Seed purchasing, because of the discounts and rebates given by seed vendors, creates a challenge to maintain an accurate cost on seed until the discounts are issued. This article is designed to establish a standard practice for the handling of seed to enable managing the cost of seed more accurately throughout the fiscal year. The following steps set a more accurate cost on seed. An accurate cost on seed products enables accurate management of profit margins, markups, and financial reports.

In addition to each seed Vendor, a corresponding Vendor for the seed discount management should be set up. To create the Vendor for discount management it is recommended use the regular seed vendor’s name with Discount at the end. This is recommended so as to not accidentally take the estimated discount/rebate against a real Vendor invoice.

Accounting for Seed Rebates / Discounts

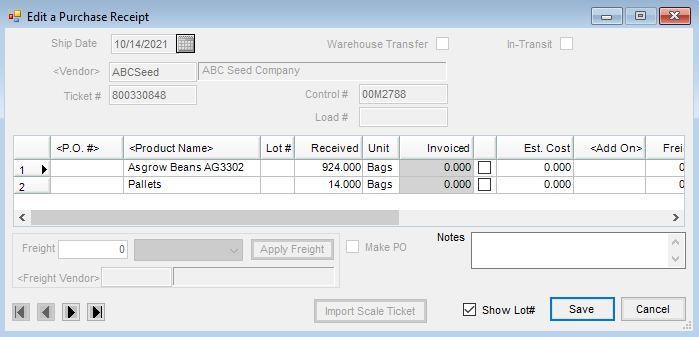

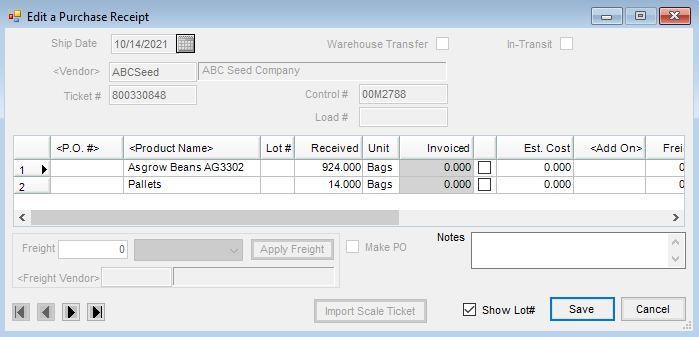

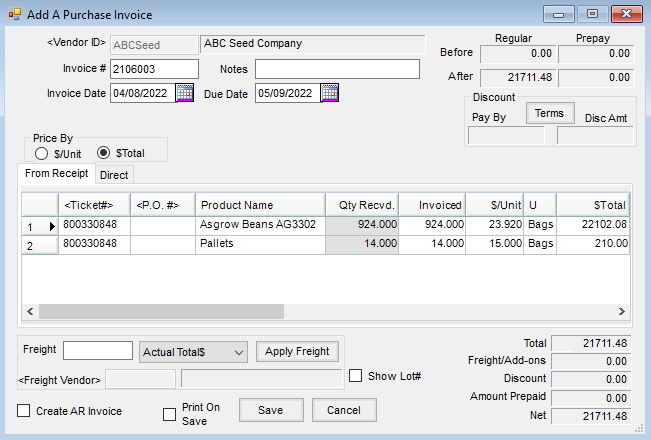

- As seed is received, enter Purchase Receipts for bags of seed, pallets etc. to the regular seed Vendor account.

