7 – Total gallons from Schedule 8 for Product Code 227

- Line 8 – Total gallons from Schedule 10 for Product Code 227

- Line 9 – Total gallons from Schedule 10B for Product Code 227

- Line 10 – From Calculated Ending Balance for Product Code 227. See Physical Inventory Balances section in this document.

- Line 11 – Line 5 plus Line 6 plus Line 7 plus Line 8 plus Line 9 plus Line 10

Gallons to Account For

- Line 12 – Line 4 minus Line 11

- Line 13 – Total gallons from Schedule 5 for Product Code 227

- Line 14 – Line 13 minus Line 12

Kerosene Fuel Schedule Recap (MF-2C)

Header Information

- Name

- FEIN – From License Setup

- Month/Year – From OH Reports window

Untaxed Receipts

- Line 1 – From Motor Fuel EOM Table. Total for Product Code 142. See Physical Inventory Balances section in this document.

- Line 2 – Total gallons from Schedule 2 for Product Code 142

- Line 3 – Total gallons from Schedule 3 for Product Code 142

- Line 4 – Line 1 plus Line 2 plus Line 3

Credits

- Line 5 – Total gallons from Schedule 6 for Product Code 142

- Line 6 – Total gallons from Schedule 7 for Product Code 142

- Line 7 – Total gallons from Schedule 8 for Product Code 142

- Line 8 – Total gallons from Schedule 10 for Product Code 142

- Line 9 – Total gallons from Schedule 10B for Product Code 142

- Line 10 - From Calculated Ending Balance for Product Code 142. See Physical Inventory Balances section in this document.

- Line 11 – Line 5 plus Line 6 plus Line 7 plus Line 8 plus Line 9 plus Line 10

Gallons to Account For

- Line 12 – Line 4 minus Line 11

- Line 13 – Total gallons from Schedule 1 for Product Code 142

- Line 14 – Line 12 plus Line 13

- Line 15 – Total gallons from Schedule 5 for Product Code 142

- Line 16 – Line 15 minus Line 13

- Line 17 – Line 15 minus Line 14

Clear Diesel Fuel Schedule Recap (MF-2D)

Header Information

- Name

- FEIN – From License Setup

- Month/Year – From OH Reports window

Untaxed Receipts

- Line 1 - From Motor Fuel EOM Table. Total for Product Code 160. See Physical Inventory Balances section in this document.

- Line 2 - Total gallons from Schedule 2 for Product Code 160

- Line 3 - Total gallons from Schedule 3 for Product Code 160

- Line 4 – Line 1 plus Line 2 plus Line 3

Credits

- Line 5 - Total gallons from Schedule 6 for Product Code 160

- Line 6 - Total gallons from Schedule 7 for Product Code 160

- Line 7 - Total gallons from Schedule 8 for Product Code 160

- Line 8 - Total gallons from Schedule 10B for Product Code 160

- Line 9 – From Calculated Ending Balance for Product Code 160. See Physical Inventory Balances section in this document.

- Line 10 – Line 5 plus Line 6 plus Line 7 plus Line 8 plus Line 9

Gallons to Account For

- Line 11 – Line 4 minus Line 10

- Line 12 - Total gallons from Schedule 1 for Product Code 160

- Line 13 – Line 11 plus Line 12

- Line 14 - Total gallons from Schedule 5 for Product Code 160

- Line 15 – Line 14 minus Line 12

- Line 16 – Line 14 minus Line 13

High Sulfur Dyed Diesel Fuel Schedule Recap (MF-2G)

Header Information

- Name

- FEIN – From License Setup

- Month/Year – From OH Reports window

Untaxed Receipts

- Line 1 - From Motor Fuel EOM Table. Total for Product Code 226. See Physical Inventory Balances section in this document.

- Line 2 – Total gallons from Schedule 2 for Product Code 226

- Line 3 – Total gallons from Schedule 3 for Product Code 226

- Line 4 – Line 1 plus Line 2 plus Line 3

Credits

- Line 5 – Total gallons from Schedule 6 for Product Code 226

- Line 6 – Total gallons from Schedule 7 for Product Code 226

- Line 7 – Total gallons from Schedule 8 for Product Code 226

- Line 8 – Total gallons from Schedule 10 for Product Code 226

- Line 9 – Total gallons from Schedule 10B for Product Code 226

- Line 10 - From Calculated Ending Balance for Product Code 226. See Physical Inventory Balances section in this document.

