Minnesota is not a Uniformity State, but some Minnesota customers also need the ability to report to a Uniformity State as well as the State of Minnesota. Agvance Motor Fuel for the State of Minnesota gives the ability to file and create reports for multiple states.

General information regarding Motor Fuel can be found here.

Modes of Transportation are not used in the State of Minnesota but, if reporting to multiple states, refer to the setup linked above for information needed to fill out on the transaction.

Assumptions

- Each Motor Fuel Purchase Invoice will only contain one fuel Product.

- Each Product that is considered a Motor Fuel Product will need to be set up as a Motor Fuel Product, excluding Soy Oil.

- Origin Cities will be set up to include the Terminal ID and City.

- Soy Oil will be transferred with a Purchase Invoice and will not be considered a Motor Fuel Product in Agvance. See PDA-56 information.

- The Filer Info or Company name will come from Agvance / Setup / Company and not the Location information.

Agvance will create the following reports:

- PDA-46

- PDA-46H

- PDA-49

- PDA-49E

- PDA-56

- PAF-1

- PDA-46E

- PDA-46Q

- PDA-49B

- PDA-49G

- PDA-57

The following Schedules are not supported in Agvance. The total from the Schedules are available as an input field on the appropriate summary Schedule.

- PDA-46F – Sales to US Govt by terminal/refinery operators (No form available, but fill-in field on the PDA-46)

- PDA-49J – Jet Fuel (No form available, but fill-in field on the PDA-49

- PDR-1AV – Aviation Fuel Tax Claim for Refund (No form available, but fill-in field on the PDA-49)

The Product Codes that are used will be the Uniformity Fuel Codes listed below.

- Gasohol – 124

- Gasoline – 065

- E-85 – 079

- Aviation Gasoline – 125

- Diesel Fuel - Undyed – 160

- Diesel Fuel - Dye Added – 228

- Kerosene - Undyed – 142

- Kerosene - Dye Added – 072

- Liquefied Natural Gas (LNG) – 225

- Propane (LPG) – 054

- Compressed Natural Gas (CNG) – 224

- Undyed Biodiesel – 284

State of Minnesota Setup

At Motor Fuel / Reports / Minnesota, there are specific setups unique to the State of Minnesota.

Company Licenses

Select Company Licenses. The License Number is the Minnesota Tax ID reported with the Schedules. The Type of tax ID and Tax ID: FEIN/SSN are not required in Minnesota.

Tax Rates Setup

Select Tax Rates Setup to open the Minnesota Evaporation and Loss Allowance and Tax Rates window. This gives the ability to enter all of the tax rates and percentages used on the PDA-46, PDA-46Q, PDA-49, and PAF-1.

Customer Licenses

Choose Customer Licenses to open the Customer Licenses Setup window. Double-click the Customer Name header to select a Customer then enter the Customer License number.

Special Fuel

Choose Special Fuel to open an area to designate the Products (Tanks) that are to be considered for the PDA-49E. Select the Product that represents the storage tank and enter the Description and/or Tank Number.

Schedules

Minnesota Motor Fuel Tax returns are divided into three parts:

- PDA-46 – Gasoline

- PDA-49 – Special Fuels (i.e. diesel)

- PAF-1 – Alternative Fuels (i.e. LPG and CNG)

The Schedules Agvance creates can be submitted as official paperwork to the State of Minnesota.

- PDA-46E – Sales of Gasohol/Gasoline to US Govt

- PDA-46H – Sales of Gasohol/Gasoline to farmers in Minnesota

- PDA-46QE85 – Sales of E-85

- PDA-46QAG – Sales of Aviation Gasoline

- PDA-46QGS – Sales of Gasoline to Qualifying Gas Stations

- PDA-49BH – Special Fuels Credit - Heating Use

- PDA-49BUS – Special Fuels Credit - US Govt

- PDA-49BE – Special Fuels Credit - Exported

- PDA-49GS – Sales of Red Dyed Special Fuel/Kerosene - State, Local Govt

- PDA-49GB – Sales of Red Dyed Special Fuel/Kerosene – Buses

PDA-46

The PDA-46 is created from several Schedules. Since Agvance Motor Fuel does not create the PDA-46F, the report will give the ability to enter the number of gallons sold to the US Government by terminal/refinery operators after OK is selected on the Report screen. The report will then calculate the Gasoline tax payable to the State of Montana.