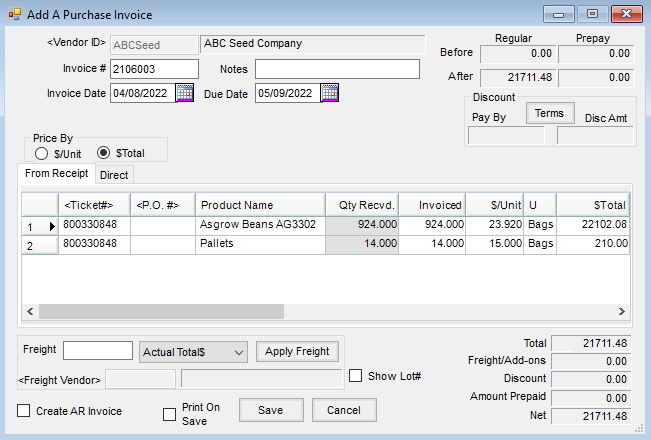

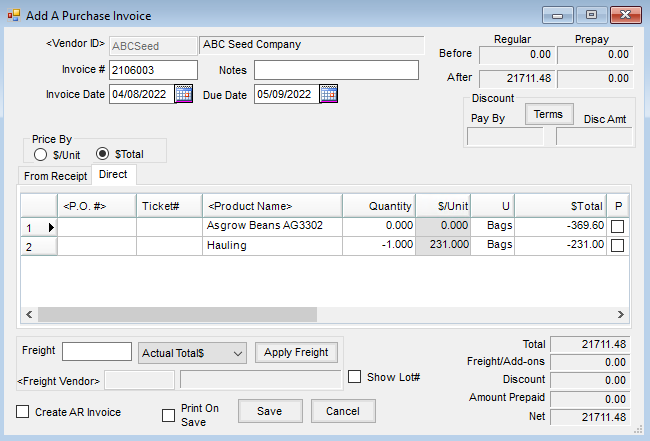

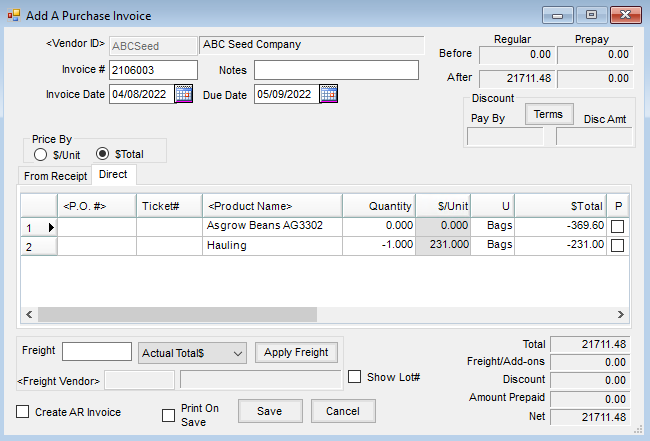

- As invoices arrive, enter Purchase Invoices to the regular seed Vendor account, pull in the Purchase Receipt on the From Receipt tab, and on the Direct tab, record any credits/price adjustments not on the Purchase Receipt.

