Montana is a Uniformity State and must conform to the requirements set by the Uniformity States. Agvance Motor Fuel has been created so reports can be run.

General information regarding Motor Fuel can be found here.

Since the program must have the ability to report to Uniformity States, the Product Codes that are used will be the Uniformity Fuel Codes listed below.

Gasoline

- 065 – Gasoline

- 122 – Blending Components

- 123 – Alcohol

- 124 – Gasohol

- 125 – Aviation Gasoline

Special Fuel

- 072 – Dyed Kerosene

- 130 – Jet Fuel

- 142 – Clear Kerosene

- 160 – Clear Diesel Fuel

- 228 – Dyed Diesel Fuel

- 241 – Ethanol - Alcohol

- 243 – Methanol

- 284 – Bio-Diesel - Undyed B100

- 285 – Soy Oil

- 290 – Bio-Diesel - Dye Added

Agvance will make the following assumptions as the documents are created in the Agvance Motor Fuel module.

- Products will need to be set up as Motor Fuel Products before the Motor Fuel Tax screens described will be available.

- Origin Cities will need to be set up to include the City Name and Terminal ID.

- Soy Oil not blended with fuel will be treated as a separate product. If a company purchases Soy Oil in bulk and then blends it into fuel, the non-fuel Soy Oil will need to be sold to reduce inventory and the fuel type Soy Oil will need to be purchased.

- Reconciliation can only happen within the current fiscal year. Linking to a prior year to reconcile is not available.

- When setting up the Schedules, the state abbreviation must precede the Schedule number (i.e. Montana Schedule 2B needs to be set up as MT2B).

Definitions

Motor Fuel Schedules

Agvance Motor Fuel supports the following reports. The Schedules of Receipts and Schedules of Disbursements must be set up in the Schedule List on the General Info setup screen in the Motor Fuel module.

Uniformity Schedules of Receipts Used to Report Purchases

- MT1 – Gallons received, tax paid

- MT2 – Gallons received from licensed motor fuel distributors tax unpaid

- MT2A – Gallons received from distributor's own refinery or pipeline terminal, tax unpaid

- MT2B – Gallons received from distributor’s own refinery or pipeline terminal tax unpaid

- MT27 – This option is used for Customers who report into the state of Montana. This will place the purchase on the MT2 and MT7 Schedule and will report on the monthly return for each Schedule 2 and 7.

- MT3 – Gallons imported from another state direct to customer

Uniformity Schedules of Disbursements Used to Report Sales

- MT5 – Gallons delivered, tax collected

- MT5R – Gallons delivered to Native American reservation, tax collected

- MT6 – Gallons delivered to licensed motor fuel distributors, tax not collected

- MT7 – Gallons exported to state of ____________

- MT7A – Gallons exported or sold for export already taxed

- MT7B – Gallons exported or sold for export already taxed

- MT8 – Gallons delivered to US Government, tax-exempt

- MT10 – Gallons delivered to tax-exempt entities (cleanup fee only)

- MT10Y – Gallons delivered, tax-exempt to railroad

Modes of Transportation

The following modes of transportation are used by Uniformity.

- J – Truck

- R – Rail

- B – Barge

- S – Ship

- GS – Gas Station

- PL – Pipeline

State of Montana Setup

At Motor Fuel / Reports / Montana, there are specific setups unique to the State of Montana. Company Licenses, Customer Licenses, Tax Rate Setup, and EDI Setup information are set up in this area.

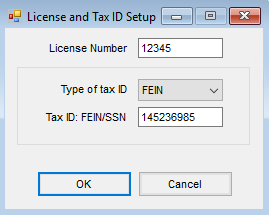

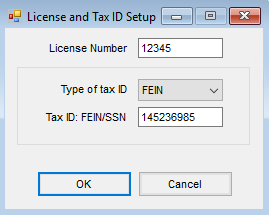

- Company Licenses – The License and Tax ID Setup window is where Company License Number Information is set up. Enter the License Number, select the Type of tax ID, and enter the Tax ID: FEIN/SSN. When finished, select OK to save.