PDA-49

The PDA-49 is created from several Schedules. Since Agvance Motor Fuel does not create the PDA-49J, gallons of Jet Fuel, or PDR-1AV, the report will give the ability to enter the number of gallons sold on the Schedules after OK is selected on the Report screen. The report will then calculate the Special Fuel tax payable to the State of Minnesota.

PAF-1

The PAF-1 is used to summarize sales of Alternative Fuels and to calculate the tax due on Alternative Fuels. The report does not require the Sales Invoice to reflect the Schedule of PAF-1. The report will calculate the gallons based on the Product Types of 054, 224, and 225. If an AR Invoice contains a Product with one of these three Product Codes, then it will use the Invoices to calculate the taxable gallons on the report and the tax payable to the State of Minnesota.

PDA-56

The PDA-56 is used to report purchases and fuel delivered to other states. There are three different forms of this Schedule:

- Fuel received from Minnesota terminals on which tax was not paid

Note: This can be indicated by the Tax/Fee Type being set to Both Paid on purchases. - Fuel imported into Minnesota

- Fuel exported from Minnesota

The transactions that are reported on the Schedules come from Purchase Invoices and AR Invoices. The Fuel Type in the Setup area will determine which column the fuel is reported on the Schedule.

Fuel Received from MN Terminals

This form of the PDA-56 will change the option to Shipments received from Minnesota terminals. Purchase Invoices are used to create the report where the Origin and Destination State are both MN.

Fuel Imported

This form of the PDA-56 will change the option to Shipments imported to Minnesota from the state of. Purchase Invoices are used to create the report where the Origin is not MN and the Destination is MN. A separate form will be created from each Origin state. If reporting this purchase to another state, designate the appropriate out-of-state Schedule on the Purchase Invoices. The Minnesota reports will not be based on the Motor Fuel Schedule but are based on the Origin and Destination states.

Fuel Exported

This form of the PDA-56 will change the option to Shipments exported from Minnesota from the state of. Sales Invoices are used to create this report where the Origin is MN and the Destination State is not MN. A separate form will be created for each Destination State. Designate the appropriate out-of-state Schedule on the Sales Invoice. The Minnesota reports will not be based on the Motor Fuel Schedule but are based on the Origin and Destination States.

PDA-57

The PDA-57 is the recap of information from the PDA-56 forms. There is no setup in Agvance for this report to be created.

PDA-46E

The PDA-46E will report the sales of gasoline to the US Govt. The sales will create one line of detail on the Schedule from a Sales Invoice if it meets the following criteria:

- The Schedule selected on the Sales Invoice is PDA-46E.

- The Sales Invoice Date is between the date range specified on the Report screen.

The report will obtain the information for the fields from several areas:

- To whom sold – First and Last Name from the Customer file based on the Customer ID for which the Invoice was created.

- Invoice No – Invoice Number

- Date – Invoice Date

- Name of purchaser – This will come from the Customer PO on the Additional Information tab on the Invoice.

- Point of delivery – The Destination on the MFT Details tab on the Invoice.

- Gallons – Number of gallons sold on the Invoice.

PDA-46H

The PDA-46H will report the sales of gasoline to farmers in Minnesota. The sales will create one line of detail on the Schedule from a Sales Invoice if it meets the following criteria:

- The Schedule selected on the Sales Invoice is PDA-46H.

- The Sales Invoice Date is between the date range specified on the Report screen.

The report will obtain the information for the fields from several areas.

- Name of Purchaser – First and Last Name from the Customer file based on the Customer ID for which the Invoice was created.

