Overview

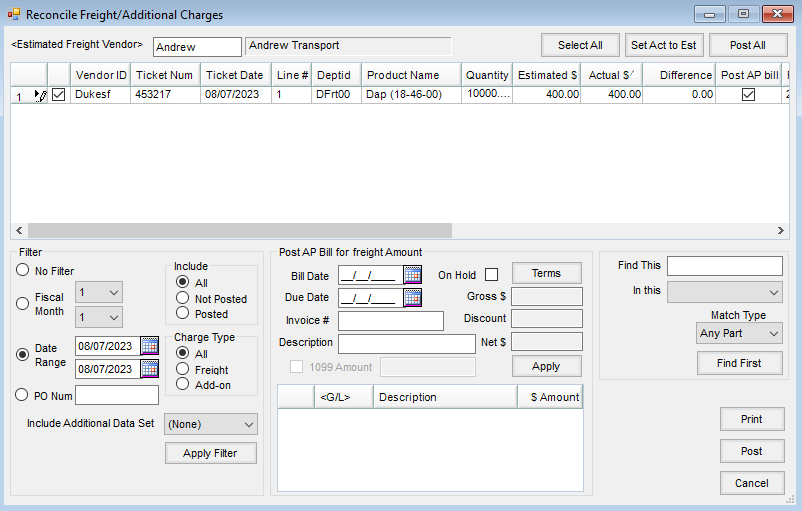

If Estimated Charges were entered during the purchasing process, this utility is helpful for reconciling the estimated add-on charges with the actual charges. This can by found by going to A/P / Reconcile Freight/Additional Charges.

This utility was designed to reconcile estimated freight and accrued add-on charge amounts entered in the Inventory area. Select the checkbox in the first column of line items to be reconciled/edited.

- Estimated Freight Vendor – Select the freight or add-on charge vendor to be reconciled. The charges display and may be filtered by selecting one of the filter options and choosing Apply found in the Filter area.

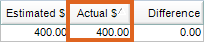

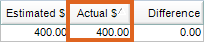

- Actual $ – Enter the actual amount of the bill in the Actual $ column.

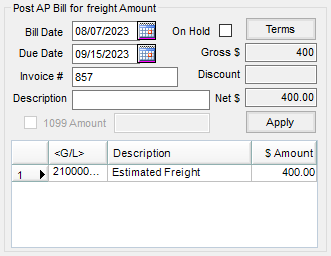

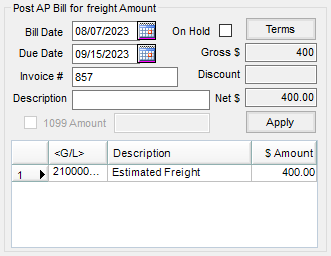

- Post AP Bill – If an A/P Bill is needed, check the Post AP bill checkbox which displays the Post A/P Bill for freight amount information.

- Post A/P Bill for freight amount – Complete the information from the A/P Bill. Selecting Apply displays the general ledger account from the estimation and the dollar amount from the actual amount in the grid. If one or more additional G/L accounts are required for this A/P Bill, double-click on the G/L column heading of the grid for additional lines. Choose Post to post the items to the general ledger and the A/P Bills.

- Select All – This selects all charges showing in the grid.

- Set Act to Est – Quickly set the Actual $ column to be the same dollar amount as the Estimated $ column. After using this, edits can be made to the Actual $ amount as necessary.

- Post All – Choose this to select the Post A/P Bill column for all the estimated charges showing in the grid.

- Print – This will print the grid.

- Post – Selecting this will post the journal entry for the difference between the estimated and actual amounts for all selected entries and optionally the A/P Bills.

Reconcile Freight/Additional Charges Process

Reconcile estimated cost to actual cost for freight and additional charges, optionally creating an A/P Bill.

- Navigate to Accounting / A/P / Reconcile Freight/Additional Charges.

- Select the freight (or add-on) vendor at the Select Vendors window. The line items to reconcile display in the grid on the Reconcile Freight/Additional Charges window.