- Line 11 – Line 5 plus Line 6 plus Line 7 plus Line 8 plus Line 9 plus Line 10

Gallons to Account For

- Line 12 – Line 4 minus Line 11

- Line 13 - Total gallons from Schedule 5 for Product Code 226

- Line 14 – Line 13 minus Line 12

Schedule of Disbursements Report over 800 Gallons

To meet Requirements #5, for the Ohio Schedule of Disbursements, a separate report detailing the individual transactions for customer who purchased more than 800 gallons of diesel fuel on Schedule 5. To meet Requirement #6, a separate report detailing the individual transactions for customers who purchased more than 800 gallons of gasoline on Schedule 5. To meet Requirement #7, a separate report detailing the individual transactions for customer who purchased more than 800 gallons of fuel on Schedule 10. The report should include the following:

Header Information

- Customer Name

- Customer Address

- Customer City

- Customer State

- Customer Zip

- Customer SSN/FEIN

Invoice Detail

- Department ID / Product ID

- Product Name

- Gross Gallons

- Gross gallons subtotal per customer

- Grand Total from all customer subtotals

Licensed Dealer's Monthly Ohio Motor Fuel Tax Report (MF 2)

| Dealer Name | CNFCOMP.COMPNAME |

| FEIN | From License Setup window |

| Month/Year | From OH Report window |

| Street | CNFCOMP.ADDRESS |

| City | CNFCOMP.CITY |

| State | CNFCOMP.STATE |

| ZIP | CNFCOMP.ZIP |

| Check here to cancel account | From MF 2 Report Setup window |

| Effective | From MF 2 Report Setup window |

| Check here if address is new | From MF 2 Report Setup window |

Transfer Totals from Fuel Schedule Recaps

- Line 1 – From Gasoline Schedule Recap (MF 2A) line 9

- Line 2 – From Low Sulfur Dyed Diesel Schedule Recap (MF 2B) line 13

- Line 3 – From Kerosene Schedule Recap (MF 2C) line 16

- Line 4 – From Clear Diesel Schedule Recap (MF 2D) line 15

- Line 5 – Intentionally left blank

- Line 6 – From Miscellaneous Fuels Schedule Recap (MF 2F) line 8

- Line 7 – Add Lines 1 through 6

- Line 8 – Multiply Line 7 by the Shrinkage Rate from Tax Rates Setup window

- Line 9 – Multiply Gallons Sold to Retailers by Retailer Shrinkage Percentage both from the Report Setup window

- Line 10 – Line 7 plus Line 9 minus Line 8

- Line 11 – Multiply Line 10 by Tax Rate from Tax Rate Setup window

- Line 12 - Intentionally left blank

- Line 13 - Intentionally left blank

- Line 14 – Copy from Line 11

- Line 15 – Penalty Rate from Tax Rate Setup window multiplied by Line 14 or Interest Minimum from Tax Rate Setup window, whichever is greater

- Line 16 – Interest Rate from Tax Rate Setup window multiplied by Line 14

- Line 17 – Line 14 plus Line 15 plus Line 16

Electronic File

Requirements

- ASCII – Fixed Field Length – No header or trailer

- File Name: EDI (month) ASC (optional)

- Character Fields Left Justified and Numerical Fields Right Justified

- For lump sum totals, i.e., various, use FEIN “111111111” and name “VARIOUS”

- Do not use a dash in the FEIN field (NNNNNNNNN format)

- N = Numerical with no commas, integer – right justified; C = Character left justified