- Address and City – The address will come from Address 2 in the Customer file and the City based on the Customer ID for which the Invoice was created.

- Zip – The Zip will come from the Customer file based on the Customer ID for which the Invoice was created.

- Invoice No – Invoice Number

- Date – Invoice Date

- Grade – Left blank

- Gallons – Number of gallons sold on the Invoice

PDA-46Q

The PDA-46Q will be broken down by the three options that can potentially be reported on the Schedule.

- PDA-46QE85 – Reports the sales of E-85 in Minnesota.

- PDA-46QAG – Reports the sales of Aviation Gasoline in Minnesota.

- PDA-46QGS – Reports the sales of gasoline to qualifying service stations in Minnesota.

The sales will create one line of detail on the Schedule from a Sales Invoice if it meets the following criteria:

- The Schedule selected on the Sales Invoice is PDA-46QE85, PDA-46QAG, or PDA-QGS.

- The Sales Invoice date is between the date range specified on the Report screen.

The report will obtain the information for the fields from several areas.

- To Whom Sold – First and Last Name from the Customer file based on the Customer ID for which the Invoice was created.

- Mailing Address – The address will come from Address 2 in the Customer file based on the Customer ID for which the Invoice was created.

- Town where delivered – City from the Customer file based on the Customer ID for which the Invoice was created.

- Date – Invoice date

- Ticket no – Invoice Number

- Gallons – Number of gallons sold on the Invoice

PDA-49B

The PDA-49B will be broken down by the option that can potentially be reported on the Schedule.

- PDA-49BH – Reports the Special Fuels credit for residential heating use sales.

- PDA-49BUS – Reports the Special Fuels Credit for US Govt sales.

- PDA-49BE – Reports the Special Fuels Credit Exported.

The sales will create one line of detail on the Schedule from a Sales Invoice if it meets the following criteria:

- The Schedule selected on the Sales Invoice is PDA-49BH, PDA-49BUS, or PDA-49BE.

- The Sales Invoice date is between the date range specified on the Report screen.

The report will obtain the information for the fields from several areas:

- Explanation – SS#/Tax ID, First and Last Name, Address (Address 2), and City/State/Zip will come from the Customer file based on the Customer ID for which the Invoice was created.

- Date – Invoice date

- Ticket no – Invoice Number

- Gallons – Number of gallons sold on the Invoice

PDA-49G

The PDA-49G will be broken down by the option that can potentially be reported on the Schedule.

- PDA-49GS – Reports bulk sales of red dyed special fuel diesel/kerosene to State/Local Govt.

- PDA-49GB – Reports bulk sales of red dyed special fuel diesel/kerosene to buses.

The sales will create one line of detail on the schedule from a Sales Invoice if it meets the following criteria:

- The Schedule selected on the Sales Invoice is PDA-49GS or PDA-49GB.

- The Sales Invoice date is between the date range specified on the Report screen.

The report will obtain the information for the fields from several areas.

- To Whom Sold – First and Last name from the Customer file based on the Customer ID for which the Invoice was created.

- Town where delivered – City from the Customer file based on the Customer ID for which the Invoice was created.

- Date – Invoice date

- Ticket number – Invoice Number

- Gallons – Number of gallons sold on the Invoice

PDA-49E

Form PDA-49E is used to reconcile inventory for undyed diesel and undyed kerosene stored in underground tanks with meters. Since Agvance does not know which tanks are metered, they have to be defined at Motor Fuel / Reports / Minnesota / Special Fuel. Agvance will calculate some of the fields for the tank reconciliation. Three fields will be handwritten on the form. For each defined tank, Agvance will print the following information.

Agvance Calculations

- Location – Description from the Special Fuels Reconciliation Setup screen

- Beginning Inventory – If the reporting period is month 1, it will use the beginning year balance. For the other reporting months, it will use the prior month's ending balance.

- Gallons purchased – Sum of the Purchase Invoices that were created for the Product

- Total to Account for – Beginning Inventory + Gallons Purchased

- Taxable Sales – Sum of the Sales Invoices that were created for the Product where the Tax/Fee Type on the MFT Details tab is blank.