- Choose the line items to be reconciled or choose Select All to select all lines.

Note: The grid is populated based on the criteria selected in the Filter section of the Reconcile Freight/Additional Charges window. Select Apply after changing the criteria. - Enter the actual charge in the Actual $ column.

Note: Selecting Set Act to Est changes the amount in the Actual $ column to the amount in the Estimated $ column for all selected line items. Post All selects the Post AP Bill column for all selected line items.

Note: Selecting Set Act to Est changes the amount in the Actual $ column to the amount in the Estimated $ column for all selected line items. Post All selects the Post AP Bill column for all selected line items. - If an A/P bill should be created, select the Post AP Bill option.

- In the Post AP Bill for freight Amount section, enter the information for the A/P bill. The Bill Date, Due Date, and Invoice # are required fields. Choose Apply.

Note: Be cautious in changing the GL account number listed in the Post AP Bill for freight Amount section. The number is automatically populated as indicated below:

Note: Be cautious in changing the GL account number listed in the Post AP Bill for freight Amount section. The number is automatically populated as indicated below:- If reconciling estimated freight, it populates from the Estimated Freight account number at Accounting / Setup / Locations on the G/L Posting tab.

- If reconciling add-on charges, it populates from the G/L Account number at the Edit a Purchase Add-on Charge window at Accounting / Setup / Inventory / Purchase Add-On Charges. If no G/L account is indicated, it populates from the same area as estimated freight.

- Journal entries for the difference between estimated and actual costs are automatically made to the account listed above and the G/L account listed as the Freight/Add On # at Accounting / Setup / Inventory Departments on the G/L Posting tab.

- The On Hold option creates the A/P bill and makes the journal entries but hides the A/P Bill at the Pay Bills window. To pay the Bill, open it at Accounting / A/P / Add/Edit Bills and uncheck the On Hold option.

- Optionally select Print to print line items displayed in the grid.

- Select Post to post the line items and the A/P Bills.

Posting Notes

If the option to Post an A/P Bill was used, the posting of the bill is identical to the posting that occurs when an A/P Bill is manually added.

Note: Freight/Additional Charges can be re-reconciled after a Bill has been posted if needed. To do this, select the Vendor and filter for Posted. Select the line item in the grid needing re-reconciled. Enter the correct Actual $ in the grid, and select Post. A Journal Entry will be made for the difference for the Freight/Add-On account from the Inventory Department and the Estimated Freight Account (for the Location) or the accrual account. The original AP Bill can then be voided and a new Bill entered at A/P / Add/Edit Bills as a new Bill cannot be posted for the same line on the Reconcile window.

- General Ledger – A Vendor-Type Journal Entry is made to move the amount from the Estimated General Ledger Account to the Actual account. If there is a difference in the Actual $ compared to the Estimated $, the difference is handled with a Journal Entry.

| Vendor Journal Entry | Debits | Credits |

| Amount Due Vendor on AP Bill (if AP Bill is posted) | Estimated Freight (for the Location) or the accrual account | |

| Amount Due Vendor for AP Bill (if AP Bill is posted) | Accounts Payable (for Vendor Location) | |

| Difference between Estimated Freight and Actual Freight | Freight/Add-On account from Inventory Department | |

| Difference between Estimated Freight and Actual Freight | Estimated Freight Account (for the Location) or the accrual account |

Note: Selecting Set Act to Est changes the amount in the Actual $ column to the amount in the Estimated $ column for all selected line items. Post All selects the Post AP Bill column for all selected line items.

Note: Selecting Set Act to Est changes the amount in the Actual $ column to the amount in the Estimated $ column for all selected line items. Post All selects the Post AP Bill column for all selected line items. Note: Be cautious in changing the GL account number listed in the Post AP Bill for freight Amount section. The number is automatically populated as indicated below:

Note: Be cautious in changing the GL account number listed in the Post AP Bill for freight Amount section. The number is automatically populated as indicated below: