There are multiple gift certificate scenarios and each one is handled differently depending on several factors such as how the gift certificates were obtained by the Customer and how the gift certificate activity is tracked in Agvance.

In one scenario, the gift certificates are expensed to the company as a gift to Customers and no cash is received in exchange. Since no cash was received for the gift certificates, the value of the certificates would be an expense to the company. Ideally, the full value of the gift certificates should be entered as a Journal Entry to a liability account called Gift Certificates, which will hold the balance of the gift cards that have not been redeemed.

- As the Customers redeem the gift certificates, the Agvance User will enter Invoices as they normally would, and then pay the portion covered by the gift certificate with a payment method that points to the Gift Certificate liability account. Because it is a liability account, it will retain its balance even when the year is closed.

Another scenario that may occur is when a gift certificate is purchased and cash is received for that transaction. This can be handled in a couple of ways.

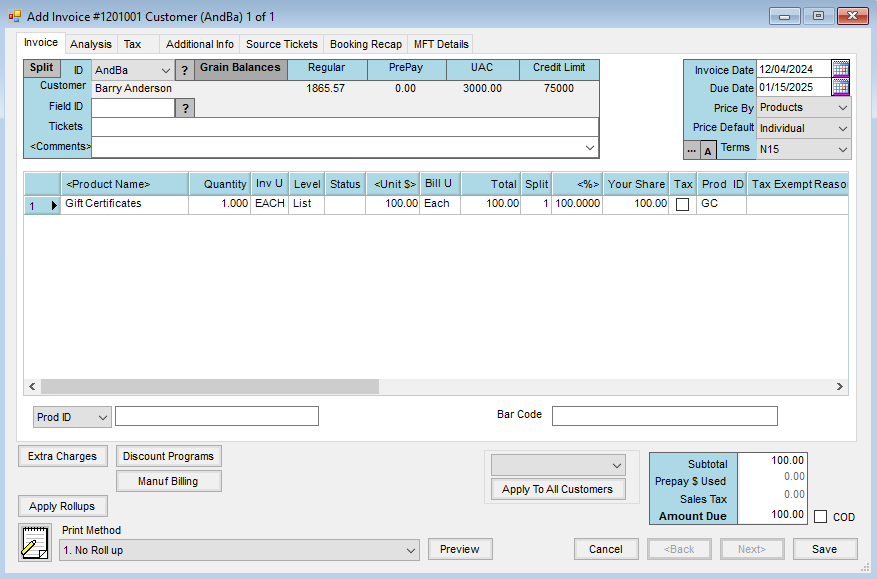

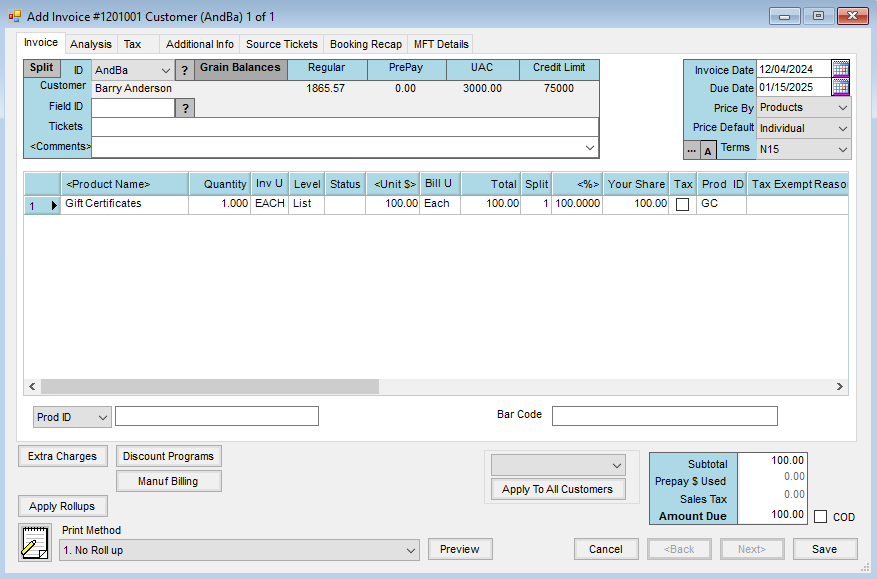

- Create a Product in a non-inventoried, miscellaneous department called Gift Certificate, which should point the sales account to a Gift Certificate liability account. At the sale of the gift certificate, create an Invoice using that new Product with a Quantity of 1 and a unit dollar price equal to the total value of the gift certificate.

