Service Charges

Elevator grain storage policies determine how Grain Bank Service Charges are handled. The following example demonstrates how the Grain Bank Service Charges may be set up in Agvance to charge storage on customer’s Grain Bank balances at the beginning or end of the month.

Monthly service charges require a Storage and Service Schedule be set up with Rates defined as a specific day of the month. This example is set up to be three cents on the balance charged on the first day of each month.

All Grain Bank Assemblies and Grain Bank Settlements to be service charged require the GBMonthly charge schedule be assigned to them.

The Grain Bank Settlements can automatically have the Charge Schedule assigned. At Grain / Setup / Commodities, edit a Commodity and select the Setup Charges button. Choose the GBMonthly Charge Schedule for the Grain Bank DPR Category.

Assemblies may be set to warn if missing a Charge ID. The Warn if Assembly has a missing Charge ID option is found at Grain / Setup / Grain Ledger G/L Posting Accounts.

If Grain Bank charges are to be invoiced monthly on month-end Grain Bank balances, reconcile the Grain Bank Shipments prior to invoicing Service Charges at Grain / Utilities / Invoice Storage and Service Charges. If charges are to be invoiced on the beginning of the month Grain Bank balance, then invoice the charges prior to Grain Bank Reconciliation.

Why Invoice on Grain Bank Ending (Beginning) Month Balances?

- Invoicing the balances simplifies the service charges calculation.

- It is easy to explain (i.e. the balance at the end of the month is 1100 bu. * $0.03=$33.00).

- It does not require daily Grain Bank Shipment reconciliation.

What Are the Concerns of Invoicing Grain Bank Charges on Month-End (Beginning) Balances?

The main issue is when the Grain Bank balances were removed, the running balance does not display a true daily charge.

What about a Charge on a Daily Grain Bank Balance?

This can be done by setting up a Grain Bank Service Schedule with a daily rate instead of a rate that is charged one day. With this schedule assigned to the Grain Bank Assemblies and Grain Bank Settlements, reconciling Grain Bank Shipments each day will result in an Invoice accurately calculating the service charges for the invoiced Grain Bank products on the day they left the elevator.

Additionally, the open Grain Bank balances at the end (beginning) of the month must also be invoiced using the utility at Grain / Utilities / Invoice Storage and Service Charges.

What if It Is not Necessary to Invoice Grain Bank Charges Each Time a Settlement to Redelivery is Done?

All storage charges from reconciled Grain Bank Shipments may be rolled up into the end of the month process of invoicing Grain Bank Storage Charges. To invoice the accumulated charges out using the Invoice Storage and Service Charges utility, the Redelivered Settlement must have a Charge Schedule attached to it. The Schedule assigned to the Redelivered Settlements should not be used for any other Settlements. The Schedule should not have any in charge values or a daily rate.

The Redelivered Settlements can automatically have the Charge Schedule assigned under Grain / Setup / Commodities. Choose Setup Charges, and select the appropriate Charge Schedule for the Redelivered DPR Category.

When running the Invoice Storage and Service Charges utility, select the Include Redelivered Settlements option.

Setup for Invoicing

Following is the recommended method of tracking grain owned by the customer but stored for later use in feed that they pay to have mixed.

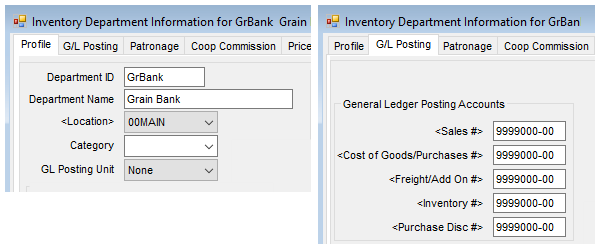

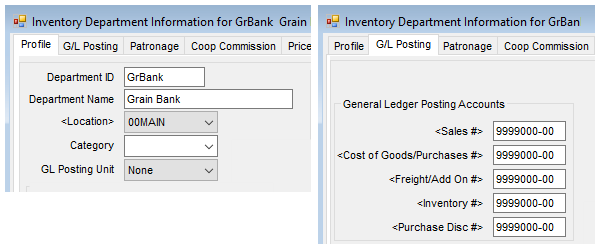

Accounting Setup

- Add a Grain Bank Inventory Department for each Location.

