John Deere Financial Multi-Use Account Integration (JDF Multi-use) is the brand name of a set of financing products from John Deere Credit (JDC). This service was formerly known as Farm Plan. A JDF Multi-use card is a lot like a credit card, except it does not have a magnetic strip and can only be used at JDF Multi-use merchants (there are more than 5400 of these). JDC works with merchants to design specific Credit Incentive Plans. For example, no payments on seed until October and no payments on purchases over $500 for six months.

JDC may also purchase a company’s AR. Instead of the company waiting for a customer to pay for a purchase, JDC reimburses the company the next day and then collects from the customer. The following explains how to set up the JDF Multi-use sale type/payment method for use in Agvance for both Quick Tickets and Payments on Accounts. John Deere Credit and SSI personnel will assist with the setup necessary for this module.

John Deere Financial Multi-Use Account Integration (JDF Multi-use) was formerly known as Farm Plan.

Contact Information

| John Deere Financial Multi-Use Account Integration Support | 800-255-5127 |

| New Merchant Information | https://merchantservice.deere.com |

| Agvance Support | 800-752-7912 |

JDC Setup

JDF Multi-Use setup can be found at Agvance / Accounting / Setup / A/R / JDC Setup. Upon opening the JDC Setup module for the first time, there will be a prompt to call SSI if an activation is needed. This area is used to establish and maintain Credit Plan Numbers, Descriptive Billing Codes, Merchant Numbers, Terminal Numbers, and Preferences. It also allows exporting a list of Customers to send to the John Deere Credit Corporation for JDF Multi-Use setup, and then JDF Multi-Use accounts may be imported for these Customers.

Before setup in Agvance can begin, JDC must provide the appropriate Merchant Numbers, Terminal Numbers, Credit Plan Numbers, and Descriptive Billing Codes.

Note: Be sure to allow enough time for the John Deere Merchant Services representative to get the required setup information.

Preferences

To set up the URL given by John Deere Credit, navigate to Accounting / Setup / A/R / JDC Setup / Setup / Preferences, and enter https://connect2.deere.com/POS/services/TransactionBroker as the Web URL.

Merchant and Terminal Numbers

To obtain Merchant and Terminal Numbers, retailers who use JDF Multi-Use must contact their John Deere Merchant Services representative who will provide these numbers. Retailers may already have a JDF Merchant Number(s) and a Terminal Number(s) for the organization; however, a new or additional Terminal Number for POS and the Payment on Account through Agvance may be required. Retailers should be assigned one Terminal Number for each location for use with the Agvance interface. The John Deere Merchant Services representative will assist in meeting the needs for the Terminal Numbers.

Note: Be sure the John Deere Merchant Services representative is aware this setup is for the Agvance interface.

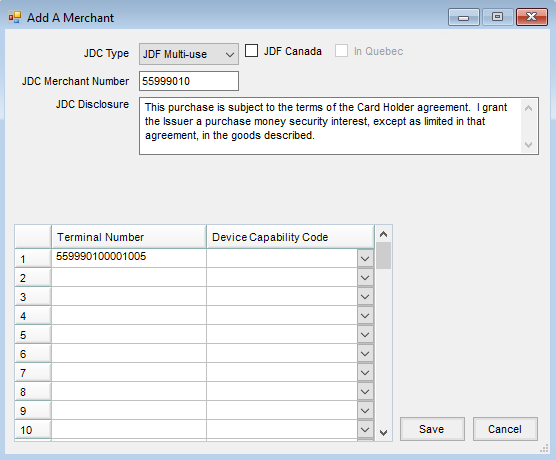

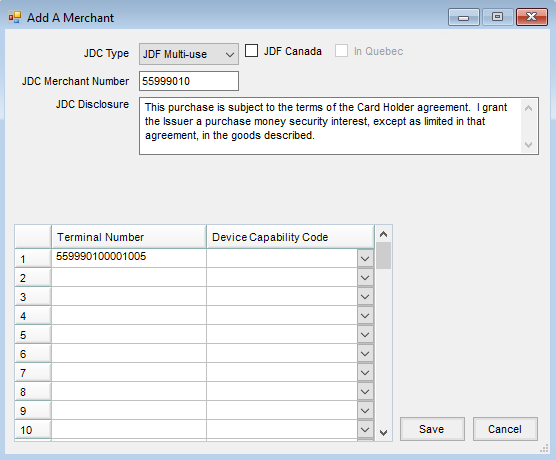

- To add a Merchant Number, select Add on the Select a Merchant Number window at Setup / Merchant Numbers. Each JDF Multi-Use Merchant Number must be set up individually.

