To calculate payroll taxes the following information is needed:

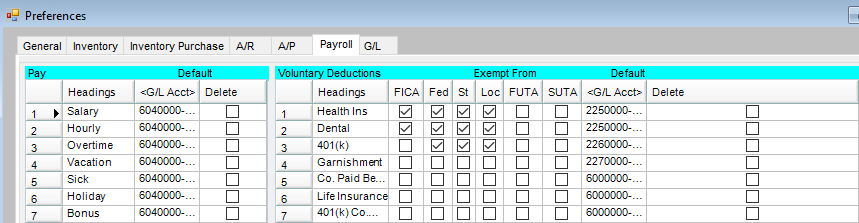

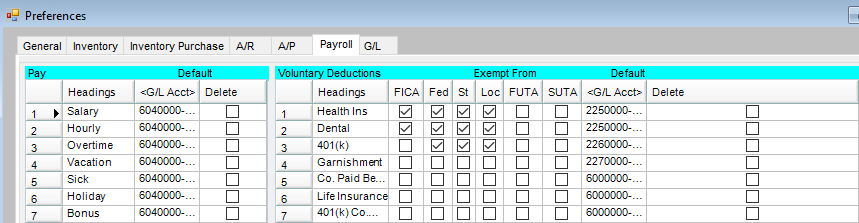

- Go to Accounting / Setup / Preferences / Payroll to find the deductions that are tax sheltered and from which payroll taxes they are sheltered.

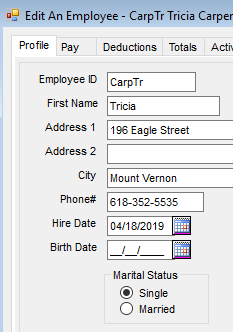

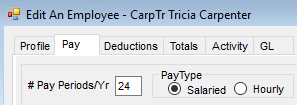

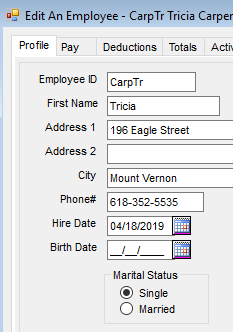

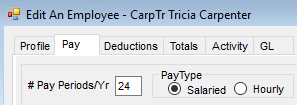

- Check the marital status claimed for the employee on the Profile tab at File / Open / Employee. Note the # of Pay Periods on the Pay tab.

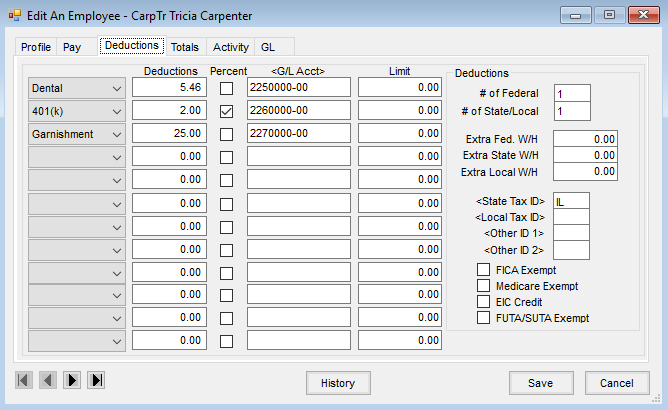

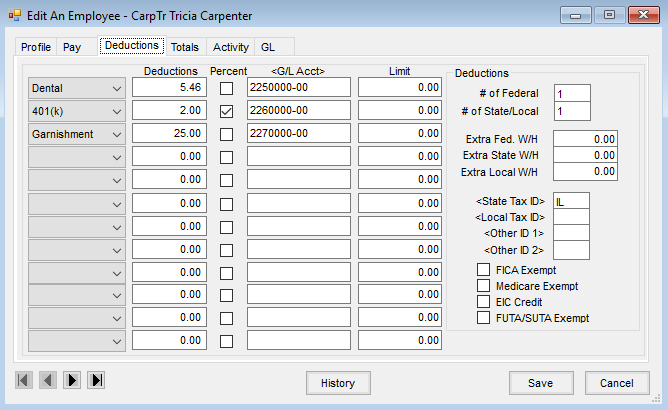

- Find the amount of any deductions that are tax sheltered on the Deduction tab for the employee at File / Open / Employee.

The basic formula for the calculation is the same for the Federal, State and Local taxes. Use the appropriate tax table for the tax you are calculating. Payroll Tax tables are found at Setup / Payroll Tax Tables.

The first step in calculating taxes is to find the “taxable wage.” This can be found by taking the gross dollar amount of the check minus applicable pre-tax (tax sheltered) deductions. (Gross Wage – pre-tax deductions = Taxable Wage)

Because all of the tax tables are setup in Agvance using annual numbers, you must find the “annual taxable wage.” Multiply the taxable wage by the number of pay periods/yr. (Taxable wage X # of pay periods per yr = annual taxable wage)

The next step is to calculate the “yearly income after allowances.” This is calculated by taking the yearly income minus standard allowance and dependent allowances times number of dependents (if applicable). (Annual taxable wage – standard allowance OR annual taxable wage – (dependent allowance X # of dependents) OR annual taxable wage – standard allowance – (dependent allowance X # of dependents) = yearly income after allowances.)

Now you are ready to find the “yearly tax.” In the applicable payroll tax table grid, find correct line item range. The yearly income after allowances must fall between the “Over” and “Not Over” dollar amounts. Using the rate from the % column, multiply the percentage by the yearly income after allowances minus the “Over” dollar amount. (Yearly Income after Allowances – “Over” dollar amount X % = yearly tax.)

At this point you are ready to finish the calculation and find the “tax for this check.” To do this divide the yearly tax by the # of pay periods and add applicable extra withholding. (Yearly tax / # of pay periods + applicable extra W/H = “tax for this check.”)

For this example we will calculate the state tax using the Minnesota/Married State Tax table.

Employee Tricia Carpenter has a gross wage of $960.00 for this paycheck. We are using the information from the screen shots above for this example. The calculation for the state tax for this check is as follows:

Note: According to the laws of your state, your employee may be subject to other tax credits etc. If any other options at the State Tax Table screen apply to your state please call SSI for further instruction.

Federal taxes can be calculated using the same basic formula as state taxes. Note that on federal there is only one withholding allowance per dependent.

If you are unsure if the Federal or State payroll tax tables you have set up in Agvance are correct, please contact SSI.