- Select None for the GL Posting Unit.

- Choose the same GL Account for each of the Key Accounts. The account chosen does not matter as nothing will be posted for sales or purchases. SSI recommends using the Accounting clearing account.

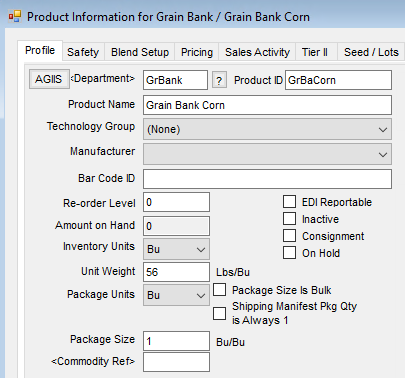

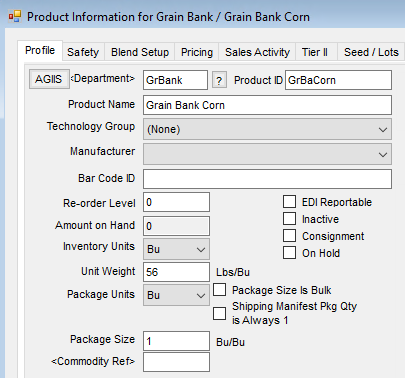

- Add a Product for each Commodity/Location with no List or Cost prices. The Product Name displays on the Invoice.