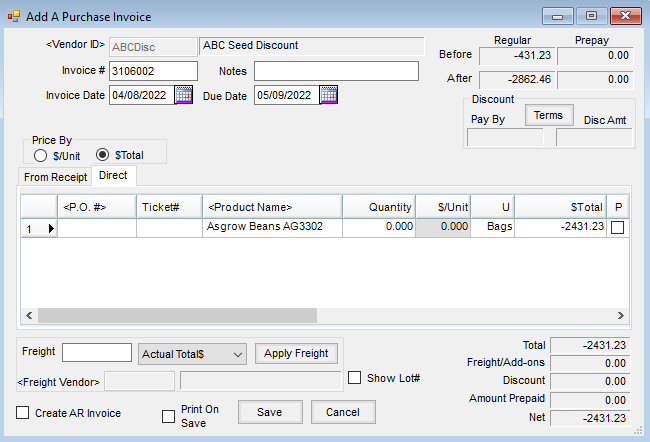

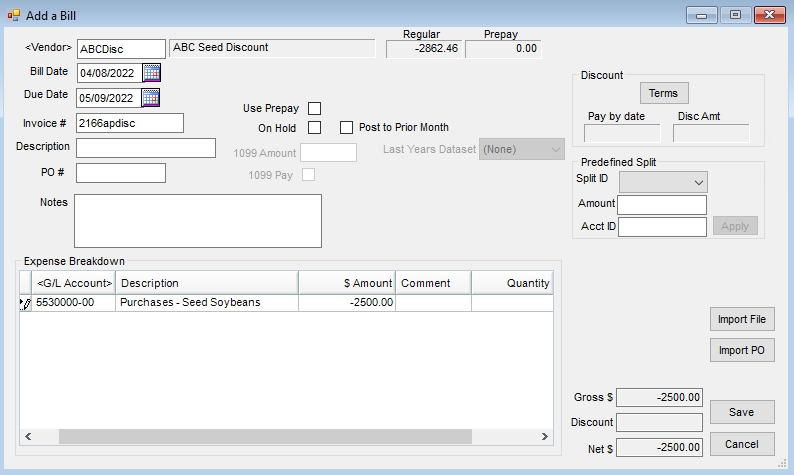

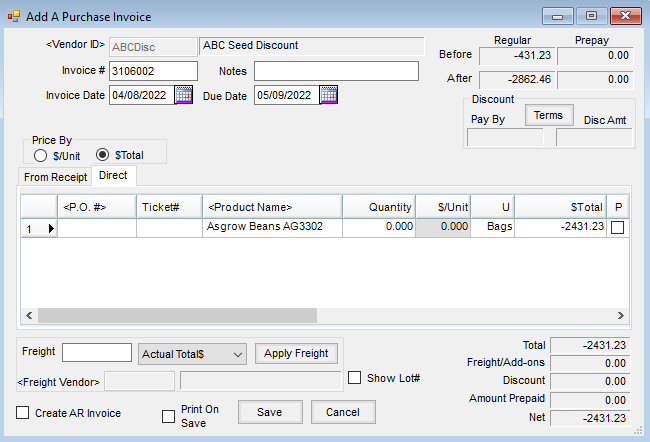

- Immediately following the entry of the Purchase Invoices on the regular seed Vendor, enter Purchase Invoices to the seed discount Vendor for the same seed Product with a zero quantity and accruing the amount of the discount anticipated on the seed.

- At the end of the season when the actual discount is received from the regular seed Vendor, it might come in two different ways. The following are suggestions on how to handle each way.

