South Dakota is a uniformity state. However, they do not have electronic filing and only the paper forms are created. Companies located in South Dakota that sell fuel only within the state do not need to file because Motor Fuel taxes are paid at the terminal. The only companies that need to report Motor Fuel Taxes are those that import motor fuel into South Dakota. This South Dakota out-of-state Motor Fuel Tax report is designed for companies located outside of South Dakota that sell fuel into or buy fuel from South Dakota. Regular uniformity states report their sales on the Schedules of Disbursements and their purchases on Schedules of Receipts. Out-of-state companies will report their South Dakota sales on Schedules of Receipts and their South Dakota purchases on the Schedules of Disbursements.

General information regarding Motor Fuel can be found here.

Assumptions

- Products will need to be set up as Motor Fuel Products before the Motor Fuel Tax screens described here will be available.

- Origin Cities will be set up to include the City Name and Terminal ID.

- Soy Oil that is not blended with fuel will be treated as a separate Product. If a company purchases Soy Oil in bulk and then blends it into fuel, the non-fuel Soy Oil will need sold to reduce the inventory then the Fuel Type Soy Oil purchased.

- Because this reporting is designed for companies not located in South Dakota, the Motor Fuel Product Types will need to be set up so they work in both South Dakota and the company's primary state.

Definitions

Motor Fuel Schedules

South Dakota out-of-state Motor Fuel Tax returns are divided into three types. The Schedules of Receipt and Schedules of Disbursement must be set up in the Schedule List on the General Info setup screen in the Motor Fuel Module.

Note: The schedule may be specified by itself or it may be specified following the schedule that will be used in the primary state.

- Importer, Exporter, and Blender Tax Return – A summary return that is used to calculate the taxes owed based on details from the Schedules of Receipts and Schedules of Disbursements.

- Uniformity Schedules of Receipts – Used to report sales of fuel into South Dakota from another state.

- 1a or ??-1a – Gallons imported, tax paid

- 2a or ??-2a – Gallons imported, tax unpaid

- Uniformity Schedules of Disbursements – Used to report purchases of fuel from South Dakota that are delivered to another state.

- 5 or ??-5 – Gallons delivered, tax collected

- 6a or ??-6a – Gallons sold tax free to licensed exporter

- 6b or ??-6b – Gallons sold tax free to licensed blender

- 6c or ??-6c – Gallons sold tax free to licensed importer

- 6d or ??-6d – Gallons sold tax free to licensed supplier

- 6e or ??-6e – Gallons sold tax free to licensed LPG Vendor

- 7 or ??-7 – Gallons exported to the state of ___________

- 8 or ??-8 – Gallons delivered to US Government, tax-exempt

- 10 or ??-10 – Gallons delivered to other tax-exempt entities

Motor Fuel Schedules not Supported by Agvance

The following South Dakota returns will not be supported by Agvance

- Blender Tax Return – (on the back of the Importer, Exporter, and Blender Tax Return) This return can be filled out by hand and will be able the total from it entered on the Importer, Exporter, and Blender Tax Return

- LPG Vendor Tax Return – Used to calculate the taxes due on sales of LPG

Out-of-State Motor Fuel Types

Some South Dakota out-of-state customers must also report to Uniformity States. Because of this, the Uniformity Fuel Codes and types will be used for South Dakota out-of-state motor fuel. The Product Type field will not be used for South Dakota out-of-state. The following describes how South Dakota out-of-state Motor Fuel Products will be set up:

| Product | Product Code (MFProds.ProdType) | Product Type (MFProds.ProdCat) |

| Propane | 054 | |

| Natural Gasoline | 061 | |

| Gasoline | 065 | |

| Kerosene - dye added | 072 | |

| Low Sulfur Kerosene - dye added

|

073 | |

| High Sulfur Kerosene - dye added

|

074 | |

| Other - Undefined Products | 092 | |

| Alcohol | 123 | |

| Aviation Gasoline (AVGAS) | 125 | |

| Jet Fuel | 130 | |

| Kerosene - undyed, clear | 142 | |

| Kerosene Low Sulfur - undyed, clear | 145 | |

| Kerosene High Sulfur - undyed, clear | 147 | |

| Diesel Fuel - undyed | 160 | |

| Clear Biodiesel Blend | 170 | |

| Dyed Biodiesel Blend | 171 | |

| Compressed Natural Gas | 224 | |

| Dyed Diesel Fuel | 228 | |

| Methanol | 243 | |

| Clear Biodiesel | 284 | |

| Dyed Biodiesel | 290 |

Modes of Transportation

The following modes of transportation are used by Uniformity.