- Select the JDC Type of JDF Multi-use.

- Type in the JDC Merchant Number. This number must be eight digits.

- In the grid, enter one or more Terminal Numbers. These must be 15 digits.

- The Device Capability Code is not required for a JDF Multi-Use merchant and can be left blank.

- The JDC Disclosure prints at the bottom of the Payment receipt and the Quick Ticket receipt if no disclosure is returned by the JDF Multi-Use transaction.

- To edit or delete Merchant Numbers and/or Terminal Numbers, select Edit or Delete on the Select a Merchant Number screen.

Canadian Merchant Setup

Merchant

Add or edit the Merchant at Setup / Merchant Numbers. Select JDF Canada if the Merchant is in Canada. For companies operating in Quebec, select In Quebec.

Selecting In Quebec displays a JDC Disclosure (French) option. If a Customer prefers French and a JDF Disclosure is not received from JDF during a transaction, the text in this section prints on the Payment Receipt and Quick Ticket receipt.

Note: See the Customer Setup section below for information on specifying French.

Customer Setup

In Agvance, navigate to File / Open / Customers and edit the Customer file. On the Miscellaneous Info tab, for companies not in Quebec, the Postal Code is in the Canadian format.

If the Merchant is set to In Quebec, the Miscellaneous Info tab has an added column Prefers French.

Credit Plan Numbers (CPN)

Credit Plan Numbers are special incentive programs that may be available for specific products and/or specific time periods. The Add a CPN window allows a Credit Plan Number to be added. To add a CPN, click Add on the Select a CPN window under Setup / Credit Plan Numbers. Select Save after entering a CPN and Description. Begin Date and End Date are both optional. Use the Edit and Delete buttons on the Select a CPN window to edit or delete a CPN.

CPNs are defined by JDC and are retailer specific except for one universal code. This universal CPN must be set up in Agvance before any Payment processing takes place. On the Add A CPN window, set the default CPN to 00249 and the Description to REGULAR PURCHASE.

If a CPN is only applicable to specific products, those products should be billed on separate Invoices in Agvance. When the payment is taken on the Invoice and sent to JDC, the special incentive will only be applied to the total dollar amount for those products.

Descriptive Billing Codes (DBC)

The Descriptive Billing Code is used to describe what type of product is being purchased. A DBC is required on any transaction that has a CPN other than the default CPN of 00249. Descriptive Billing Codes are assigned by JDC.

The Add a DBC window allows a Descriptive Billing Code to be added. To add a DBC, click Add on the Select a DBC window under Setup / Descriptive Billing Codes. Select Save after entering a DBC and Description. Begin Date and End Date are both optional. Use the Edit and Delete buttons on the Select a DBC window to edit or delete a DBC.

The following default Descriptive Billing Codes should be added to be used when a credit is being transmitted to JDC: DBC of 00960 with a Description of Refund of Finance Charge, DBC of 00970 with a Description of Billing Correction, and DBC of 00980 with a Description of Returned Merchandise. The Begin/End Dates are not needed.

Setting up JDF Multi-Use Account Numbers for Customers

Merchants are able to save JDF Multi-Use account numbers on Customers’ accounts to speed up the transaction process, as well as maintain accuracy. JDF Multi-Use numbers must be 10 digits. Once the JDF Multi-Use number is entered and the Customer file is saved, the Account # is encrypted.

If the Display JDF Multi-use Numbers option is selected at Accounting / Setup / Preferences on the General tab, the JDF account numbers will fully display on the Miscellaneous Info tab on the Customer profile.

JDF Multi-Use numbers for Customers are set up at Accounting / Customers on the Miscellaneous Info tab.

Note: If JDF Multi-Use has not been activated, the grid in the bottom of the window is not available.

JDC Transfers

New JDF Multi-Use merchants may export a list of Agvance Customers which JDC then uses to set up the Customers with JDF Multi-Use accounts. After these Customers have been assigned JDF Multi-Use account numbers, JDC sends the file back to the merchant so these account numbers can be imported into Agvance.

Export

To export the list of accounts, in the JDC Setup area select Transfers / Export. When the Export Customers window opens, the option is available to select all Customers or a specific group of Customers to be set up with JDF Multi-Use accounts.

