While it may not be known exactly what rebates will be received until the end of the seed season, it is important to incorporate an estimate of the rebate in the cost of the seed Products so the sales margins are reasonable. There are two seed discount scenarios - a rebate given at the end of the season and a discount given prior to the season when prepaying for seed. Both types of discounts can be handled in Agvance with additional charges. The following instructions show how to set up and use additional charges for this purpose.

Setup

- Set up a General Ledger Account to which the expected rebates should be accrued. An accountant can help determine how this account should be numbered and categorized.

- Add a Vendor called something similar to Seed Discounts or Seed Rebates Anticipated. This is the Vendor to which the discount accrual Journal Entries will be tied.

- Optionally set up Classifications for each type of seed Product with a different expected discount. Classifications will allow the rebate add-on charge to default in automatically on the Purchase Invoice so there is no risk of forgetting. The charge can be added manually instead if preferred.

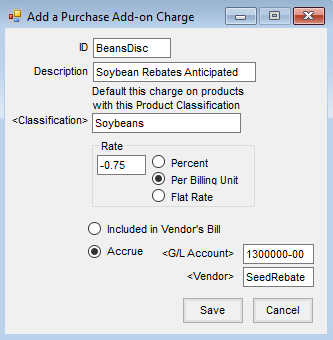

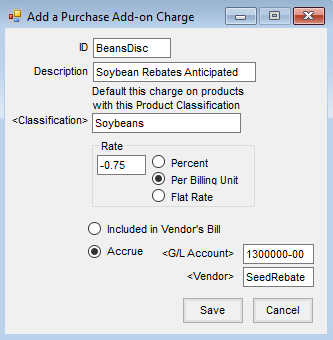

- Add a Purchase Add-on Charge at Accounting / Setup / Inventory / Purchase Add-on Charges. Optionally select a Classification if this charge should appear on the Purchase Invoice automatically. The rate will be negative and can be either Percent, Per Billing Unit, or Flat Rate. Set the charge to Accrue To and choose the seed rebates G/L Account and Vendor. A separate add-on charge should be set up for each group of Products that will get a different discount rate.

Rebate at the End of the Season

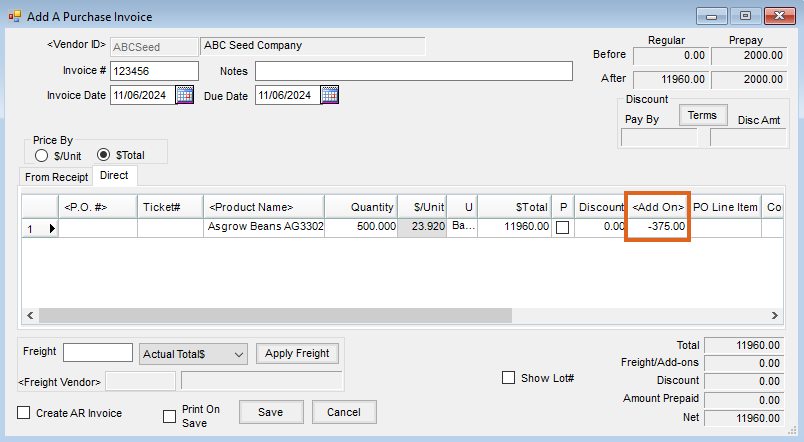

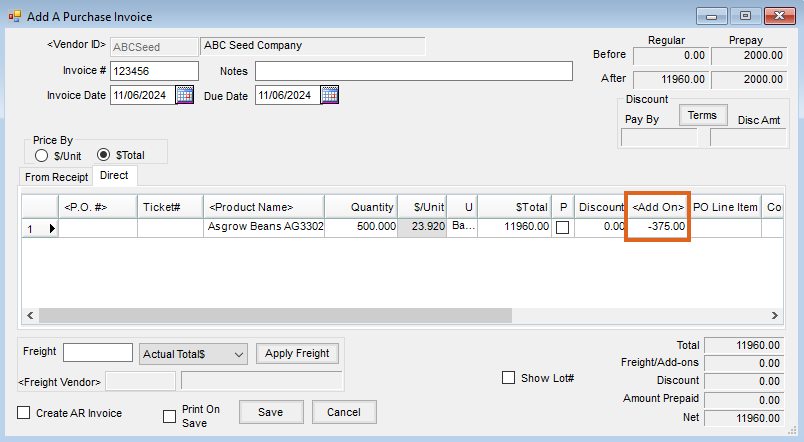

- When a Purchase Invoice is added for a seed Product, the rebate additional charge will default in based on the Classification. Since it is an accrual type charge, the anticipated rebate will not change the net amount due on the Invoice.