- Nontaxable Sales – Sum of the Sales Invoices that were created for the Product where the Tax/Fee Type on the MFT Details tab is Both Free.

- Total Sales – Adds Taxable and Nontaxable sales

- Balance – Total to Account for - Total Sales

- Ending Inventory – If the reporting on the current fiscal month (the fiscal month being reported has not been closed in Agvance), it will use the current amount on hand. If the reporting month is a prior fiscal month, it will use the month-end quantities.

User Inputs

- Ending meter reading

- Beginning meter reading

- Gallons metered

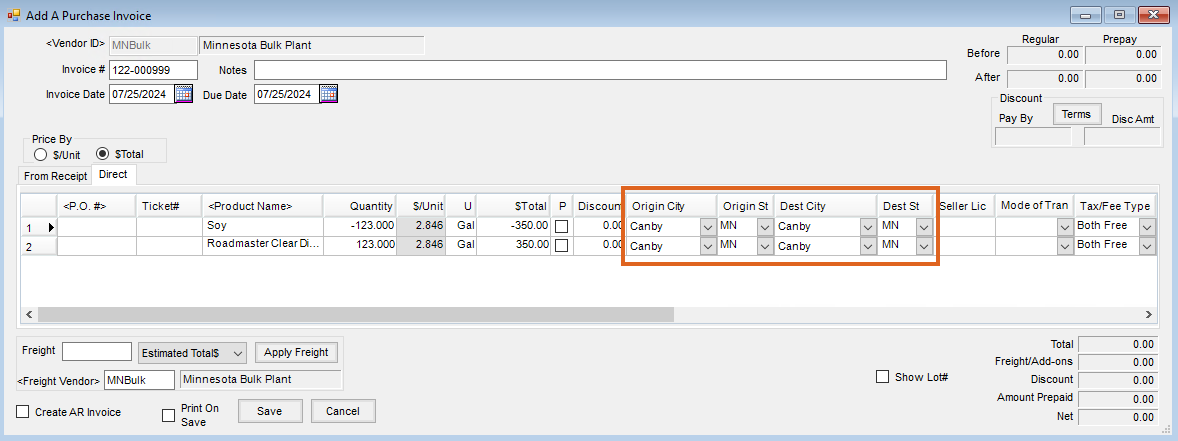

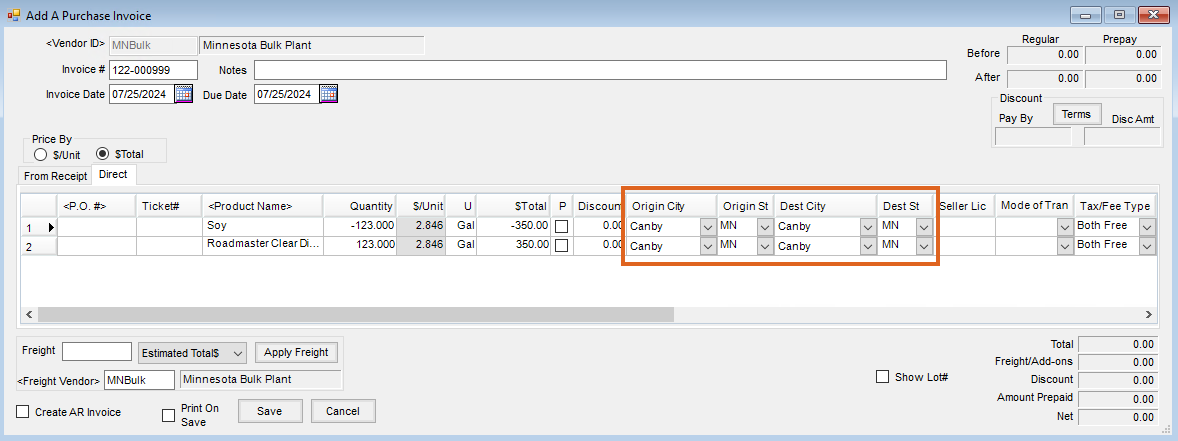

Soy Oil

The movement of Soy Oil from a non-fuel Product to a fuel Product will be handled in Agvance in the following way:

- Enter a Purchase Receipt/Purchase Invoice to bring the Soy Oil into inventory as it is received at the facility.