In the File Name, type the path and name of the file for exporting the list of accounts, and select OK. The resulting data file includes the Customer ID, first name, last name, address, city, state, zip, phone, and tax ID.

After the file has been exported, open it in Excel, and edit the 16th column (column P) to specify the type of JDF Multi-Use account each Customer should be assigned. JDC will help with this account type assignment if needed.

- B – Commercial

- G – Governmental

- C – Consumer

- F – Agricultural - Business Accounts

- I – Individual Agricultural Accounts

Once the account type assignment has been done, the file is ready to be sent to JDC.

Import

JDC Setup allows a list of JDF Multi-Use account numbers assigned by JDC to be imported. The import file must be a tab delimited (.txt) file type. To import the list of accounts, navigate to Transfers / Import, and specify the file to import.

- Column A – JDC Account Number (must be 10 digits)

- Column B – Agvance Customer or Grower ID

- Column C – Customer Name for clarification

The account numbers for the Customers are imported into the Miscellaneous tab of the Customer file.

When using the import, Agvance uses the Pay Method Short Description to set the JDC Payment Type. This Short Description should be set to Farm Plan in order to work with the import. Find this Pay Method at Accounting / Setup / Pay Methods and be sure to change the Short Description on Farm Plan from JDF Multi-use to Farm Plan if it is not already set that way.

Note: The file JDC sends may be saved as an Excel (.xls) file and may have extra rows at the top or end of the file. If so, open the file with Excel, and remove all header and footer rows. Also, check for any Customers in the file that have a JDF Multi-Use account number that is fewer than 10 digits. Add leading zeroes to the number as necessary to make it 10 digits in length. Delete any rows in the file with blank account numbers. The JDF Multi-Use account numbers for these Customers may be added manually in Agvance. Save the file as a tab delimited (.txt) file. Make sure there are no lingering blank lines at the end of the file.

Using JDF Multi-Use in Agvance

JDF Multi-use is available at the Quick Ticket as a Sale Type. It is also available as a Pay Method on the Payment on Accounts screens.

Before processing JDF Multi-Use transactions, the Customer must have a JDF Multi-Use account set up by John Deere Credit. The merchant must also have Credit Plan Numbers, Descriptive Billing Codes, Merchant Numbers, Terminal Numbers, and the Web URL set before processing transactions.

Invoice Detail

When using the Farm Plan Payment Method, there are a few reasons Invoice Detail may not be sent to John Deere.

- The payment was only a partial payment. The Farm Plan interface does not send Invoice detail with partial payments since there is no way to know which line items are being paid.

- The Farm Plan interface also does not send Invoice detail when the payment includes multiple Invoices. There is no way to indicate to John Deere that multiple Invoices are being sent, so the detail would appear to be part of a single Invoice.

- The Invoice being sent may have a partially prepaid line item.

Invoice Chargeback

When a Customer puts a bill on the Farm Plan account, the merchant pays the Invoice with a Farm Plan type payment which moves the A/R off the merchant's books and onto John Deere's. Depending on the merchant's contract with John Deere, if the Customer goes into default on the Farm Plan account, John Deere may turn the overdue Invoices back over to the merchant. The merchant must pay John Deere the amount of the original settlement on those Invoices plus some fees. The merchant will then need to put the money back on A/R either to collect payment from the Customer or to turn the account over to a collection agency.

- Either add an A/P Bill to John Deere or write a Quick Check for the amount the merchant owes, expensing a miscellaneous GL account like clearing, Farm Plan pending, or miscellaneous expense.

- Enter an A/R Invoice to the Customer for a miscellaneous Product whose sales account is set to post to the same expense account used on the A/P Bill or Quick Check. The amount of the new Invoice should match the amount the merchant paid back to John Deere, including any fees or extra charges.

- At this point, if the Invoice is turned over to a collection agency, the merchant can take a payment on the Invoice for the amount the collection agency paid and discount the remainder to a bad debt expense account.

Using JDF Multi-use as the Sale Type on a Quick Ticket

JDF Multi-use is available on Quick Tickets. After clicking the Quick Tickets button in Agvance Accounting, enter the Quick Ticket transaction information as normal. Choose Take Payment to select the JDF Multi-use sale type.

When the Quick Ticket is complete, click Tender and then Save.

If the Pay Method is JDF Multi-use, the Transfer JDC Information screen displays to collect additional information and send the transaction to JDC. Please see the Transferring JDC Information section below.