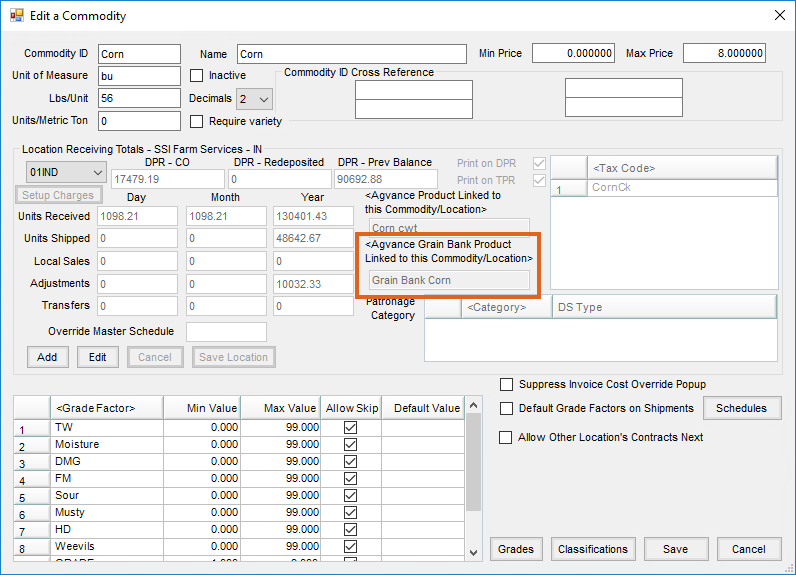

Grain Setup

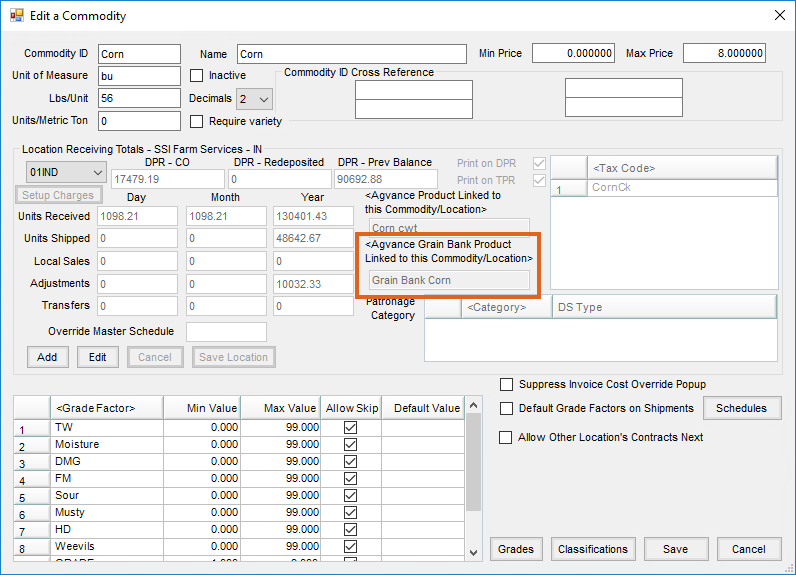

- Edit the Commodity and select the Agvance Grain Bank Product Linked to this Commodity/Location.