- Once a load of soy oil has been moved to a tank of fuel, enter a Purchase Invoice.

- Select the Soy Product and the Product to which the Soy is being added.

- Enter the number of gallons of soy being added to the fuel tank as a negative number, then enter the number of gallons by which the Fuel Product will be increased.

- The cost that will be used is the current Average Cost of the soy oil. This will increase the Average Cost appropriately. This will create a zero sum Purchase Invoice.

- Select an Estimated Freight Vendor.

- Enter the Origin and Destination of the fuel.

Form PDA-46 Minnesota Gasoline Tax Return

Form PDA-46 is used to summarize the information on the other PDA-46 and PDA-56 forms and to calculate the tax due on Gasoline. This form has two columns. The first is used to report Gasoline/Alcohol and the second is used to report Other than Gasoline. The supporting forms (below) are the source of this data.

The Schedule will reflect the Company’s Name, Tax ID, and Month/Year in the appropriate area designated on the Schedule.

| Line 1 – Shipments received | Total from Column F from PDA-56 for Receipts from MN Terminals | Total of G + Total of H from PDA-56 for Receipts from MN Terminals |

| Line 2 – Shipments imported | Total from Column F from PDA-56 for Imports into MN | Total of G + Total of H from PDA-56 for Imports into MN |

| Line 3 – Total Received | Line 1 + Line 2 | |

| Line 4 – Total Exported | Total from Column F from PDA-56 for Exports from MN | Total of G + Total of H from PDA-56 for Exports from MN |

| Line 5 – Total Gallons | Line 3 - Line 4 | |

| Line 6 – Sales to US Govt by Terminal | Typeable popup field on the Preview of report | NA |

| Line 7 – Gallons Subject to Evaporation | Line 5 - Line 6 | NA |

| Line 8 – Evaporation and Loss Allowance | Line 7 * Evap/Loss Allowance from Setup screen | NA |

| Line 9 – Net Gallons Before Credits | Line 7 - Line 8 | NA |

| Line 10 – Sales to US Govt from Paid Stock | Total from PDA-46E | NA |

| Line 11 – Bulk Gasoline Sales to Farmers from Paid Stock | Total from PDA-46H | NA |

| Line 12 – Gallons Subject to Gasoline Tax | Line 9 - Line 10 - Line 11 | NA |

| Line 13 – Tax Payable to State | Blank | Line 12 * MN Gasoline Tax Rate from Setup screen |

| Line 14 – Inspection Fee Payable | Blank | (Line 5 Column 1 + Line 5 Column 2) * Inspection Fee Tax Rate from Setup screen |

| Line 15 – Amount Payable to State Before Adjustments | Blank | Line 13 + Line 14 |

| Line 16a – Aviation Gasoline Adjustment -

Gallons from PDA-46QAG @ Aviation Tax Rate Reduction from Setup screen |

Gallons from PDA-46QAG * Aviation Tax Rate Reduction from Setup screen | Blank |

| Line 16b – Service Station Adjustment -

Gallons from PDA-46QGS @ Gas Station Tax Rate Reduction from Setup screen |

Gallons from PDA-46QGS * Gas Station Tax Rate Reduction from Setup screen | Blank |

| Line 16c – E-85 Adjustment -

Gallons from PDA-46QGS @ Gas Station Tax Rate Reduction from Setup screen |

Gallons from PDA-46QE85 * E-85 Tax Rate Reduction from Setup screen | Blank |

| Total Authorized Adjustments | Blank | Line 16a + Line 16b + Line 16c |

| Amount Due | Blank | Line 15 - Line 16 |

Form PDA-49 Special Fuel Tax Return

Form PDA-49 is used to summarize the information on the other PDA-49 and PDA-56 forms and to calculate the tax due on Special Fuel. This form has two columns. The first is used to report Jet Fuel (not supported by Agvance) and the second is used to report Special Fuel. The supporting forms (below) are the source of this data.