If a JDF Multi-use Quick Ticket is voided, Agvance displays the Transfer JDC Information screen and sends a reversing transaction to JDC.

Using JDF Multi-Use as the Pay Method for a POA

JDF Multi-use is available as a Pay Method on the Payment on Accounts and Receive Payment(s) on Account screens.

When the Payment is saved, if the Pay Method is JDF Multi-use, the Transfer JDC Information screen displays to collect additional information and send the transaction to JDC. Please see the Transferring JDC Information section below.

If a JDF Multi-use Payment is voided, Agvance displays the Transfer JDC Information screen and sends a reversing transaction to JDC.

Note: Line item detail is sent to JDC only if one Invoice is being fully paid with the Payment. If a partial Invoice is paid with JDF Multi-use, the total Payment amount is sent to JDF Multi-use without any line item detail. If multiple Invoices are going to be paid, then separate Payments must be taken for each Invoice.

Note: Discounts may be entered when creating the Payment for Quick Tickets, Payments on Account, or roll-through payments. Only the net Payment amount is transmitted to JDC. No information about the discount is sent.

JDF Multi-use Preauthorizations

JDF Multi-use preauthorizations are available at Accounting / A/R / JDF Multi-use Preauthorization and can be used to preauthorize and lock in an amount on the Customer’s JDF Multi-Use account. The preauthorization can then be used on a regular JDF Multi-Use transaction.

Preauthorizations may be added, viewed, or deleted. If a preauthorization is deleted, a Cancel Authorization transaction is submitted to JDC. The Cancel button on the Add A JDF Multi-use Authorization screen closes the window; it does not cancel the authorization.

At the time of the sale, the preauthorization number is entered when transmitting to John Deere.

A new authorization may be added by specifying the Customer ID, Date, and Amount.

To use a preauthorization, double-click in the Authorization field on the Transfer JDC Information screen, and select a preauthorization.

Note: Preauthorizations do not affect the Customer’s A/R balance or the G/L.

Making a Payment on a JDF Multi-Use Account

This area under the A/R menu is for entering payments that Customers make on JDF Multi-Use accounts through John Deere Credit. The Agvance JDF Multi-Use module interfaces with John Deere and is an additional module for purchase. For more information, contact SSI.

This transaction is not a Payment against their A/R with the company.

- If the validation code is unavailable, then type 'NP' (for "Not Present") into the Validation Code field.

- If the validation code is present but unreadable, type 'IL' ("Illegible") into the Validation Code field.

In both cases, the credit card should clear through without error.

When processing a credit card through John Deere Credit processing, the authorization is saved, but it is not saved on the Quick Ticket. All transactions are logged in the JDCTransaction table. This table has a link to the document on which the transaction is included.

Note: John Deere Financial Multi-Use Account Integration (JDF Multi-use) was formerly known as ‘Farm Plan’

- Customer ID – Double-click to select the Customer.

- Payment Date – Enter the date for the Payment.

- Amount – Enter the amount of the Payment.

- Ref Number – Optionally, enter a reference number, such as the check number.

- Notes – These are optional.

After selecting Save, the Transfer JDC Information screen displays to collect additional information and send the transaction to JDC. Please see the Transferring JDC Information section below.

Note: This transaction debits the Cash on Hand account set up for the current location and credits the account set up for the JDF Multi-use payment method of the current location. If the Customer selected is from somewhere other than the default location, a location conflict message is displayed and posting is done accordingly.

Voiding

In certain cases it is necessary to void a JDF Multi-Use type payment without sending a credit transaction to JDF Multi-Use. One of these situations is when a JDF Multi-Use transaction is initially accepted but then rejected later.

To accomplish this, you will need to add a new payment method at Accounting / Setup / Pay Methods called JDF Multi-Use Correction. Set the G/L account for this payment method to the JDF Multi-Use clearing account.

If payment's fiscal month is still open, follow these steps:

- Edit the original payment at Hub / Utilities / Admin Utilities / Accounting / A/R Utilities / Edit Pay Methods and select JDF Multi-Use Correction.

- Void the payment.

If the fiscal month has been closed (so the payment can't be voided), follow these steps:

- Reverse the Invoice(s) paid by the JDF Multi-Use payment.

- Take a negative payment on the credit invoice(s) using the JDF Multi-Use Correction payment method.