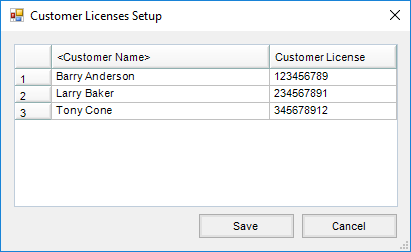

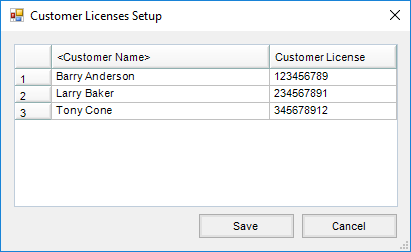

- Customer Licenses – The Customer Licenses Setup window is used to set up license numbers for Customers. Double-click <Customer Name> then choose the Customers from the Select Customers window. Select Done to add the Customers to the list. Enter the Customer License for each of the Customers and select Save when finished.

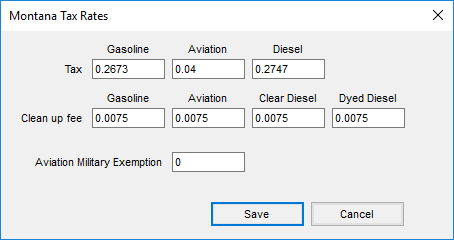

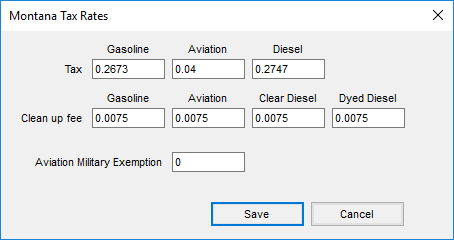

- Tax Rates Setup – The Montana Tax Rates window is used to set up tax rates for use on Motor Fuel Tax reports. These fields can be edited since rates and percentages are subject to change.

- Gas Tax Rate – Used on Distributor's Fuel Tax report Section 1, Line 2

- Aviation Tax Rate – Used on Distributor's Fuel Tax report Section 1, Line 2

- Diesel Tax Rate – Used on Distributor's Fuel Tax report Section 1, Line 2

- Aviation Military Exemption Rate – Used on Distributor's Fuel Tax report Section 1, Line 3

Setup Uniformity States Defaults

General Setup for Montana is found at Motor Fuel / Setup / Setup Uniformity State Defaults.

Distributor's Fuel Tax Report

The Montana Distributor’s Fuel Tax Report is used to summarize Receipts and Disbursements and to calculate the tax due. The totals from the Uniformity Schedules of Receipts and Disbursements and several amounts specified are reported on this return. The Montana Distributor’s Fuel Tax Report is divided into two sections and four columns (one for each category of fuel (gasoline, aviation, clear diesel, and dyed diesel).

Section 1: Gasoline/Special Fuel Computation

Section 1 of the Montana Distributor’s Fuel Tax Report is used to calculate the taxes due. Lines 1-10 have four columns. Lines 11-13 have one column.

Tax

- Line 1 – Total gallons from Section 2, Line 9

- Line 2 – Tax Due Line 1 times the appropriate tax rate from the Tax Rate Setup screen. This does not apply to Dyed Diesel.

- Line 3 – Exempt - Military. Applies only to Aviation. Section 2 Line 13 times Aviation military exemption rate from the Tax Rate Setup screen

- Line 4 – Total Tax Due. Line 2 minus Line 3. Does not apply to Dyed Diesel.

Cleanup Fee

- Line 5 – Gallons subject to fee Section 1. Line 1 plus Section 2 Line 7

- Line 6 – Gallons exempt. Section 2 Line 13 plus Section 2 Line 14. Does not apply to Gasoline.