The Schedule will reflect the Company’s Name, Tax ID, and Month/Year in the appropriate area designated on the Schedule.

| Line 1 – Gallons of Undyed Diesel/Kerosene from PDA-56 Column G | Blank | Total of G from PDA-56 for Receipts from MN Terminals |

| Line 2 – Gallons of Dyed Diesel/Kerosene from PDA-49G | Blank | Total from PDA-49GS and PDA-49GB |

| Line 3 – Gallons of Jet Fuel from PDA-49J | Blank | Blank. Not supported by Agvance at this time. |

| Line 4 – Total Gallons | Blank (from Line 3, Column B) | Line 1 Column B + Line 2 Column B |

| Line 5 – Credits from PDA-49B | Blank. Not supported by Agvance | Sum of Total Gallons from PDA-49BUS, PDA-49BH, and PDA-49BE |

| Line 6 – Gallons Less Credit | Blank. Not supported by Agvance. | Line 4 - Line 5 |

| Line 7 – Evaporation and Loss | Blank. Not supported by Agvance. | Line 6 * Special Fuel Evaporation/Loss Allowance from Setup screen |

| Line 8 – Gallons Subject to Tax | Blank. Not supported by Agvance. | Line 6 - Line 7 |

| Line 9 – Tax Rate | Blank. Not supported by Agvance. | Minnesota Special Fuel Tax Rate from Setup screen |

| Line 10 – Line 8 * Line 9 | Blank. Not supported by Agvance. | Line 8 * Line 9 |

| Line 11 – Less PDR-1AV | Blank. Not supported by Agvance. | Blank |

| Line 12 – Total Tax Due | Blank. Not supported by Agvance. | Line 10 |

| Line 13 – Total Amount Due | Blank | Line 10 |

Form PAF-1 Alternative Fuels Tax Return for Special Fuels

Form PAF-1 is used to summarize sales of Alternative Fuels and to calculate the tax due on Alternative Fuels. This form has three columns. The first is used to report Taxable Gallons, the second is used to report Tax Rate and the third column is used to report the excise tax due. Sales Invoices where the Schedule (InvoiceLi.MFSched) is PAF-1 are the source of this data.

The schedule will reflect the Company Name, Tax ID, and Month/Year in the appropriate area designated on the Schedule.

| Line 1 – LPT used or sold as Motor Fuel | InvLi.invamt where Product Type is 054 | Minnesota LPG Tax Rate from Setup screen | Column A * Column B |

| Line 2 – CNG used or sold as Motor Fuel | InvLi.invamt where Product Type is 224 | Minnesota CNG Tax Rate from Setup screen | Column A * Column B |

| Line 3 – LNG used or sold as Motor Fuel | InvLi.invamt where Product Type is 225 | Minnesota LNG Tax Rate from Setup screen | Column A * Column B |

| Line 4 – Total Excise Tax | Blank | Blank | Line 1 + Line 2 + Line 3 |

| Line 5 – Evaporation and Loss (Rate Printed in Line Description) | Blank | Line 4 * Alternative Fuel Evaporation/Loss Allowance from Setup screen | |

| Line 6 – Amount Due | Blank | Line 4 - Line 5 |

Rules for Forms Reporting Purchases

Form PDA-56 is used to report purchases and fuel delivered to other states. There are three versions of this Schedule:

- Fuel received from MN terminals

- Fuel imported

- Fuel exported

The data on these Schedules is based on Purchase Invoices and, in the cases of fuel delivered to other states, Sales invoices. The Fuel Type is used to determine on which column a particular purchase/sale is reported.

