Agvance can export a file of retirement information from payroll into a file format that can be submitted to some retirement plans and satisfies the United Benefits Coop Retirement plan. This is a database activated module. In this case, it may be appropriate to consider applying user security to restrict access to certain users.

Setup

Activating the Module

The Payroll Retirement Plan Export is found at Accounting / Payroll / Export Retirement Plan.

The first time in, the following screen will display.

Contact SSI for the Activation Key. A support representative will call to give the one-time activation key to provide access into the module. The resulting activation key is case-sensitive (meaning that capital letters must be entered as such).

Once the activation code has been entered, the Export screen will appear.

Setup Notes

- Set up a folder that can be used to hold the export file.

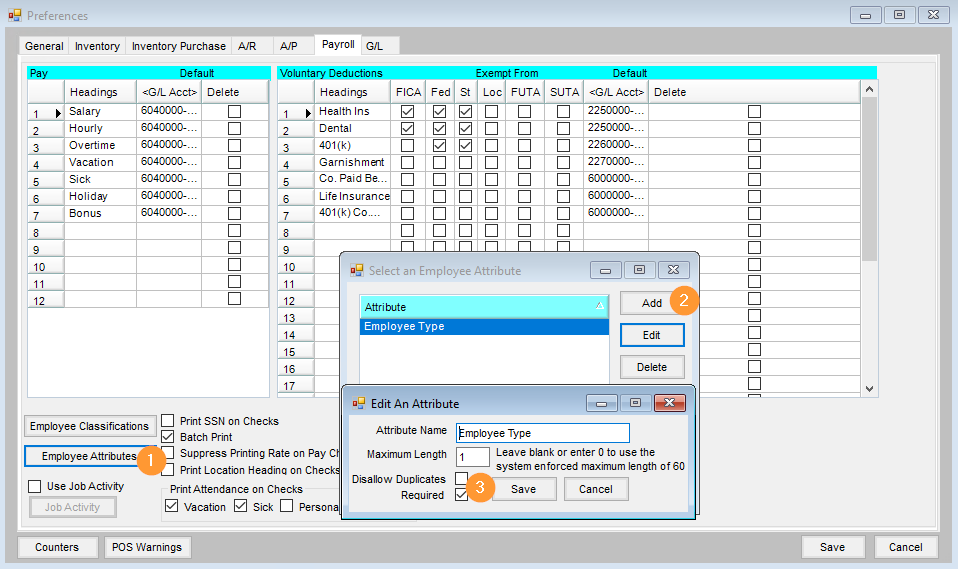

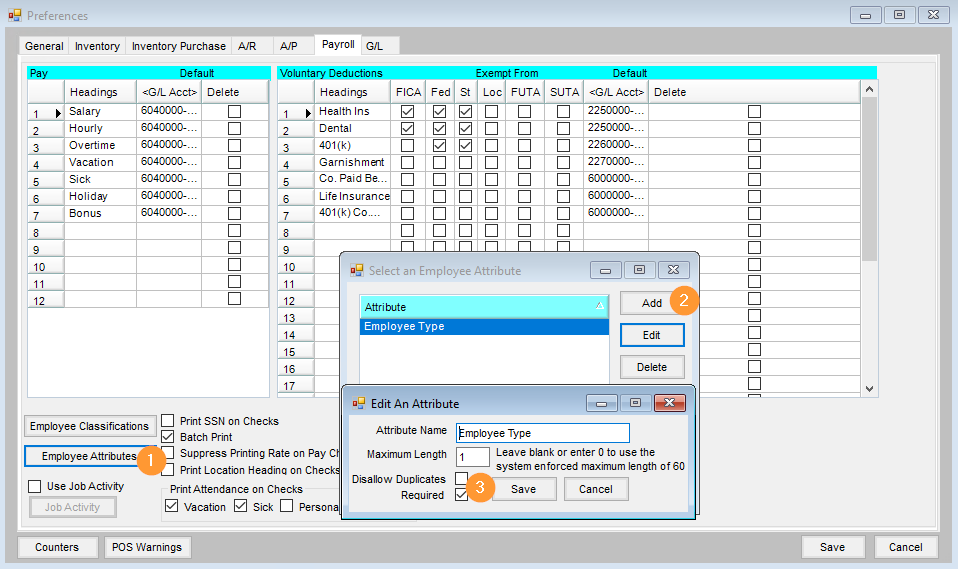

- A Retirement Plan Pay Type Attribute must be established at Accounting / Setup / Preferences / Payroll. This attribute should be required and limited to 1 character in length. It will be used to indicate whether the employee is Full Time, Part Time, or Seasonal. This should be recorded by entering an F, P, or S in the attribute.

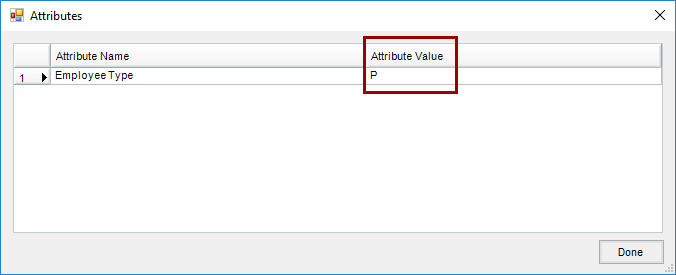

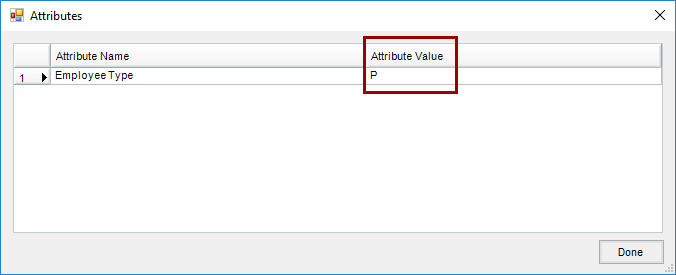

- Edit each employee and set the appropriate attribute on the employee file. The Attribute button is found on the Profile tab at File / Open / Employees / Edit. Enter F, P, or S in the Attribute Value column.