Deleting a JDF Multi-Use Payment

A JDF Multi-Use Payment may be deleted by navigating to Accounting / A/R / JDF Multi-use Payment, selecting the Payment, and choosing Delete. Deleting the transaction does not transmit any information to JDC. It also does not reverse the journal entry for the original Payment. Manually reverse the journal entry for the original payment, and contact JDC directly to void the transaction on their records.

Transferring JDC Information

When one of the following Agvance documents is saved with a JDF Multi-use sale type or Pay Method, a Transfer JDC Information screen displays to collect additional information and send the transaction to JDC.

- Quick Ticket

- Payment on Account

- JDF Multi-use Preauthorization

- JDF Multi-use Payment

Processing JDF Multi-Use Transactions

If processing a JDF Multi-Use transaction, the screen above displays and must be completed.

- Merchant Number – Defaults to the JDF Multi-Use Merchant Number last used.

- Terminal Number – Defaults to the JDF Multi-Use Terminal Number last used.

- Amount – Defaults from the Agvance document. This is not editable.

- Card Number – Contains a list of JDF Multi-Use account numbers for the selected Customer. A number may be selected or a new number entered. The account number defaults if it is saved in the Customer profile.

- Invoice number – Defaults from the Agvance document but may be changed.

- Original Invoice – Defaults from the Agvance document if the Agvance document is being reversed or voided but may be changed. These numbers are displayed on the Customer’s JDF Multi-use statement.

- Credit Plan Number (CPN) – For regular purchases, the CPN must be 00249. JDC assigns the CPN for each Special Terms or Incentives program.

- Descriptive Bill Code (DBC)

- For regular purchases (CPN 00249), the DBC is not required.

- For other CPNs, the DBC is required.

- For returns or credits (any negative transactions), the DBC must be one of the following.

- 00960 – Refund of Finance Charge

- 00970 – Billing Correction

- 00980 – Returned Merchandise

- Serial Number – This is not required. It displays on the JDF Multi-use statement.

- Model Number – This is not required. It displays on the JDF Multi-use statement.

- Authorization Number

- For most transactions, the Authorization Number is left blank and is returned by JDC when the transaction is processed.

- If the Customer has a preauthorization, double-click in the Authorization Number field to select which preauthorization this transaction should use. For details on how to create preauthorizations, please see the JDF Multi-use Preauthorizations section above.

After entering the required fields, choose Process to process the transaction. A window displays to show the status of the transaction. When the transaction is complete, select Save. A log record is written to the JDCTransaction table.

Possible JDF Multi-Use Transaction Results

- Approved – If the transaction is approved, an Authorization Number is returned in the text field of the Transfer JDC Information window. The transaction is ready to be saved.

- Review – If the transaction requires further review, the message displays a phone number to call along with a reference number to reference the transaction over the phone. If John Deere Credit authorizes the transaction over the phone, the cashier is given an Authorization Number to enter in the Authorization Number field, and then select Process. The response should now be approved and the transaction saved.

- Declined – If the transaction is denied authorization by JDC, a different method of payment must be selected.

- Error – If an error occurs, the details of the error are displayed in a message.

Processing Negative JDF Multi-Use Transactions

Processing a negative JDF Multi-use transaction is very similar to processing a purchase transaction. If the amount is negative, Agvance automatically submits a ‘Credit’ request instead of a ‘Purchase’ request so the amount is credited to the Customer’s JDF Multi-Use account.

When a negative transaction is sent, a DBC is required. The three options for a negative transaction are 00960, 00970, and 00980 (Refund of Finance Charge, Billing Correction, or Returned Merchandise).

There are several situations that will cause a transaction to be negative, including the following:

- Paying a credit Invoice

- Voiding a Payment

- Reversing a Payment

- Taking a negative Payment

Syngenta/JDF Multi-Use Credit Plan

Syngenta supports a special credit plan for JDF Multi-Use, and requires specific information about the sales before they can be processed.

These payments can't be entered in Agvance the way a normal JDF Multi-Use payment is entered. Instead, set up a new payment method (at Accounting / Setup / Pay Methods) called JDF Multi-Use Syngenta (or something similar) and point it to the JDF Multi-Use Clearing account. Take the payment on the Invoice in Agvance using this new payment method. The JDF Multi-Use Clearing account can be reconciled normally at the appropriate time.

To enter the payment for JDF Multi-Use, the user must go to JDF Multi-Use's website and manually enter the information there.