- Line 7 – Total Gallons subject, Line 5-6

- Line 8 – Total Cleanup Fee, Line 7 times Cleanup rate from the Tax Rate Setup screen

- Line 9 – Credit, entered by User

- Line 10 – Subtotal, Line 4 + Line 8 - Line 9

- Line 11 – Penalty, entered by User

- Line 12 – Interest, entered by User

- Line 13 – Total Amount Due, Sum of Line 10 columns, Line 11, and Line 12

Section 2

Section 2 of the Montana Distributor's Fuel Tax report is used to calculate the taxes due. All lines have four columns.

Receipts

- Line 1 – Gallons from own refinery, Total from Schedule 2b

- Line 2 – Gallons from other refinery, Total from Schedule 2

- Line 3 – Gallons imported, Total from Schedule 3

- Line 4 – Total Receipts, Line 1 + Line 2 + Line 3

Disbursements

- Line 5 – Gallons delivered to distributors, Total from Schedule 6

- Line 6 – Gallons exported, Total from Schedule 6

- Line 7 – Gallons exported, tax paid, Total from Schedule 6

- Line 8 – Total Disbursements, Line 5 + Line 6 + Line 7

- Line 9 – Total Gallons, Line 4 - Line 8

- Line 10 – Portion of Line 9 that is Gasohol. Applies only to Gasoline.

- Line 11 – Portion of Line 9 that is Aviation. Applies only to Aviation.

- Line 12 – Portion of Line 9 that is Jet Fuel. Applies only to Aviation.

- Line 13 – Portion of Line 9 sold to Military. Applies to Aviation, Clear Diesel, Dyed Diesel.

- Line 14 – Portion of Line 9 sold to railroad. Applies to Clear Diesel and Dyed Diesel.

Schedules

The printed Schedules can be used to prove out monthly totals. Select a Starting Date, Ending Date, and Fiscal Month for the date ranges of the reports on the Montana Reports window.

- Schedules of Receipts – There are three Schedules of Receipts. These Schedules provide detail in support of the gallons shown as receipts on the Distributor's License Tax report. Each receipt of Product must be listed on separate lines of the appropriate Schedules.

- Schedules of Disbursements – There are eight Schedules of Disbursements. These Schedules provide detail in support of the gallons shown as disbursements on the Distributor's License Tax report. Each Disbursement of Product must be listed on separate lines of the appropriate Schedules.

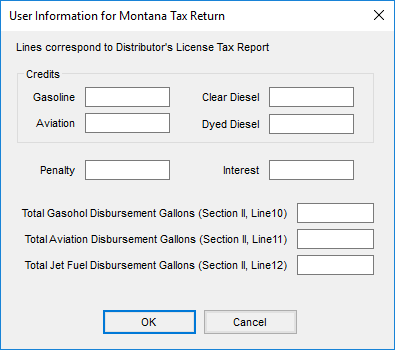

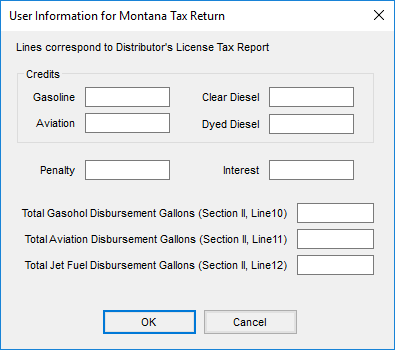

- Distributor's License Tax Report – This report is used to report a monthly summary of all taxable and nontaxable purchases and sales of gasoline, gasohol, and special fuel plus some additional information. The totals from the Schedules of Receipts and Disbursements and a few amounts specified are reported on this return. The User Information for Montana Tax Return window opens when choosing to Preview or Print the Motor Vehicle Fuel Tax report, giving the ability to enter amounts to be used in figuring tax return totals.