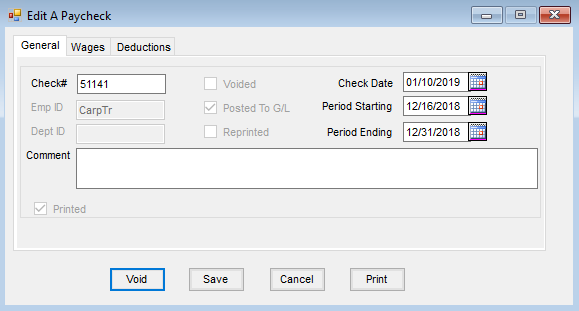

Although very little about a paycheck may be edited, this function is useful for viewing a check, changing a check number that was entered wrong on the run, or changing a date associated with a check.

From this screen, Void and Reprint are available. There are also indicators to show if the check been posted to the general ledger or batch printed.

Information from the check such as hours and wages may be viewed on the Wages tab. Deduction and taxes withheld may be viewed on the Deductions tab along with the Gross wage, the Federal Wage Base, and the FICA Wage Base for the selected check.

Limited editing, reprinting, or voiding a paycheck is done from Payroll / Edit a Paycheck or from the Activity tab of the employee file found at File / Open / Employee. A paycheck can be voided even after the check has been posted to the general ledger.

Process

Editing a paycheck allows limited editing, reprinting, or voiding of a paycheck.

- Navigate to Accounting / Payroll / Edit a Paycheck.

- On the Select a Pay Check window, choose the paycheck and select Edit.

- On the Edit a Paycheck window, the Check #, Check Date, Period Starting, Period Ending, and Comment areas are available to edit. After editing, select Save.

Note: Wages and Deductions tabs are available to view corresponding details. The Edit a Paycheck window also displays if a paycheck was voided, posted to G/L, or reprinted. - A paycheck may be reprinted by selecting Print.

- Void a paycheck by choosing Void. Paychecks are posted to the G/L through the Detailed Posting method (posts each check’s entry individually) or the Summarized Posting method (posting the sum of all paycheck entries to each appropriate G/L account). If the check had not yet been posted to the general ledger, the voided check will show in red at the Post to G/L screen. Selecting this check to post creates a zero dollar journal entry.

Note: A voided paycheck shows on most payroll reports marked as Void. The amounts for the voided check are not added into the report totals.- Summarized Posting – The journal entry for the paycheck must manually be reversed. If the summarized posting report was printed or saved at the time the check was posted, refer to this report for the information needed for the journal entry. To add the journal entry, go to G/L / General Journal Entries and select Add and add the appropriate entry.

- Detailed Posting – The corresponding journal entry will automatically be reversed if it was posted in the current fiscal year. If the original journal entry was posted in the prior fiscal year, a reversing journal entry must manually be entered.