Grain

The following considerations apply when a company is ending the December fiscal month.

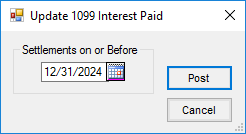

- Companies who pay interest on Installment Sales/Deferred Payment Settlements should use the Update 1099 Paid Value utility found at Grain / Utilities / Update 1099 Interest Paid Values before ending the month of December. This utility may be used after early staging of Installment Sales/Deferred Payment Settlements including interest, provided the Settlements are dated as of the first week of January and the Update 1099 Interest Paid utility’s Settlement on or Before date is the end of December.

- Many companies want to start writing checks early in December to pay out Deferred Payments or Installment Sale Contracts that are due the first week of January.

Patronage

During the end of the fiscal month of December, the 1099 Int Early Withdrawal YTD$ amount, found when editing a Patron on the 1099 Totals/Dues tab at Patronage / File / Open / Patron Info, is zeroed.

Companies not Ending the Fiscal Year in December

Companies who do not end their fiscal year in December and use Agvance for processing 1099s should consider doing the following steps prior to ending the fiscal month of December.

- Early in December, verify Vendor 1099 figures for accuracy. Review an AP 1099 Detail report for all 1099 types, found at Accounting Reports / Accounts Payable / AP Status. Also, print the 1099 Summary report found at Accounting Reports / Accounts Payable / A/P Status / Vendor Balances and select 1099 Summary in the Select Balance area.

- After the last Vendor checks for the year are processed and posted to the GL, create the 1099 file (Accounting / End of Periods / Print EOY Tax Forms) to import into Mag-Filer.

- Companies using interest deductions in the Grain module should use the Update 1099 Interest Paid Values utility at Grain / Utilities to update the Customer’s 1099 amount for interest paid.

- Companies using the Patronage module should verify the Customer 1099 figures. Use Patronage / Reports / Patrons / Patron 1099 Amounts to verify Patron 1099 information.

- Companies using the Grain module should verify the Customer 1099 amounts. Use the Grain / Grain Reports / Settlements / 1099 Grain Interest Report to verify the grain interest Customers received and all Customers who received interest are also set to receive a 1099.

Note: This Grain report is only accurate after using the Update 1099 Interest Paid Values utility in Grain. - Make a Play Data dataset to use when processing 1099s. It is suggested to include 1099 in the name of this dataset to clarify this is the data to use for 1099s.

- Optionally make an image of the data directory and back up this image.

- Print the 1099 forms from Mag-Filer.

- When ending the month of December, the 1099 Paid YTD figures for all Vendors zero out (whether it is the end of the fiscal year or not).

- When ending the month of December, the 1099 Amt Paid to Date for all Customers zero out (whether it is the end of the fiscal year or not).

- The following 1099 figures are cleared out for all Patrons when ending the month of December (whether it is the end of the fiscal year or not):

- 1099 Patr YTD$

- 1099 Div YTD$

- 1099 Int YTD$

- 1099 Int Early Withdrawal YTD$

- 1099 NQ YTD$

- Backup Withhold Patr

- Backup Withhold Div

- Backup Withhold Int

- Dividend Check Holding

- Interest Check Holding

- Closeout Check Holding

Companies Ending the Fiscal Year in December

Companies who end the fiscal year at the end of December have the option to create 1099 files prior to ending the fiscal year or from the archived fiscal year dataset.

- Early in December, verify Vendor 1099 figures for accuracy. Run an AP 1099 Detail report for all 1099 types found at Accounting Reports / Accounts Payable / AP Status. Also, print the 1099 Summary report found at Accounting Reports / Accounts Payable / AP Status / Vendor Balances and select 1099 Summary in the Select Balance area.

- Companies using the Patronage module should verify the Customer 1099 figures. Use Patronage / Reports / Patrons / Patron 1099 Amounts to verify Patron 1099 information.

- Companies using the Grain module should verify the Customer 1099 amounts. Use the 1099 Grain Interest report at Grain / Grain Reports / Settlements to verify the grain interest Customers have received and that Customers who received interest are also set to receive a 1099.

Note: This Grain report is only accurate after using the Update 1099 Interest Paid Values utility in Grain. - After all checks for the year are processed and posted to the GL, the 1099 file can be created. This 1099 file can also be created from the archived dataset after the fiscal year is ended.

Printing 1099 Information

The Agvance program maintains a 1099 Year to Date Paid amount for any Vendor or Customer marked as a 1099 candidate. To maintain this number, as the A/P Bills are entered or Quick Checks are processed, edit the Vendor's 1099/Payment Info tab, select the appropriate 1099 Type, and enter the Vendor’s Federal Tax ID #. With this done, as A/P Bills or Quick Checks are processed for this Vendor, the portion of the transaction to affect the 1099 total is confirmed.

For those required to file 1099s electronically, an option to create an electronic file is available. To file electronically, a Transmitter Control Code (TCC) must be obtained from the IRS. Questions about filing electronically can be answered at http://www.irs.gov/businesses.

Note: The printing of the 1099 forms will be completed in Mag-Filer.

Processing Printed 1099s/1096s

- Go to Accounting / End of Periods / Print EOY Tax Forms / 1099’s.

- Fill out the required information. See Reference Section under 1099s for explanations of the information fields as shown below.

- Select Write.

- The file created will be imported into Mag-Filer. The forms will be printed using Mag-Filer.

See the 1099s section for a description of each option on this screen.

Processing 1099s/1096s using Mag-Filer

Mag-Filer, a third-party software, is provided to Customers through SSI. This program has some additional benefits available for processing 1099s. The electronic 1099 file is created in Agvance on the Print 1099’s window and then imported into Mag-Filer. For more information on the setup and use of Mag-Filer, contact SSI at support@agvance.net.