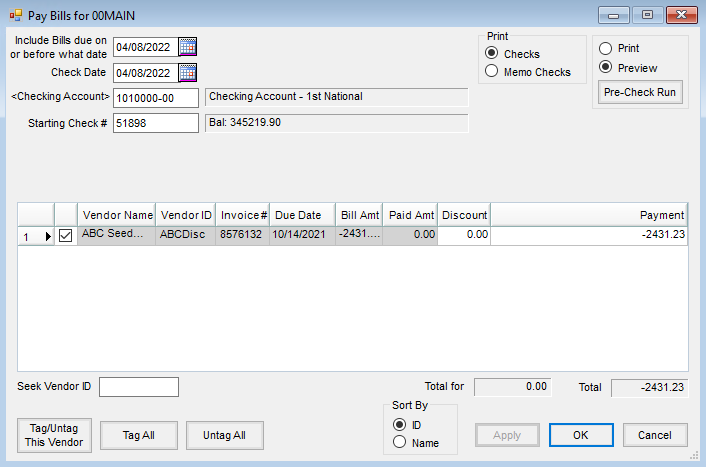

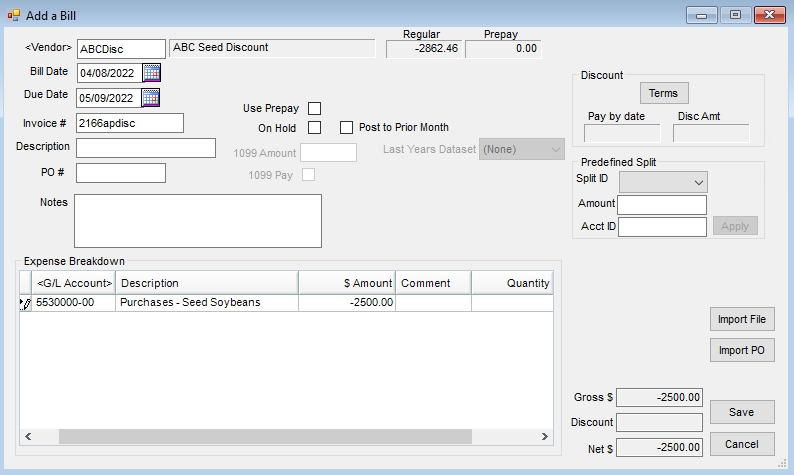

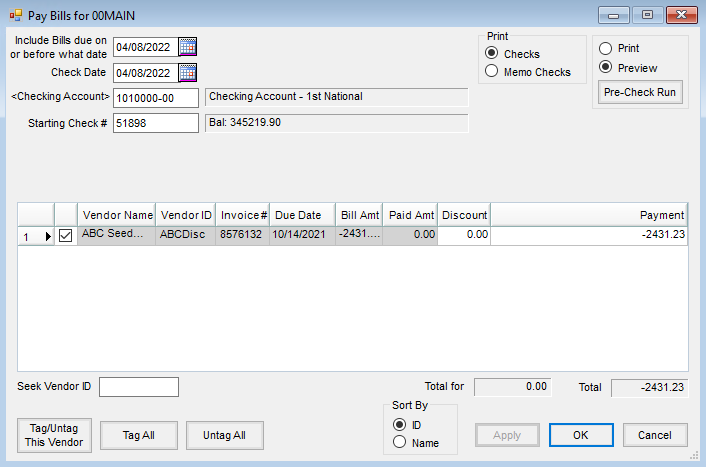

- If the discount/rebate is received in the form of a credit invoice, enter a negative A/P Bill to the regular seed Vendor using the COGS (purchase) account for seed as the expense. Issue a Memo Check for the seed discount Vendor to reconcile the accrued discount with the actual discount issued. Change the checking account to the COGS (purchase) account for seed.

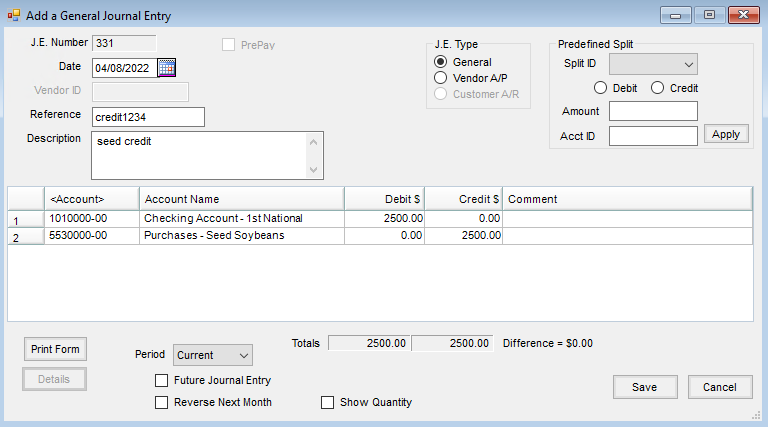

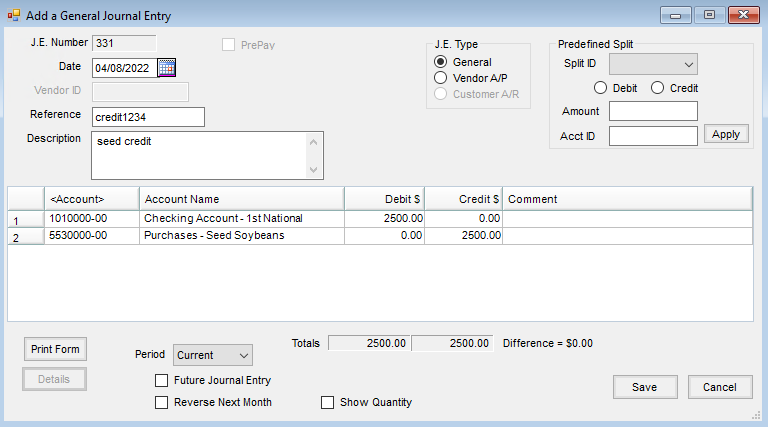

- If the discount/rebate is received in the form of a check from the Vendor, enter the check using a Journal Entry. The debit will be Undeposited Cash to include the check in the deposit or will be the checking account if either the check has already been deposited or should not be included in the deposit for another reason. The credit is the COGS (purchase) account for seed. Issue a Memo Check for the seed discount Vendor to reconcile the accrued discount with the actual discount issued. Change the checking account to the COGS (purchase) account for seed.

- If the discount/rebate is received in the form of a credit invoice, enter a negative A/P Bill to the regular seed Vendor using the COGS (purchase) account for seed as the expense. Issue a Memo Check for the seed discount Vendor to reconcile the accrued discount with the actual discount issued. Change the checking account to the COGS (purchase) account for seed.