If taxable Products are being sold but some Customers are tax exempt, the various tax exemption reasons are defined at Setup / A/R / Sales Tax Exemptions. These reasons are then used at the Invoicing screen to explain why sales tax is not being charged.

Setup

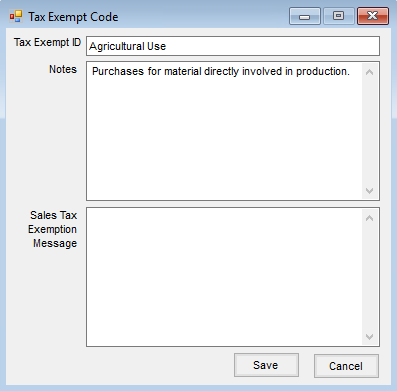

- Select Add. On the Tax Exempt Code window, add a Tax Exempt ID.

- Any Notes that are added are for internal use only. Information can be added about the exemption such as why it was set up or what is required to use this exemption.

- The Sales Tax Exemption Message prints on Invoices if the Print Sales Tax Exemption Message option is selected at Setup / Location Preferences / Invoice Printout.

- Select Save.

Using a Sales Tax Exemption

There are two ways to select a Sales Tax Exemption.

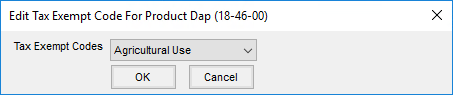

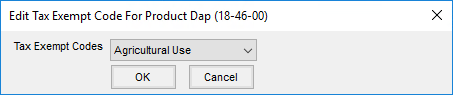

- In the Product grid on the Invoice, right-click the Tax checkbox and a screen appears with the previously defined exemption reasons listed. Choose the reason that applies.

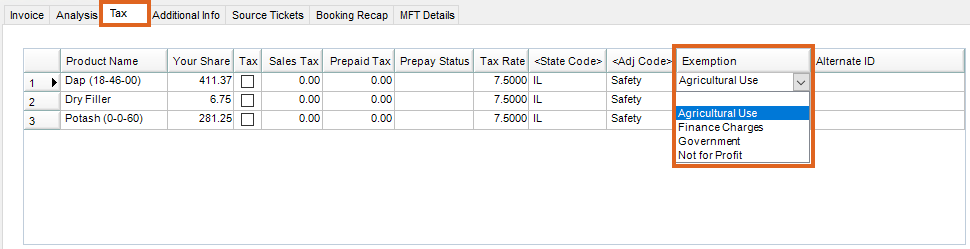

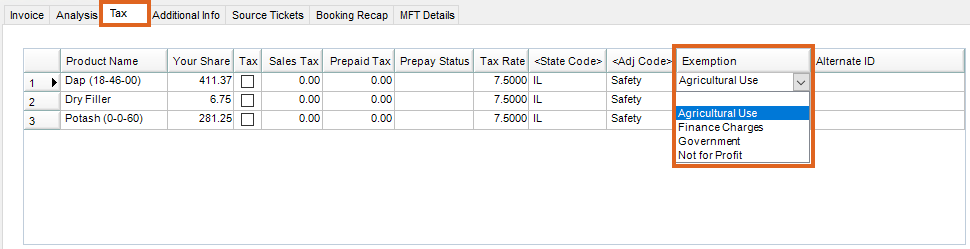

- Select the Sales Tax Exemption reason on the Invoice's Tax tab, and choose the applicable reason in the Exemption column.

Note: If the Tax checkbox is selected on the Tax tab, it must be unchecked to be able to choose the Exemption from the drop-down. Alternatively, right-click the Tax checkbox on the Invoice tab to select the exemption reason.

Save the Invoice and tax will not be applied for the items with the Tax column unchecked.

These exemption reasons are summarized on the Sales Register and Sales Tax Summary reports for sales tax reporting.