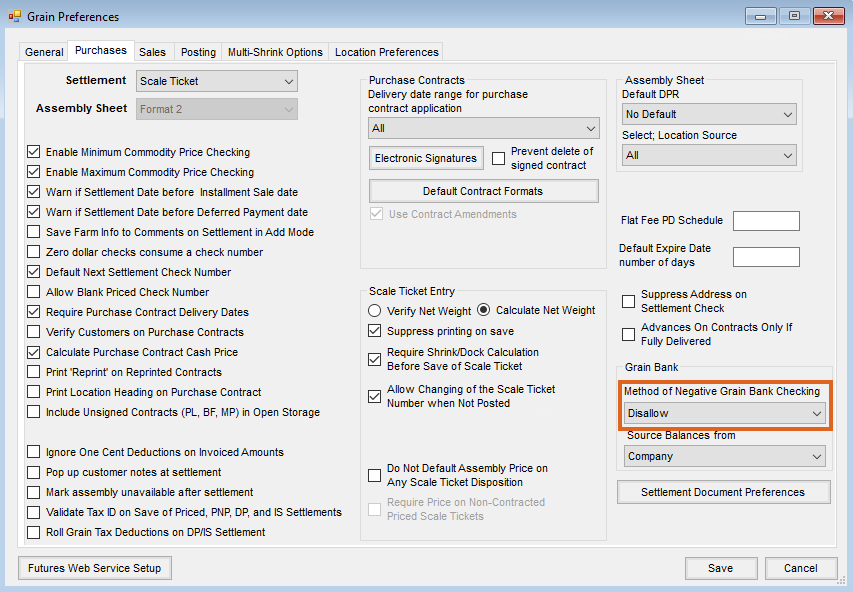

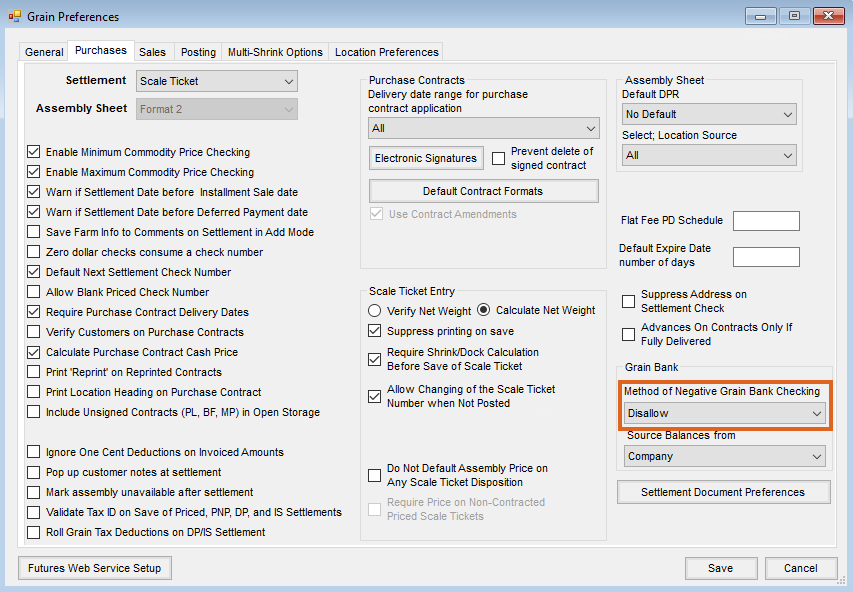

- Set the Method of Negative Grain Bank Checking on the Purchases tab at Grain / Setup / Preferences.

- Don’t Check – This option will not check for negative grain bank balances when adding a transaction.

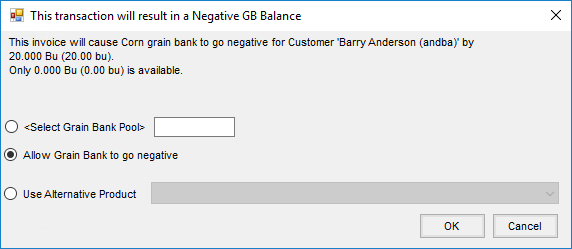

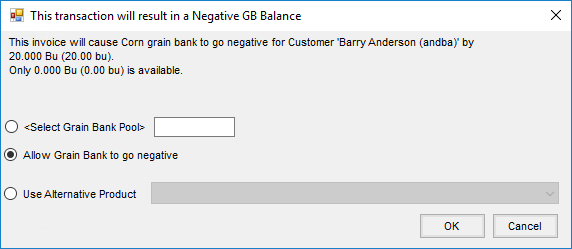

- Warn Only – This option will check the Customer’s grain bank balance to determine if a transaction will create a negative balance. If the balance is negative, a warning message will display asking how to continue with the transaction. An alternative Product can then be selected. Only Products with a Commodity tied to them will be available. If Allow Grain Bank to go negative is chosen, the Product that prompted the warning will remain on the Invoice.

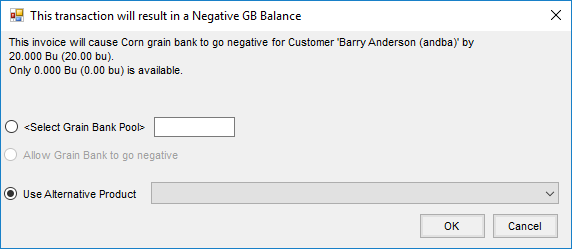

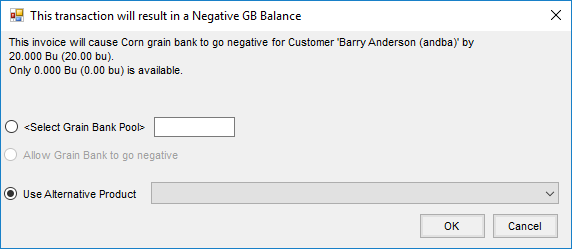

- Disallow – This option will check the Customer’s grain bank balance to determine if a transaction will create a negative balance. If the balance is negative, a message will display requiring that an alternative Product be selected. The transaction will not finish until a different Product is selected. Only Products with a Commodity tied to them will be available. The Allow Grain Bank to go negative option cannot be selected with Disallow checking.

With both Warn Only and Disallow options, the only Products available to select are ones tied to the Commodity.

Reconcile Grain Bank

Reconciling Grain Bank balances is an important process to remove units utilized through invoicing and direct Grain Bank shipments from Grain Bank contracts.