Form PDA-56 Fuel Received from MN Terminals

Form PDA-56 is used to report fuel received from MN terminals. Purchase Invoices where the Origin and Destination are both MN are the source for this data. The totals from this form are reported on Line 1 of PDA-46.

Detail Lines and Their Data Sources

- Point of Origin Terminal

- Point of Origin Supplier

- Name of Carrier

- Unloaded At (Destination City)

- Date

- Manifest Number

- Gallons Gasoline (Product Type is 124, 065, 079, 125)

- Gallons undyed diesel fuel (Product Type is 160, 142, 285, 145, 147, 161, 167, 284)

- Gallons other (Product Type is 228, 072, 285, 073, 074, 226, 227)

The three Gallons columns are totaled at the bottom of each page.

Form PDA-56 Fuel Imported into MN

Form PDA-56 is used to report fuel imported into MN. Purchase Invoices where the Origin is not MN and Destination is MN are the source for this data. A separate form is produced for each Origin State. The totals from this form are reported on Line 2 of PDA-46.

Select the appropriate Out-of-State Schedule for these Purchase Invoices. The Minnesota reports will not be based on the Motor Fuel Schedule (they are based on the Origin and Destination States) but the Out-of-State reports will be based on the Motor Fuel Schedule.

Detail Lines and Their Data Sources

- Point of Origin Terminal

- Point of Origin Supplier

- Name of Carrier

- Unloaded At (Destination City)

- Date

- Manifest Number

- Gallons Gasoline (Product Type is 124, 065, 079, 125)

- Gallons undyed diesel fuel (Product Type is 160, 142, 285, 284)

- Gallons other (Product Type is 228, 072, 285)

The three Gallons columns are totaled at the bottom of each page.

Form PDA-56 Fuel Exported from MN

Form PDA-56 is also used to report fuel exported from MN. Sales Invoices where the Origin is MN and Destination is not MN are the source for this data. A separate form is produced for each Destination State. The totals from this form are reported on Line 4 of PDA-46.

Select the appropriate Out-of-State Schedule for these Sales Invoices. The Minnesota reports will not be based on the Motor Fuel Schedule (they are based on the Origin and Destination States) but the Out-of-State reports will be based on the Motor Fuel Schedule.

Detail Lines and Their Data Sources

- Point of Origin Terminal

- Point of Origin Supplier

- Name of Carrier

- Unloaded At

- Date

- Manifest Number

- Gallons Gasoline (Product Type is 124, 065, 079, 125)

- Gallons undyed diesel fuel (Product Type is 160, 142, 285, 284)

- Gallons other (Product Type is 228, 072, 285)

The three Gallons columns are totaled at the bottom of each page.

Form PDA-57 Recap of Petroleum Products

Form PDA-57 is used to recap the information on the PDA-56 Forms. This form has four sections. Section 1 lists Fuel from Minnesota Terminals totaled by Terminal (PurInvdt.PiDtMFOrgCity). Section 2 lists total Gallons from Section 1. These totals are then reported on PDA-46. Section 3 lists fuel imported totaled by source state. Section 4 lists total Gallons from Section 3. These totals are then reported on PDA-46 and PDA-49. This report has four columns. The first column is used for the Terminal or description of the line, columns 2, 3, and 4 correspond to PDA-56 column F, G, and H.

The schedule will reflect the Company Name, Tax ID, and Month/Year in the appropriate area designated on the Schedule.

Section 1 from Form PDA-56 Fuel Received from MN Terminals

- Column 1 - Minnesota Terminals Source

- Column 2 - Gas – Total of column F

- Column 3 - Undyed Diesel – Total of column G

- Column 4 - Dyed Fuel Oil – Total of column H

Section 2 Totals from Section 1 – See Form for Format

Section 3 from Form PDA-56 Fuel Imported into MN

- Column 1 - Shipments into Minnesota

- Column 2 - Gas – Total of column F

- Column 3 - Undyed Diesel – Total of column G

- Column 4 - Dyed Fuel Oil – Total of column H