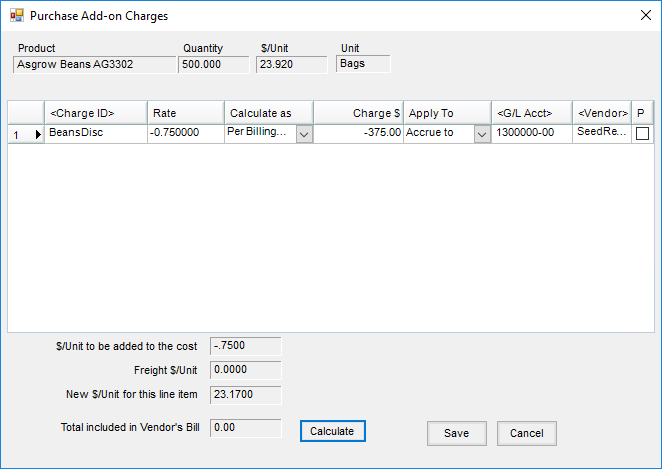

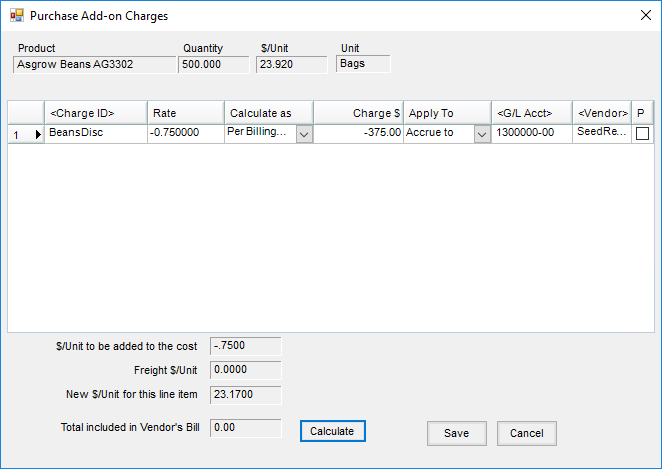

- Double-click in the Add On column to see the charge detail and how much it changes the cost of that line item. This is the cost that will be used to update the Product's Last and Average Cost when the Purchase Invoice is saved.

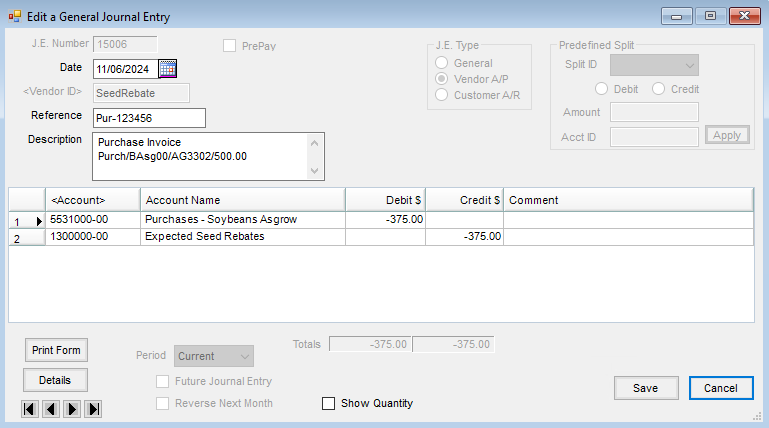

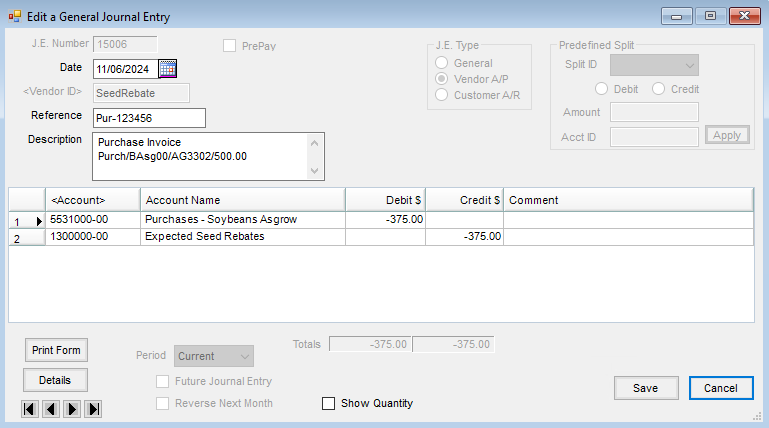

- When the Purchase Invoice is saved, the add-on charge will create a Journal Entry for the seed rebates Vendor debiting the cost of sales and crediting the seed rebate anticipated G/L account.

- At the end of the season when the real rebates are received, enter a Journal Entry debiting the cash account and crediting the seed rebate anticipated account. The difference between the actual rebate and the anticipated rebate should be reflected in a Journal Entry into the cost of sales for the appropriate departments.

Note: Additional charges default in to Purchase Orders and Purchase Receipts as well.

Discount on Early Pay

- Enter a prepaid Purchase Order for the Product for the full amount of the prepay which will be received. Create a partial payment on the bill for the money being sent to the Vendor and memo check the discount into the seed rebates G/L Account.

- If it is generic prepay money, write a prepay Quick Check to the Vendor then enter a prepay Journal Entry to the same Vendor debiting accounts payable and crediting the seed rebates G/L account.

- Follow the steps in the section above to add Purchase Invoices as the product comes in.

- As the Purchase Invoices are saved, the Journal Entry created by the add-on charges will move the money out of the seed rebates G/L Account that was added when the prepay check was written and put it in the cost of sales.