- J – Truck

- R – Rail

- B – Barge

Business Functions

South Dakota Reports

The South Dakota Reports screen is found at Motor Fuel / Reports / South Dakota.

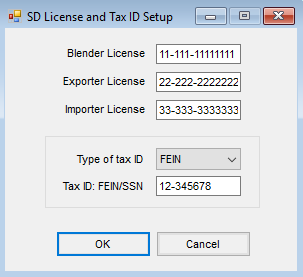

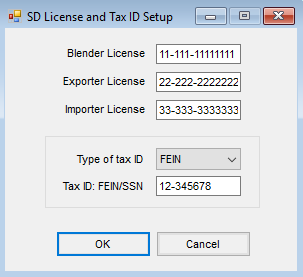

- Company Licenses – Select Company Licenses to enter the Blender License, Exporter License, Importer License, Type of tax ID, and Tax ID: FEIN/SSN.

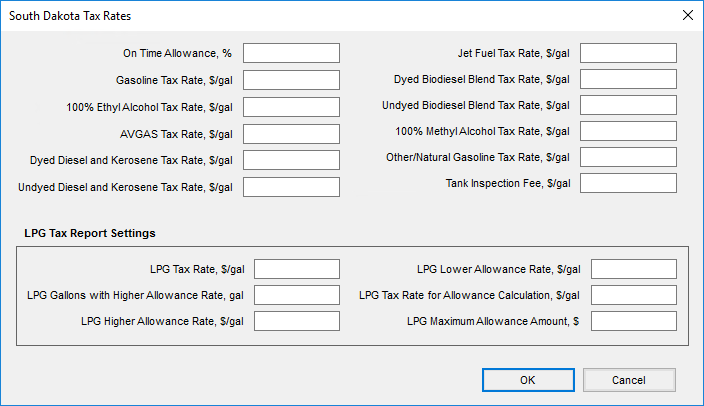

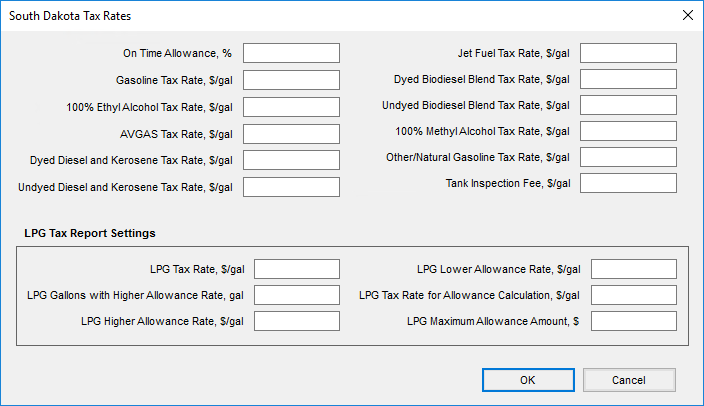

- Tax Rates Setup – All values are stored in prefmisc and are used on Importer, Exporter, and Blender Tax Return.

Uniformity State Carrier Setup

Set up the default carrier for disbursements at Motor Fuel / Setup / Setup Uniformity State Defaults / South Dakota.

Out-of-State Rules for Motor Fuel Tax Returns

South Dakota Out-of-State Motor Fuel Tax Returns are divided into three types. The Importer, Exporter, and Blender Tax Return is a summary return used to calculate the taxes owed based on details from the Schedules of Receipts and Schedules of Disbursements. The uniformity Schedules of Receipts are used to report sales of fuel into South Dakota from another state. The uniformity Schedules of Disbursements are used to report purchases of fuel from South Dakota delivered to another state.

Uniformity Schedules of Receipts

There are two Schedules of Receipts. These Schedules are identical except for whether or not tax was paid on the Receipt and whether or not the fuel was imported. Each Schedule is used to report a single type of fuel. If multiple types of fuel are received, multiple copies of the Schedule will be created. All of the state that have adopted Uniformity use these Schedules. In some cases, a state may not require a column of information. In these cases, the column is included on the Schedule but not filled in. The Schedule Types are:

- 1a – Gallons received and imported from the origination state, SD tax paid

- 2a – Gallons received and imported from out-of-state-terminals, refineries, or distributors, SD tax unpaid

- 2b – Gallons received and imported, SD tax unpaid, blendable stock

- 2c – Gallons received and imported, SD tax unpaid (diverted loads)

These Schedules include the following information for each receipt:

- Schedule Type

- Carrier Name

- Carrier FEIN

- Mode of Transportation

- Point of Origin

- Point of Destination

- Acquired from

- Seller's FEIN (Tax ID from South Dakota Out-of-State Company Licenses Setup screen)

- Date Received

- Document Number

- Gross Gallons

- Product Type

Logic for the Schedules of Receipts

All of the Schedules of Receipts are produced at the same time. Sales Invoices are the source of data for these schedules.

