These contributions must be reported on W-2s. At Accounting / End of Periods / Print EOY Tax Forms / W-2’s on the Setup tab, there is not a deduction to select which represents the employer’s contribution since this money was not deducted from the employee’s paycheck.

There are a few different ways to accomplish this task depending on if the employee made any contribution to the HSA and if the employer contribution can be reported on a separate line from the employee contribution.

Note: Some accountants or auditors do not want the employer portion reported on a separate line on the W-2s.

Scenario #1 - Both Employee and Employer Contributed to the HSA

Some companies require the employee to participate in the HSA before the employer contribution is made. In this scenario, on the Setup tab of the Preview/Print W-2-W-3 Forms window, enter the prefix, and select the deduction representing the employee contribution, along with all other setup information. Click the Preview W-2’s button to load the information on the Preview/Print tab. On this tab, edit the Box 12 number representing the HSA to include the employer contribution. Click Save W-2’s. The W-2s may now be processed.

Scenario #2 - Employer Contribution Reported on a Separate Line on Box 12 of the W-2

In this situation, a contribution by the employee is not required to receive the employer contribution. Therefore, some employees receive the employer contribution without having contributed to the HSA. By using this method, the amount the employee contributed will show in one line in Box 12, and the employer contribution shows on another line, also in Box 12.

- In Accounting, navigate to the Setup / Preferences / Payroll tab. In the Voluntary Deductions grid, if there is not a previously existing deduction heading for the employer portion of the HSA (i.e. HSA-Employer), then add one. Do not mark any of the Exempt From boxes for the various types of taxes. Click Save to save the payroll preferences.

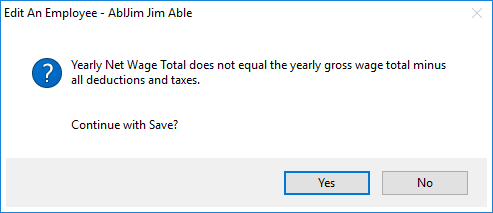

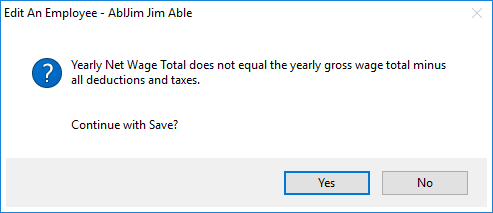

- Go to File / Open / Employees, and edit any employee who received the company contribution to the HSA. On the Deductions tab, select the HSA-Employer deduction. On the Totals tab, click the Year option at the top of the tab. In the HSA-Employer deduction, enter the amount the company contributed to the employee’s HSA. Click Save. The following message appears; click Yes to continue with the save.

- When this has been done for each affected employee, navigate to the End of Periods / Print EOY Tax Forms / W-2’s / Setup tab. In the Box 12 area, enter the Prefix and select the HSA Employer in one of the four available boxes. If applicable, enter the Prefix, and select the deduction for the employee HSA contribution on another line of the Box 12 options.

Scenario #3 - Employer Contribution Must Be Reported on the Same Line in Box 12 of the W-2 as the Employee Contribution.

Some companies have three other deductions in addition to the HSA to report in Box 12, forcing the employee and the employer contributions to be reported on the same line of Box 12. Other times, the accountant or auditor requires the employee and employer HSA amounts are combined into one line on the W-2s. The following processes allow the amounts to be reported on one line on the W-2s.

- In Accounting, navigate to the Setup / Preferences / Payroll tab. In the Voluntary Deductions grid, if there isn’t a previously existing deduction heading to represent the total of the HSA on the W-2, then add one (i.e. HSA-W2). Do not mark any of the Exempt From boxes for the various types of taxes. Click Save to save the payroll preferences.

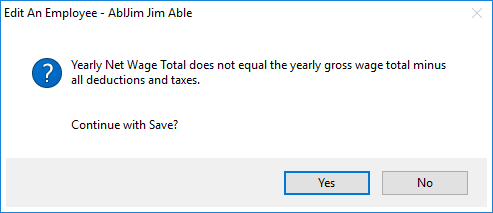

Note: Because of the differing tax-sheltered status, the deduction used for the employee portion deducted from paychecks must not be used on the W-2 in this scenario when employer contributions have been made. - Go to File / Open / Employees, and edit any employee who participated in the HSA deduction or received the employer HSA company contribution. On the Deductions tab, select the HSA-W2 deduction. On the Totals tab, click the Year option at the top of the tab. In the HSA-W2 deduction, enter the total amount the company contributed to the employee’s HSA plus the amount that the employee contributed. Click Save. The following message appears; click Yes to continue with the save.

- Navigate to End of Periods / Print EOY Tax Forms / W-2’s, and complete the information on the Setup tab. In the Box 12 area, enter the Prefix, and select the HSA-W2 deduction. Continue processing the W-2s as usual.