Agvance does not allow COD Payments from being voided or reversed as this process was designed to be used when a Customer is required to provide payment before leaving with the Product, and paid Invoices are not to be voided in Agvance. Therefore, a workaround is necessary in place of voiding or reversing a COD Invoice. See the COD tab here for more information.

Void an Invoice

Invoices saved in the current fiscal month may be voided from A/R / Invoices by selecting the Invoice and then choosing Void. If an Invoice was saved in a prior fiscal month, the void is not allowed. When an Invoice is voided, all posting for the customer account, the inventory, and the general ledger is reversed. If tickets (Delivery, Blend, or Energy) were used to create the Invoice, the tickets are reopened when the Invoice is voided. Voided Invoices do not show on the Customer Statement.

Invoices are only available to void in the same month it was entered.

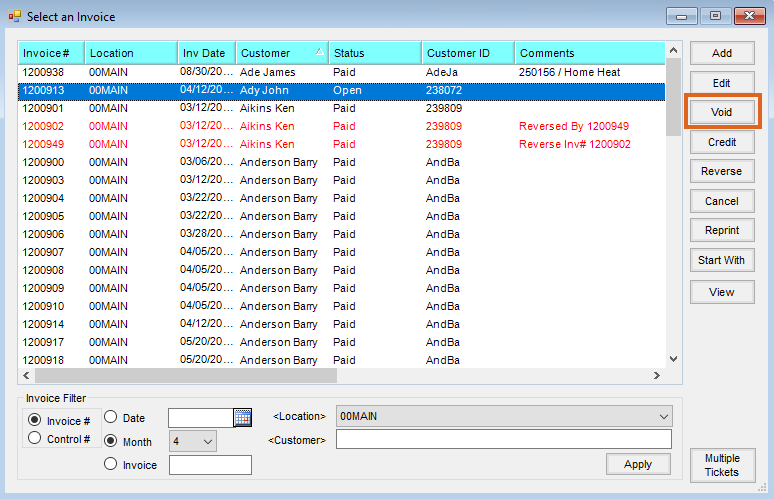

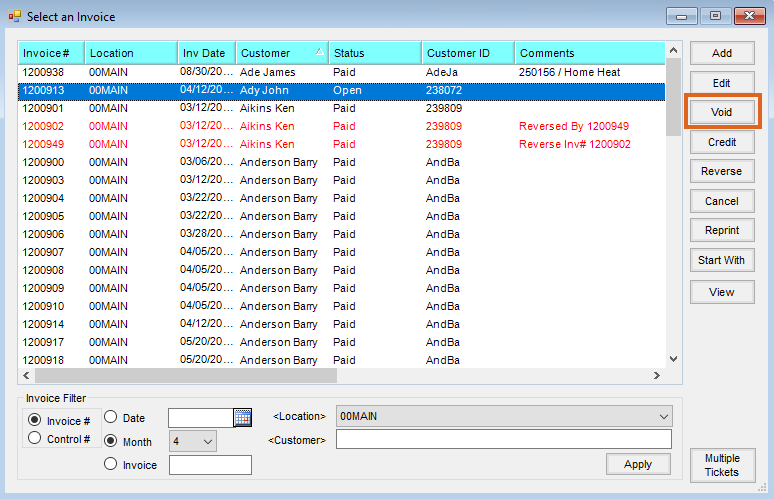

- Navigate to Accounting / A/R / Invoice.

- Highlight the appropriate Invoice and choose Void.

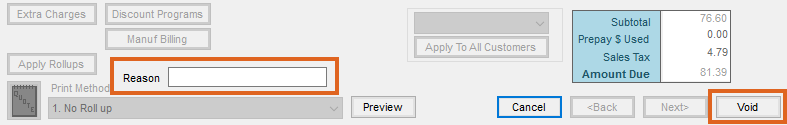

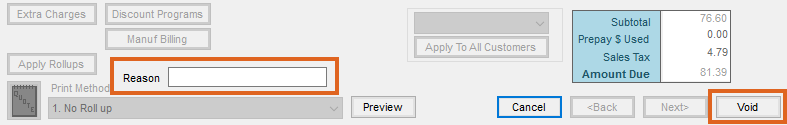

- Verify the correct Invoice has been chosen, optionally enter a reason for voiding in the Reason field, then select Void. Information may not be be edited on the Void Invoice window.