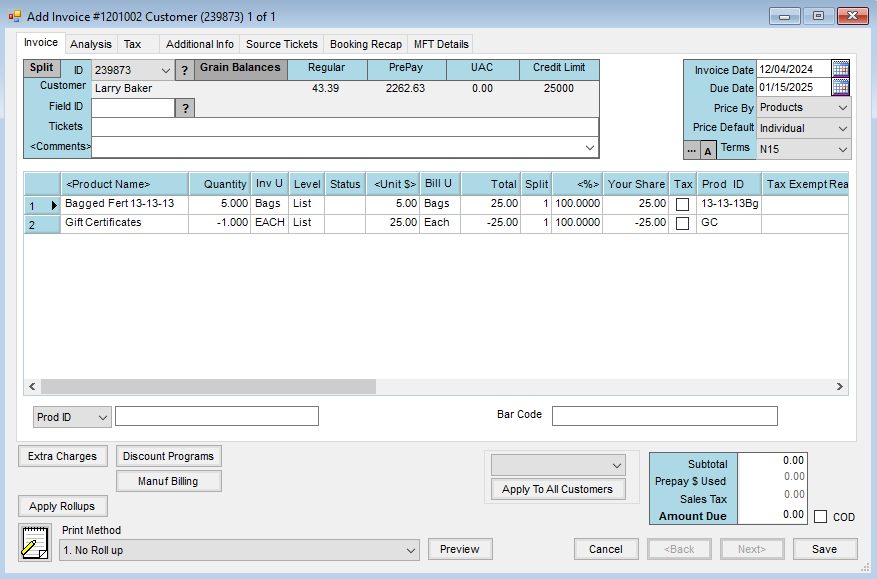

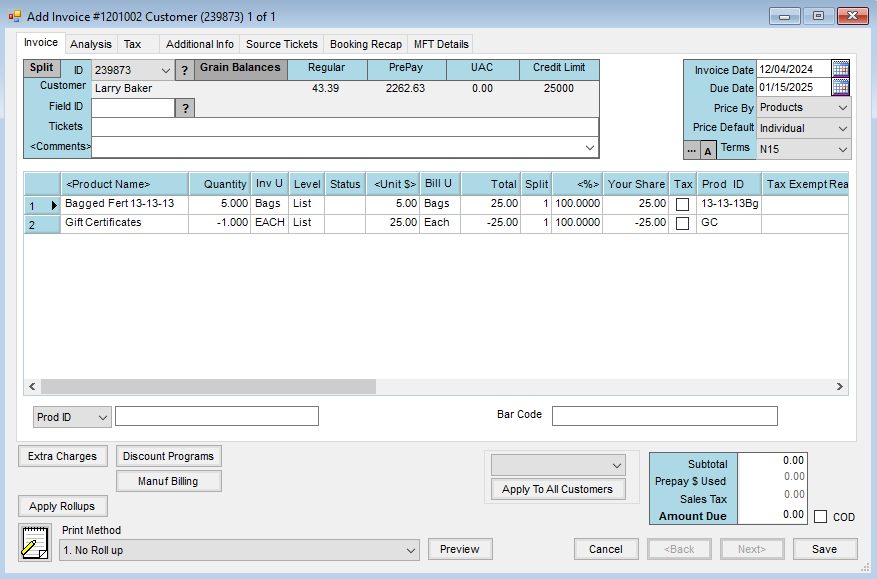

- When the gift certificate is redeemed, add an Invoice with the Product being purchased and an additional line item for the gift certificate Product with a quantity of -1 and a unit price of the value of the gift certificate. This will reduce the total cost of the Invoice by the value of the gift certificate and the Customer will owe the balance of the Invoice.

Note: If this method is used, track the gift certificate activity by running a Sales Analysis report for the Gift Certificate Product.

- When the gift certificate is redeemed, add an Invoice with the Product being purchased and an additional line item for the gift certificate Product with a quantity of -1 and a unit price of the value of the gift certificate. This will reduce the total cost of the Invoice by the value of the gift certificate and the Customer will owe the balance of the Invoice.

- At the sale of the gift certificate, create a paid Booking for the Gift Certificate Product and use the payment method appropriate for the cash used for purchasing the gift certificate. When the gift certificate is redeemed, enter an Invoice for the Product being purchased and steal dollars from the Booking entered for the Gift Certificate Product. The Customer will owe the balance remaining after the Booking dollars have been used.

Note: If this method is used, tracking the usage of gift certificates will be more challenging. Booking reports are not set up to focus on Products, but rather Customers.