Setup

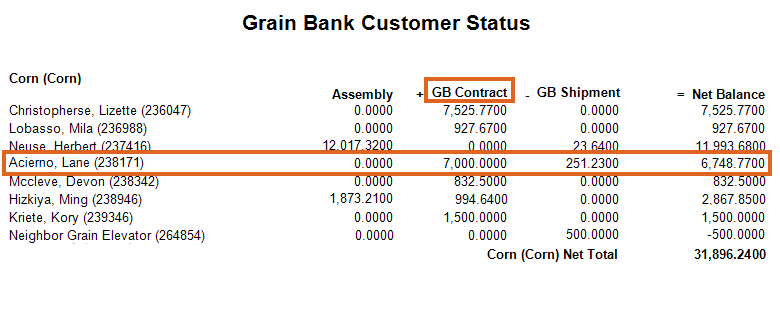

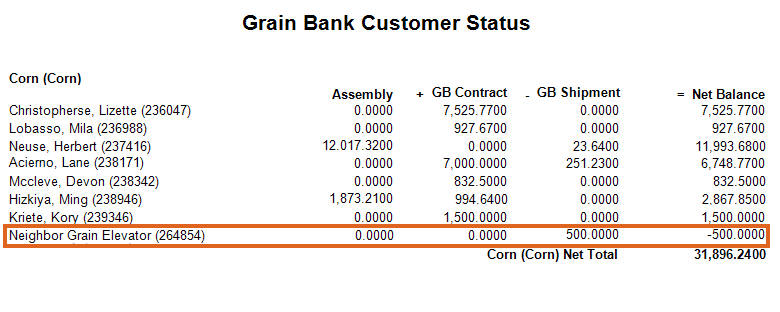

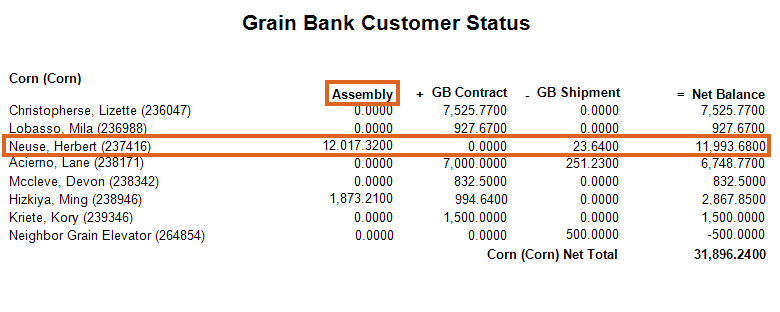

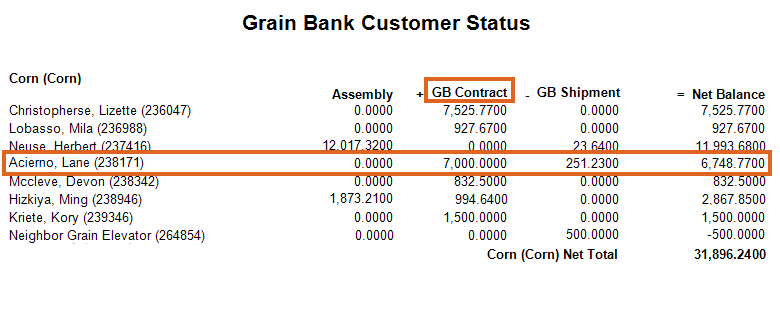

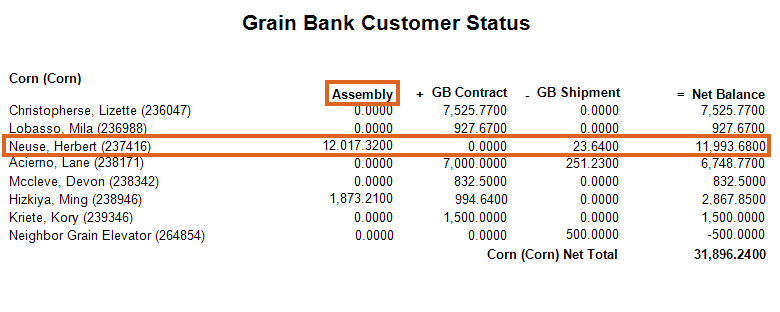

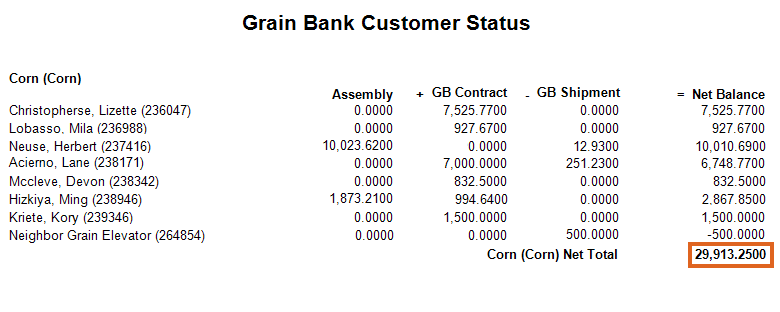

- Run the Grain Bank Customer Status Report found at Grain / Grain Reports / Grain Bank Shipments / Grain Bank Customer Status. Review Customers with Grain Bank Shipments and make sure the Grain Bank Contract is enough to cover the Shipments.

- For Customers who do not have enough on Grain Bank Contract but have enough available on Assembly, settle what is on the Assembly to a Grain Bank Contract as Grain Bank Shipments can only be reconciled against Grain Bank Settlements. Run the Grain Bank Customer Status report again to make sure Shipments will be covered by the Grain Bank Contract.

