PO Types

User definable Purchase Order Types may be entered at Accounting / Setup / Inventory / PO Types. Once entered, they can be selected at the Purchase Order screen when adding or editing. Some common uses for Purchase Order Types might be to enter the shipping method, such as rail car or truck.

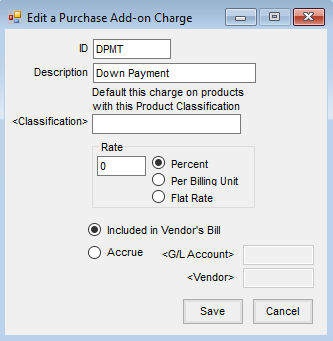

Purchase Add-on Charges

Purchase Add-on Charges may be used on the Purchase Order, the Purchase Receipt, or the Purchase Invoice. It allows standard or estimated charges (percent, per unit, or flat fee) such as taxes to be figured into the cost of the products on a Purchase Invoice but not necessarily added into the vendor’s bill. This may be set to default into the products belonging to a specified classification.

These can be added at Accounting / Setup / Inventory / Purchase Add-on Charges.

- ID – Enter an ID which can be up to 10 characters.

- Description – Enter a description for the add-on charge. The ID and Description are visible when selecting add-on charges in the Inventory area.

- Classification – Double-click and select the Product Classification to which this Purchase Add-On applies.

- Rate – Select whether this rate is a Percent, Per Billing Unit, or a Flat Rate. Enter the Rate in the field. This may be overridden on the purchasing transaction.

- Included in Vendor’s Bill – If the Add-On Charge is generally included in the Vendor’s Invoice, select this option. This may be overridden when entering the inventory transaction.

- Accrue – Use this option if the Add-On Charge is typically accrued then specify the G/L Account and Vendor for the accrual. The option to accrue may be overridden at the purchasing transaction.