Create Export File

- Go to Agvance Accounting / Payroll / Export Retirement Plan File.

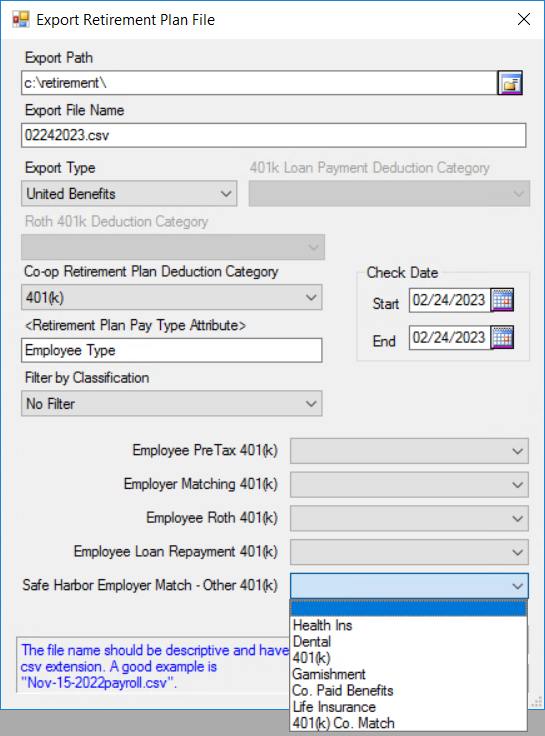

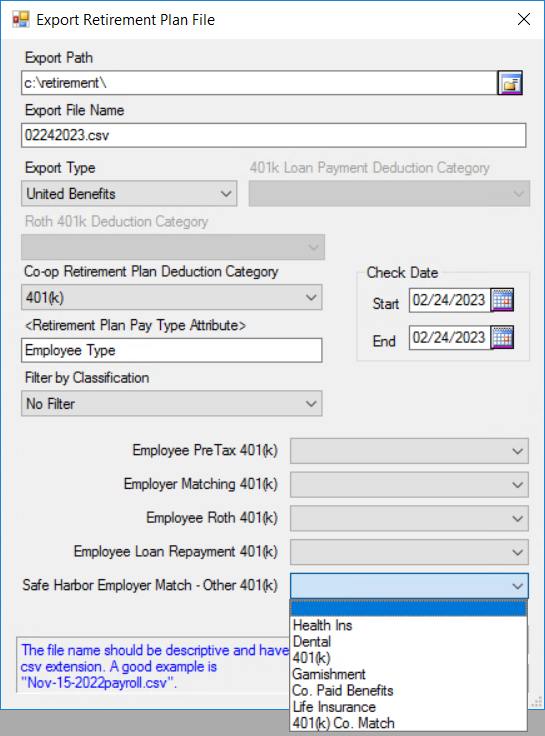

- At the Export Retirement Plan File screen, complete the Export File Path with the folder created in the Setup Notes above. Enter the Export File Name – this name is user defined. It could be a name required by the retirement plan, the paycheck date, or any other meaningful name.

Note: The file created is a comma separated value file (.csv) and can be opened by various programs. Since this file contains sensitive payroll information, special care should be taken to write/store this file in a secure area. - Select United Benefits as the Export Type.

- Select the Retirement Plan Deduction from the drop-down list. This is the deduction used on the employee paycheck for the amounts withheld from the paycheck for the retirement plan.

- Select the Retirement Pay Type Plan Attribute that was created in the Setup Notes above by double-clicking in the Retirement Plan Pay Type Attribute text box.

- Enter the Start Date and End Date for the paycheck date range that the export should include.

- An employee classification can optionally be selected in the Filter by Classification by using the drop-down menu if necessary. This would be used to limit the employees included in the retirement plan file. If all the employees should be included in the export, use the No Filter option in this area.

- Select the appropriate option from the drop-down for the Employee PreTax 410(k), Employer Matching 401(k), Employee Roth 401(k), Employee Loan Repayment 401(k), and, Safe Harbor Employer Match - Other 401(k) fields.

- Choose Export to create a file in the specified location that can be sent to the retirement plan administrator.

Uploading to United Benefits

- Log into the Co-op Website, select Upload, and then browse to the CSV file. The proper dates and payroll name should be entered.

- Choose Validate, which searches for errors or missing information. If there is anything missing or an error, a message will indicate what is needed before submitting.

- Once validation is successful, select Submit. The Online Payments page appears for entering the bank information for the payment.

Operational Considerations

If a text file is created and exported to a local folder, it will overwrite the previous existing file unless the file names differ.

United Benefits Contact Information

Brent Evans (Brent.Evans@ubgonline.net)

800-816-5535 ext. 312