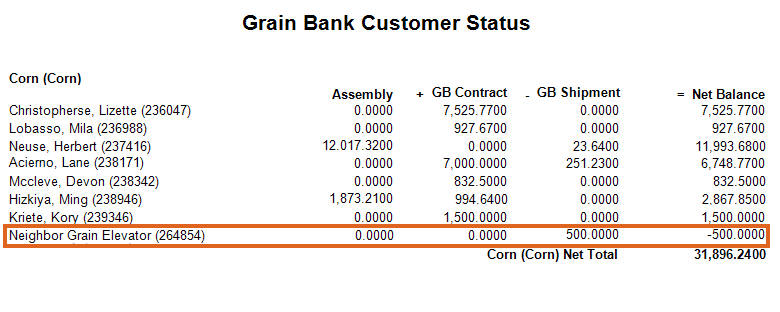

Note: To avoid having to settle to Grain Bank Contracts daily, settle the units to a Grain Bank Contract when the Customer is done hauling on a weekly or monthly basis. This keeps the Customer from having several small contracts. The Grain Bank Shipments do not have to be reconciled until the End of Month process if desired. However, these shipments should be cleaned up prior to the Month End. - If allowing the Grain Bank to go negative and there is a Customer with a negative Net Balance, a decision should be made as to whether the Customer will be allowed to continue to be negative (in which case nothing needs to be done). If that Customer needs to purchase additional Grain Bank to cover their negative balance, an Invoice can be generated in Accounting.

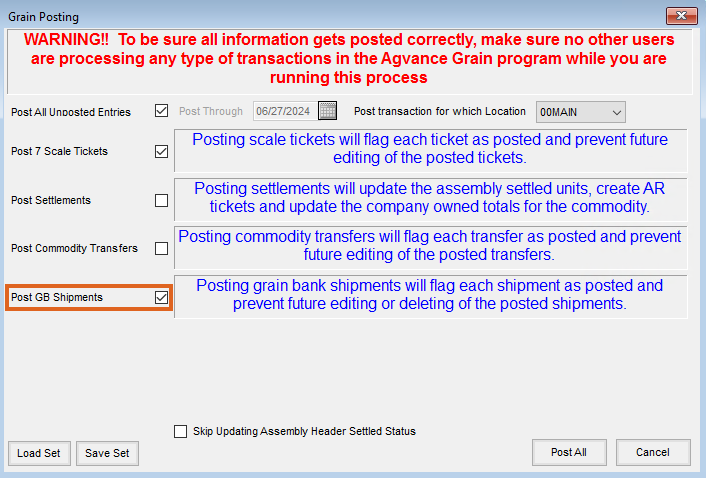

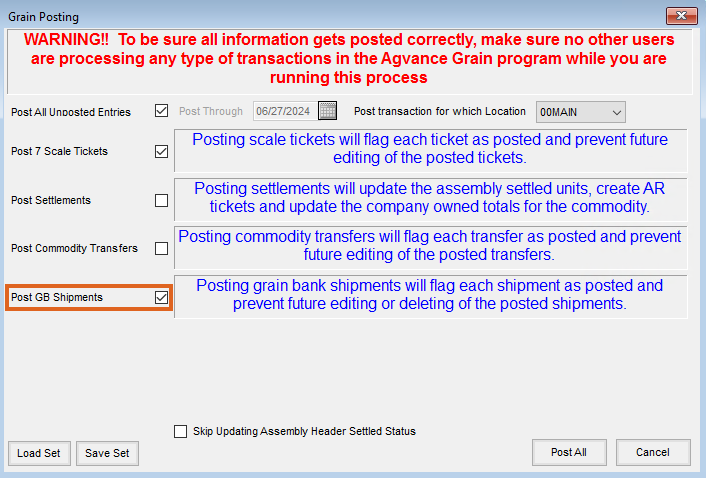

- Post all Grain Bank Shipments at Grain / End of Periods / Grain Posting. This locks down the shipments on the DPR so they can be reconciled using the Grain Bank Utility.

- Run the Grain Bank Reconciliation Utility at Grain / Utilities / Grain Bank Reconciliation Utility.

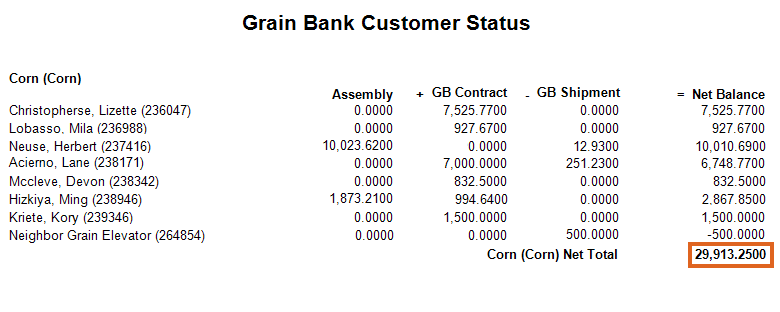

Note: No Grain Bank activity should be occurring during this process. - Run the Grain Bank Customer Status Report. If there are any outstanding Grain Bank Shipments, research why they are still outstanding. Is there enough on the Grain Bank Contract to cover the Grain Bank Shipment(s)? Is the customer negative? If invoicing out Settlement Deductions, is there a settlement deduction on the Grain Bank Contract Settlement that has no invoice item? A call to SSI Support can help to identify why these Grain Bank Shipment(s) did not post.