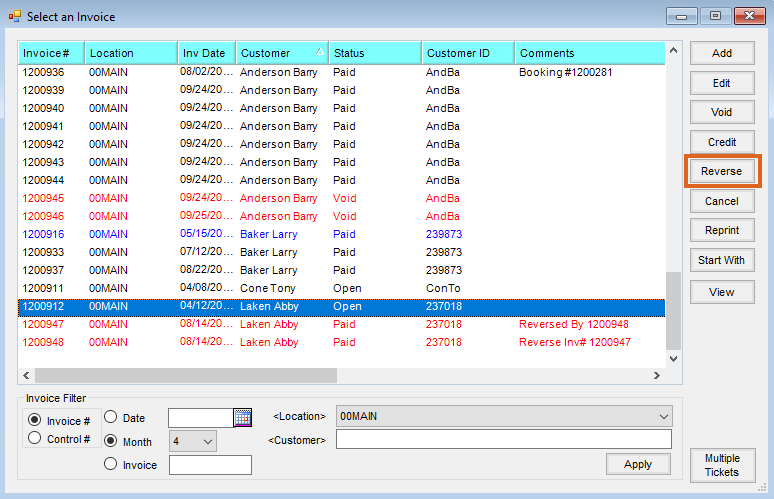

Note: A voided Invoice displays in red on the Select an Invoice window.

Note: A voided Invoice displays in red on the Select an Invoice window.

Reverse an Invoice

Invoices in a prior fiscal month cannot be voided but instead need to be reversed. From A/R / Invoice, select the original Invoice and choose Reverse. Reversing an Invoice leaves the original Invoice in the fiscal month where it was originally saved and creates a new, offsetting Invoice in the current month. When an Invoice is reversed, all posting for the Customer account, the inventory, and the General Ledger is reversed. If tickets (Delivery, Blend, or Energy) were used to create the Invoice, the tickets are reopened when the Invoice is reversed. Reversed Invoices show on the Customer Statement.

In Accounting Preferences, there is an option on the A/R tab called Do Not Mark Reversing Invoices as Paid. If this option is NOT selected, both the original Invoice and the reversing Invoice are marked as Paid upon saving the reversal. If this option IS selected, both the original and the reversing Invoices remain with an Open status.

Note: Once an Invoice is reversed, neither the original Invoice nor the reversal Invoice may be voided.

Invoices can be reversed at any time regardless of the Paid status or when the original Invoice was entered.

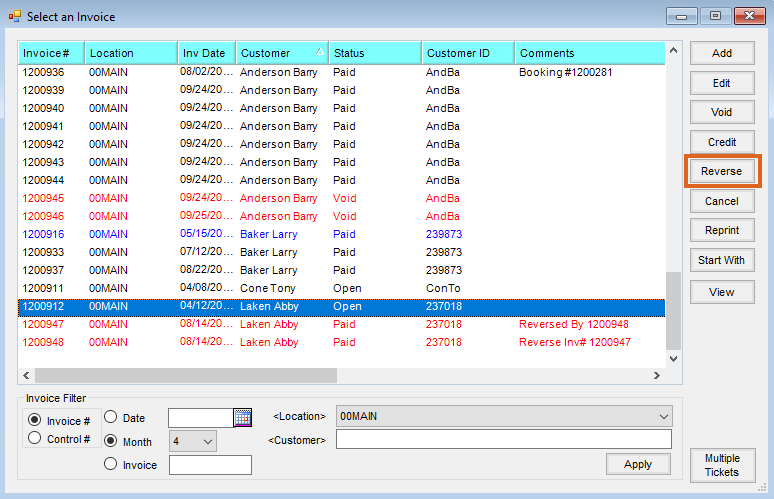

- Navigate to Accounting / A/R / Invoice.

- Highlight the appropriate Invoice and choose Reverse. Information can not be edited on the Reverse Invoice window, but a reason can be entered in the Reason field for the reverse.

Note: Reversing an Invoice creates a new Invoice with the same products, quantities, and prices as the original Invoice. When saved, those quantities are negated. The original Invoice and reversed Invoice display in red on the Select an Invoice window.

Note: Reversing an Invoice creates a new Invoice with the same products, quantities, and prices as the original Invoice. When saved, those quantities are negated. The original Invoice and reversed Invoice display in red on the Select an Invoice window.

Require Reason

There is a Location Preference, found at Accounting / Setup / Location Preferences, to Require a reason when invoice is voided or reversed. When selected and an Invoice is voided or reversed, a Reason area displays and must be entered to allow the transaction to be saved.

When the voided or reversed Invoice is edited, the Reason entered displays. It also optionally displays at the Select an Invoice screen, found at Accounting / AR / Invoice.

Note: This Require a reason when invoice is voided or reversed preference also enables a Void Reason area at the Batch Void Invoices utility, found at Hub / Admin Utilities / Accounting / A/R Utilities / Batch Void Invoice.

Note: A voided Invoice displays in red on the Select an Invoice window.

Note: A voided Invoice displays in red on the Select an Invoice window. Note: Reversing an Invoice creates a new Invoice with the same products, quantities, and prices as the original Invoice. When saved, those quantities are negated. The original Invoice and reversed Invoice display in red on the Select an Invoice window.

Note: Reversing an Invoice creates a new Invoice with the same products, quantities, and prices as the original Invoice. When saved, those quantities are negated. The original Invoice and reversed Invoice display in red on the Select an Invoice window.