Motor Fuel Dealers - Receipts

|

From |

To |

Length |

Type |

Schedule Column |

Description / Data |

Required |

|

1 |

9 |

9 |

C |

|

Your FEIN / From License Setup window |

Yes |

|

10 |

44 |

35 |

C |

|

Your Name / CNFCOMP.COMPNAME |

Yes |

|

45 |

53 |

9 |

C |

6 |

FEIN of Seller of Fuel / Vend1099.taxid for PurchInv.VendorID |

Yes |

|

54 |

88 |

35 |

C |

5 |

Name of Seller of Fuel / VendProf.Name for PurchInv.VendorID |

Yes |

|

89 |

97 |

9 |

C |

2 |

FEIN of Carrier / Vend1099.taxid for PurchInvDt.PiDtMFFreightVendID |

Yes – unless unobtainable |

|

98 |

132 |

35 |

C |

1 |

Name of Carrier / VendProf.name for PurchInvDt.PiDtMFFreightVendID |

Yes |

|

133 |

134 |

2 |

C |

3 |

Mode / PurchInvDt.MFMOT |

Yes |

|

135 |

159 |

25 |

C |

4 |

Point of Origin / PurchInvDt.PiDtMFOrgCity space PurchInvDt.PiDtMFOrgSt |

Yes – if Schedule 3 |

|

160 |

169 |

10 |

C |

7 |

Date (YYYY/MM/DD Format) / PurchInvDt.PiDtMFBillofLad |

Yes |

|

170 |

184 |

15 |

C |

8 |

Document Number / PurchInvDt.TickNum |

Yes |

|

185 |

198 |

14 |

N |

10 |

Gross Gallons (NNNNNN Format) / PurchInvDt.PiDtMFGrossGal |

Yes |

|

199 |

201 |

3 |

C |

|

Schedule Type / PurchInvDt.PiDtMFSched |

Yes |

|

202 |

204 |

3 |

C |

|

Product Type / MFProds.ProdType for PurchInvDt.DeptID/PurchInvDt.ProdID |

Yes |

|

205 |

224 |

20 |

C |

|

Other Product Type Description / Left 20 of Product.ProdName for PurchInvDt.DeptID/PurchInvDt.ProdID |

optional |

|

225 |

231 |

7 |

C |

|

Period of Report (YYYY/MM Format) / from OH Reports window |

Yes |

|

232 |

235 |

4 |

C |

|

Four Digit Terminal Code / blank |

Not applicable |

|

236 |

249 |

14 |

N |

|

Net Gallons (NNNNNN Format) / PurchInvDt.PiDtMFNetGal |

Optional |

|

250 |

251 |

2 |

C |

|

State of Origin (Use State Code) / PurchInvDt.PiDtMFOrgSt |

Optional |

Motor Fuel Dealers - Disbursements

|

From |

To |

Length |

Type |

Schedule Column |

Description / Data |

Required |

|

1 |

9 |

9 |

C |

|

Your FEIN / From License Setup window |

Yes |

|

10 |

44 |

35 |

C |

|

Your Name / CNFCOMP.COMPNAME |

Yes |

|

45 |

53 |

9 |

C |

7 |

FEIN of Purchaser of Fuel / Customer License from Setup |

Yes – unless unobtainable |

|

54 |

88 |

35 |

C |

6 |

Name of Purchaser of Fuel / Grower.Growname1 + Grower.Growname2 for InvLi.CustID |

Yes – use “Various” for lump sums |

|

89 |

97 |

9 |

C |

2 |

FEIN of Carrier / Invoice.MFCarrierFEIN |

Yes – unless unobtainable |

|

98 |

132 |

35 |

C |

1 |

Name of Carrier / Invoice.MFCarrierName |

Yes |

|

133 |

134 |

2 |

C |

3 |

Mode / Invoice.MFMOT |

Yes |

|

135 |

159 |

25 |

C |

4 |

Point of Destination / Invoice.MFDestCity space Invoice.MFDestSt |

Yes – except “Various” |

|

160 |

169 |

10 |

C |

8 |

Date (YYYY/MM/DD Format) / Invoice.InvDate |

Yes – except “Various” |

|

170 |

184 |

15 |

C |

9 |

Document Number / Invoice.InvNum |

Yes – except “Various” |

|

185 |

198 |

14 |

N |

11 |

Gross Gallons (NNNNNN Format) / InvLi.MFGrossGal |

Yes |

|

199 |

201 |

3 |

C |

|

Schedule Type / InvLi.MFSched |

Yes |

|

202 |

204 |

3 |

C |

|

Product Type / MFProds.ProdType for InvLi.DeptID/InvLi.ProdID |

Yes |

|

205 |

224 |

20 |

C |

|

Other Product Type Description / Left 20 of Product.ProdName for InvLiDeptID/InvLi.ProdID |

Optional |

|

225 |

231 |

7 |

C |

|

Period of Report (YYYY/MM Format) / from OH Reports window |

Yes |

|

232 |

235 |

4 |

C |

|

Four Digit Terminal Code / blank |

Not applicable |

|

236 |

249 |

14 |

N |

|

Net Gallons (NNNNNN Format) / InvLi.MFNetGal |

Optional |

|

250 |

251 |

2 |

C |

|

State of Destination (Use State Code) / InvLi.MFDestSt |

Yes if Schedule 7 |