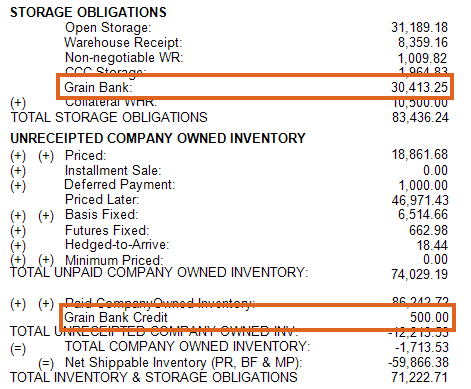

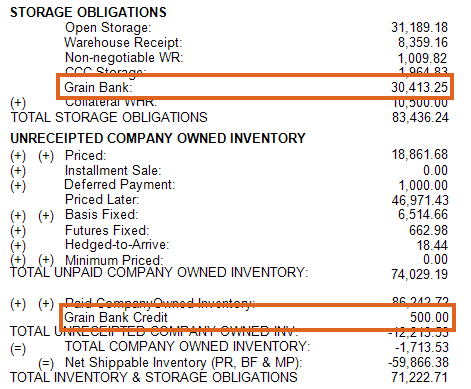

- Posting of the DPR can now be done. The Grain Bank Balance minus the Grain Bank Credit should equal the balance on the Customer Status report.

- To keep the Grain Inventory report in balance, any Customers with a negative balance at month end should have their shipments posted as In Transit. The Grain Bank Shipment In-Transit report is located at Grain / GL Posting Reports / Grain G/L Posting Reports. This is a quantity-only Journal Entry to Grain Bank Issued.

Grain Bank Reconciliation Utility

A utility is available to automate several steps for reconciling Grain Bank Shipments. The automated steps that are available include:

- Settlements to Redelivered

- Storage and Service Charges calculated and either invoiced, rolled, or forgiven

- Settlement Deductions invoiced or forgiven

- Settlement information and/or Grain Bank Shipment Listing printed

Setup

- Grain Bank Product(s) must be added in Accounting and reference back to the Commodities. In Grain at Setup / Commodity / Location, the Grain Bank Product(s) need to be linked to each Commodity/Location set up.

- Each Commodity/Location/Setup charge must have the Redelivered DPR category Charge Schedule set to a Schedule that is a zero $ rate and the Settlement action must be set to Roll Over to New Settlement.

- The Post Settlements Live option must be checked on the Posting tab at Grain / Setup / Preferences. A message will display if this is not selected.

- Select Location(s), Commodity, Customer(s) or Customer Classification – These selections are used to determine which Grain Bank shipments will be reconciled (if any are available to be reconciled based on the selected criteria).

- Settlement Date – This date will appear on the Settlement to redeliver that is created. It is also the date storage will be calculated through if the Calculate Storage/Service Charges using GB Shipment Date option is not used.

- Calculate Storage/Service Charges using GB Shipment Date – This allows the calculation of all Storage and Service Charges on Grain Bank Shipments to be based on the Grain Bank Shipment date instead of the Settlement date.

- Create Positive GB Settlements with Negative GB Balances – This is used when company-owned grain is sold into a Customer Grain Bank to create the Grain Bank contract from that sale.

- Allow GB Reconciliation across Source Locations – This allows Grain Bank grain to be delivered to one Location but removed from another to keep the individual Location’s DPR accurate as well as update the Customer’s Grain Bank balance in the delivered Location.

- What to do with Storage / Service Charges – The following options are available:

- Invoice – This creates an Invoice as a result of running this utility.

- Roll Over to New Settlement – This rolls charges over to a future Settlement and no Invoice is created.

Note: If this option is selected, the rolled charges can only be invoiced by using the Invoice Storage and Service Charge utility. - Forgive – Charges are not invoiced or rolled and will not be available to be invoiced in future.

- What to do with Other Settlement Deductions – The following options are available:

- Invoice – This creates an Invoice as result of running this utility.

- Forgive – Deductions are not invoiced and will not be available to be invoiced in future.

- Print Settlements – Checking this option will print information related to the Settlement to Redelivered that was created for each Customer/Commodity/Location selected.

- Print Report of Unreconciled GB Shipments after Processing – Checking this option will cause a Grain Bank Shipment Listing to be printed to show all Grain Bank Shipments that have not yet been reconciled or completed but are posted and available to be reconciled.

- Save Set /Load Set – This allows utility criteria settings to be saved except for Location, Commodity, and Customer.

Note: Customer Classifications will be saved.