Agvance assumes there are 12 fiscal months within the fiscal year. The end of month process saves the balances (Customers, Vendors, G/L Accounts, Inventory Products, etc.), and increments the fiscal month counter. It sets important data markers and the suggested reports assist in carefully analyzing company position.

Payroll end of month is a separate function.

The following checklist guides through the End of Month process.

Note: Transactions are posted into the fiscal month open at the time posted regardless of the date associated with the transactions. For example, if a company running their fiscal year January through December is currently in the third month (March), then an Invoice entered with an April date will be associated with fiscal month three since that is the open month. End month three before entering transactions that should be posted in month four.

All Users

- Check that all transactions for the month have been entered. If this is the end of the twelfth month, eliminate as many unprocessed transactions (Delivery Tickets, loaded Blend Tickets, Purchase Receipts, etc.) as possible by invoicing them.

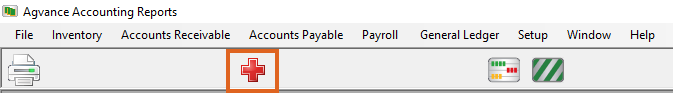

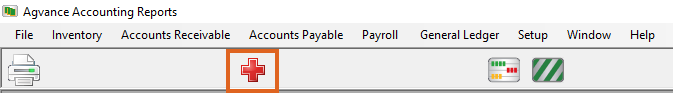

Note: If the Grain module is used, Grain End of Month procedures must be completed before ending the Accounting month. - Accounting Checkup – At Accounting / Accounting Reports select the Red Cross icon for Checkup Reports.

On the Agvance Utilities - Checkup screen in the Select Checkups section, run Checkup Reports for all applicable areas of the program (G/L Accounts, Customers, Vendors, Inventory, and Budget Billing). Run a Detail Report on any entity that is out of balance (Customer Statements for Customers, Vendor Detail for Vendors, Account Detail for G/L, and Inventory Detail for Products).

On the Agvance Utilities - Checkup screen in the Select Checkups section, run Checkup Reports for all applicable areas of the program (G/L Accounts, Customers, Vendors, Inventory, and Budget Billing). Run a Detail Report on any entity that is out of balance (Customer Statements for Customers, Vendor Detail for Vendors, Account Detail for G/L, and Inventory Detail for Products).

Note: Running the G/L Accounting Checkup daily is strongly recommended to find data concerns before the end of month. - Reconcile Credit Invoices – Use the Reconcile Credit Invoices utility found under the A/R menu to automatically apply open credits on Customer accounts to open Invoices.

- Finance Charges (optional) – Post Finance Charges at A/R / Post Finance Charges.

- Customer Statements – Run the statement style preferred (Balance Forward or Open Item) at Reports / Accounts Receivable / A/R Status / Statements, or the Combo Statement at Reports / Accounts Receivable / A/R Status.

- Verify Unprocessed Delivery or Blend Tickets – If using Delivery Tickets and/or Blend Tickets, run the Delivered Product Analysis report found at Reports / Inventory / Inventory Status to verify the inventory balances shown on the Company-Owned Inventory Statement (Step 8). It is recommended to run this report for Unprocessed tickets with the Start date set back at least a year and sorted by Product. This report also verifies that the unprocessed tickets are valid to be invoiced. Tickets that are not valid can be addressed accordingly.

Note: Running this report is required prior to ending the month. This process cannot be recreated after posting for a new month begins. - Verify Unprocessed Purchase Receipts – If using Purchase Receipts, run the Purchase Receipts report found at Reports / Inventory / Purchase. Uncheck Use Date Range and sort by either Date or Product. This report will substantiate the number in the Unprocessed Purchase Receipts column of the Company-Owned Inventory Statement report (Step 8). Verify the validity of any unprocessed Purchase Receipts.

Note: Running this report is required prior to ending the month. This process cannot be recreated after posting for a new month begins. - Inventory Company-Owned Inventory Statement – On the Inventory Statement at Reports / Inventory / Inventory Status with Company Owned selected as the style, look carefully at Product costs and quantities. Make any adjustments to correct Amount on Hand at the Inventory Adjustment screen. Edit costs by using the utility provided at Hub / Utilities on the Edit Product Pricing screen.

Archive Reports

Run archive reports on paper for future reference. The Customer Aging and Inventory Company-Owned reports must be run prior to ending the month. These cannot be recreated after ending the month and entering activity for the new month. If all the steps above proved out satisfactorily, then any of the other archive reports can be run after ending the month. Another option is to preview the report then export to a file such as Word, Excel, or a PDF. These files can be saved in the data folder so they are backed up and archived for safe keeping.

- Customer Current Balance – At Accounting Reports / A/R Status / Customer Balances, choose the Current Balance option.

- Customer Aging – At Accounting Reports / A/R Status / Customer Balances, choose the Aged Balance option. The overall total should equal the Customer Current Balance reports.

Note: Running this report is required prior to ending the month. This process cannot be recreated after posting for a new month begins. - Payment Register – At Accounting Reports / A/R Status / Payment Register, run this report for the entire month.

- Sales Register – At Accounting Reports / Accounts Receivable / Sales / Sales Register, run this report for the entire month's Invoice range.

- Inventory Company-Owned (if changed from the run above) – At Accounting Reports / Inventory / Inventory Status / Inventory Statements, choose the Company-Owned option.

Note: Running this report is required prior to ending the month. This process cannot be recreated after posting for a new month begins.

End the Month

Everything up to this point has been in preparation for the ending of the month. The process is complete upon finishing this section.

- Back Up the Data Set –Make an on-demand image of the data at Hub / Utilities / Make Database Image. Back up that image which will be found in the \Lastimage folder inside the data folder. It is best to keep this backup until the end of year. Therefore, use a separate tape, zip disk, or CD.

Note: For assistance or questions with creating an image and backing up data, contact the SSI Support Team. SSI will communicate the information to the hardware dealer who can help set up some month-end backup processes. - End the Month – Run the process at End of Periods / Fiscal Month. If this is also the end of the fiscal year, the option to Reserve Journal Entries is grayed out because the number of entries that can be added into month 12 is unlimited.

- Log back into the program and check the Month indicator at the bottom of the Accounting screen. It should reflect the new month.

On the Agvance Utilities - Checkup screen in the Select Checkups section, run Checkup Reports for all applicable areas of the program (G/L Accounts, Customers, Vendors, Inventory, and Budget Billing). Run a Detail Report on any entity that is out of balance (Customer Statements for Customers, Vendor Detail for Vendors, Account Detail for G/L, and Inventory Detail for Products).

On the Agvance Utilities - Checkup screen in the Select Checkups section, run Checkup Reports for all applicable areas of the program (G/L Accounts, Customers, Vendors, Inventory, and Budget Billing). Run a Detail Report on any entity that is out of balance (Customer Statements for Customers, Vendor Detail for Vendors, Account Detail for G/L, and Inventory Detail for Products).