The Schedules of Receipts will have one detail line for each Sales Invoice line item that meets the following criteria:

- The Schedule on the line item (InvoiceLi.MFSched) is 1a or 2a.

- The Invoice Date is within the Date Range specified for the report.

The Schedules of Receipts detail lines will be grouped based on the Schedule Type and Fuel Type Code with each Schedule Type and Fuel Type on a separate page. For example:

- All of the 065 Type Products with Schedule Type 2a will be reported on one (or more) pages

- All of the 160 Type Products with Schedule Type 2a will be reported on one (or more) pages.

Each page should include a subtotal of that page. The detail lines on each page should be sorted by Invoice Date/Bill of Lading number (ticket number). The Total (of all detail lines from all pages) is printed at the bottom of the last page of each Schedule Type. In many cases, these totals are also reported on the Importer, Exporter, and Blender Tax Return.

Uniformity Schedules of Disbursements

There are 6 Schedules of Disbursements. These schedules are identical except for whether or not tax was paid on the Disbursements and whether or not the fuel was exported. Each schedule is used to report a single type of fuel. If multiple types of fuel are delivered, multiple copies of the schedule will be created. All of the states that have adopted Uniformity use these schedules. In some cases, a state my not require a column of information, in these cases the column is included on the schedule but it is not filled in. The schedule types are:

- Schedule Type 5 – Gallons delivered, tax collected

- Schedule Type 7 – Gallons exported to the state of ________________

- Schedule Type 7b – Gallons sold for export, originating state tax paid from bulk plant

- Schedule Type 10 – Gallons delivered to other tax-exempt entities

These Schedules include the following information for each receipt:

- Schedule Type

- Carrier Name

- Carrier FEIN

- Mode of Transportation

- Point of Origin

- Point of Destination

- Sold to

- Purchaser’s FEIN (Tax ID from South Dakota Out-of-State Company Licenses Setup screen)

- Date

- Document Number

- Gross Gallons

Logic for Schedules of Disbursements

All of the Schedules of Disbursements are produced at the same time. Purchase Invoices are the source of data for these schedules.

The Schedules of Disbursements will have one detail line for each Purchase Invoice line item that meets the following criteria:

- The Schedule on the line item (InvoiceLi.MFSched) is 5, 6, 7, 8, 9, or 10.

- The Invoice Date is within the Date Range specified for the report.

The Schedules of Disbursements detail lines will be grouped based on the Schedule Type and Fuel Type Code with each Schedule Type and Fuel Type on a separate page. For example:

- All of the 065 Type Products with Schedule Type 5 will be reported on one (or more) pages

- All of the 160 Type Products with Schedule Type 5 will be reported on one (or more) pages.

Each page should include a subtotal of that page. The detail lines on each page should be sorted by Invoice Date/Bill of Lading number.

The Total (of all detail lines from all pages) is printed at the bottom of the last page of each Schedule Type. In many cases, these totals are also reported on the Importer, Exporter, and Blender Tax Return.

Importer, Exporter, and Blender Tax Return

The Importer, Exporter, and Blender Tax Return is used to report a monthly summary of all taxable and nontaxable purchases and sales of fuel products. The totals from the Uniformity Schedules of Receipts and Disbursements described in this article and several amounts specified are reported on this return. This return is divided into five sections and six columns.

- Column A is used to report Gasoline (Product Type 065).

- Column B is used to report 100% Ethyl Alcohol (Product Type 124, ???).

- Column C is used to report AVGAS (Product Type 125).

- Column D is used to report Dyed Diesel and Kerosene (Product Types 072, 073, 074, 228).

- Column E is used to report Undyed Diesel and Kerosene (Product Types 160, 142, 145, 147).

- Column F is used to report Jet Fuel (Product Type 130).

- Column G is used to report Dyed Biodiesel Blend (Product Type 290).

- Column H is used to report Undyed Biodiesel Blend (Product Type 284).

- Column I is used to report 100% Methyl Alcohol (Product Type 243).

- Column J is used to report Other/Natural Gasoline (Product Type 224).

Tax Liability Section (Disbursements)

- Line 1 – Total gallons imported (Totals from Schedules 1a and 2a)

- Line 2 – Total gallons diverted from pipeline (From popup screen - see below)

- Line 3 – Total gallons (Line 1 + Line 2)

Credits Section (Receipts)

- Line 4 – Total gallons imported taxes paid (Total from Schedule 1a)

- Line 5 – Total gallons exported from own storage (From popup screen)

- Line 6 – Total gallons Kerosene sold tax free (Schedule 10 for Product Types 142, 145, 147 only)

- Line 7 – Total gallons delivered tax paid (Total from Schedule 5)

- Line 8 – Total credits (Sum of Lines 4, 5, 6, 7)

- Line 9 – Total gallons exported tax unpaid (Total from Schedule 7)

Tax Computation Section

- Line 10 – Sub Total Taxable gallon (Line 3 - Line 8)

- Line 11 – On Time allowance (Line 10 * On Time Allowance from Tax Rate Setup screen)

- Line 12 – Total Taxable Gallons (Line 10 - Line 11)

- Line 13 – Tax Rates (Tax Rates from Tax Rate Setup screen)

- Line 14 – Taxes Due (Line 12 * Line 13)

- Line 15 – Total Taxes Due (Sum of Columns A-F on Line 14)

Biodiesel Tax Computation Section (Disbursements)

- Line 16 – Gal of Biodiesel sold to licensed party (Total from Schedule 6a, 6b, or 6d for Product Type 284)

- Line 17 – Gal of Biodiesel sold to unlicensed party (Total from Schedule 6a, 6b, or 6d for Product Type 284)

- Line 18 – Total gal Tax Due on Biodiesel sales (Line 17 * tax rate for biodiesel)

- Line 19 – Total Gallons (Line 10 Col. A-J and Line 6 Col. E, & Line 17)

Taxes and Fees Due

- Line 20 – Tank Inspection Fee (Line 19 * Tank Inspection Fee rate)

- Line 21 – Grand total of tax due & inspection fee (Line 15 + Line 18 + Line 20)

- Line 22 – Interest and Penalty (from popup screen)

- Line 23 – Balance or Credit from Prior Period (from popup screen)

- Line 24 – Grand Total (Line 21 + Line 22 + Line 23)

- Line 2 – Total gallons diverted from pipeline (From popup screen)

- Line 5 – Total gallons exported (from own storage)

- Line 22 – Interest and Penalty

- Line 23 – Balance or Credit from Prior Period

Liquefied Petroleum Gas (LPG) Vendor Tax Return

Sales Summary

- Line 1 – Gallons sold, tax unpaid to other licensed LPG Vendors (Total from Schedule 6e where Product Code is 054)

- Line 2 – Gallons sold, tax unpaid for agricultural (exempt) use

- Line 3 – Gallons sold, tax unpaid to exempt government agencies (Total from Schedule 8 where Product Code is 054)

- Line 4 – Gallons sold, tax unpaid to licensed LPG Users or Highway Contractors

- Line 5 – Gallons exported from South Dakota (Total from Schedule 7 where Product Code is 054)

- Line 6 – Gallons sold on which South Dakota sales tax is due and will be reported and remitted on the sales tax return

- Line 7 – Gallons sold for or used in licensed vehicles upon which fuel tax is due (unless sold to a licensed LPG User or Highway Contractor)

- Line 8 – Total LPG Gallons Sold or Exported (Line 1 + Line 2 + Line 3 + Line 4 + Line 5 + Line 6 + Line 7)

Inventory Reconciliation

- Line 9 – Beginning LPG Inventory (From popup screen)

- Line 10 – Total gallons received during the month or brought into South Dakota

- Line 11 – Total gallons to be accounted for (Line 9 + Line 10)

- Line 12 – Total gallons sold or exported (Amount from Line 8)

- Line 13 – Ending LPG Inventory (Line 11 - Line 12)

Tax Calculation and Remittance

- Line 14 – Fuel Taxable Sales (Amount from Line 7)

- Line 15 – Fuel Tax Rate (From Tax Setup screen)

- Line 16 – Fuel Tax Liability for this reporting period (Line 14 * Line 15)

- Line 17 – Allowance (From Tax Setup screen)

- Line 18 – Net Fuel Tax Liability (Line 16 - Line 17)

- Line 19 – Interest and/or Penalty (From popup screen)

- Line 20 – Balance Due or Credit from prior records (From popup screen)

- Line 21 – Total Remittance (Line 18 + Line 19 + Line 20)